Stable coins are pretty weird.

Are they crypto? Are they fiat? Are they secure? What are they pegged to? How will they evolve?

Certainly the easiest question there to answer revolves around the peg. I know there are coins out there that aren't pegged to the dollar but I've never actually seen or used one. For the most part, stable coins are pegged to $1, which is the first mistake that we just seem to keep making over and over again.

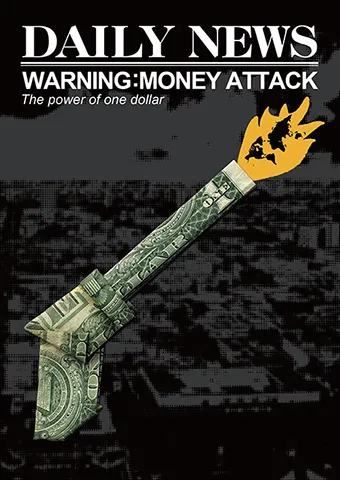

Why $1?

Why peg a crypto to the exact asset that crypto is trying to compete with?

Lot's of reasons...

- User experience (UX)

- Familiarity with USD

- Unit bias.

- Stability (duh)

At this point I'm sure more than half of users in the cryptosphere think a stable coin has to be pegged to $1 out of necessity and there is no other way to do it. However, I hope it's obvious to my readers that this is not the case.

There is nothing stopping us from pegging a token to literally any value we desire. The stable coin I have in mind would be pegged to a tenth of a cent, as that would give users x1000 more whole coins than they would have if they were pegged to the full dollar. Unit bias causes us to enjoy big numbers when the topic at hand is currency.

The problem with pegging stable coins to $1 is that doing so creates a false sense of what that token actually is. We think of it as an extension of the dollar. "These coins are the same as dollars." This is obviously absurd logic for those who actually know how the banking sector operates vs how crypto operates.

Two Archetypes

There are two kinds of stable coins:

- Centralized stable coins pegged by USD in a legacy bank.

- Decentralized algorithmic stable coins pegged by smart-contracts.

One of these archetypes has a future...

While centralized stable coins pegged to dollars in a bank are immune to smart-contract hacks (because these contracts don't exist) it is painfully obvious what the attack vectors are when concerning these assets.

Fractional Reserve Banking.

Take Tether for example. Not only do we not know if they legitimately have $62,500,000,000 in the bank, but even if they did it is impossible that all of it would be liquid at all times. That's just how the banking sector operates. The banks that hold other people's money are allowed to loan the vast majority of that value to other entities at interest. A bank run occurs when there's not enough liquidity left to give users their money back, and the fear spirals out of control, forcing everyone to demand their money back.

On top of that, bank accounts can be frozen and money can be confiscated. Your money is only safe in a bank if you can trust the people that not only run the bank, but also the governments that can move in and demand that the bank perform a certain action by law. Yeah, not great.

Algorithmic Stable coins are the future.

Why? Because there are no rules. The networks and smart-contracts themselves forge the rules from the ground up. So while 1 Tether and 1 DAI might both be worth $1, the way in which they got there was completely different.

The truly interesting thing about DAI is that it's complete trash even though it's algorithmically pegged. The interest rates don't make sense. The Ethereum network is too slow and expensive. The deflationary mechanics of Maker are nonsensical and using ETH as collateral (a token that Maker doesn't control) hamstrings the entire operation.

However, algorithmically pegged coins can evolve, whereas legacy stable coins can not.

If USD goes to shit and starts hyperinflating, all of the legacy stable coins will become completely worthless. Meanwhile, the algorithmic stable coins can pivot. How? As I said before, the peg is whatever we decide it is.

So if USD lost 20% of its value in a year, many of these algorithmic stable coins could simply increase the peg to $1.20 to make up for it. Of course such a change has a price to be paid (everyone that owed back stable coins to CDP smart-contracts now owes even more). However, if the system moves slowly and gives users plenty of warning these peg changes are possible.

An evolution such as this would make algorithmic stable coins more stable and retain value better than every single fiat currency on the planet. That's the beginning of the end of the legacy economy right there if you ask me.

Back to legacy stable coins.

Nothing is stopping dollars in a bank from pegging a token to any starting value. Tether could be pegged to 37 cents. It doesn't matter what the peg is set to. What matters is how well the token maintains liquidity and stability.

When someone buys a stable coin, they have an expectation that said stable coin isn't going to be worth less when they go to sell it. If it happens to be worth more then no foul: free money. However, anyone who bought at that higher level also has an expectation that the price will not go down.

By definition and expectation, Stable coins must always trade flat or upwards, or someone is going to lose value and be mad about it. We've never seen a stable coin trade up, but when fiat is fully destabilized that will be the most obvious path forward to maintain the value of stable coins.

HBD

Hive's stable coin is very interesting. The way we peg our token is unlike any other stable coin. The diversity is very nice, but unfortunately our peg is the worst one in the business. Luckily it has improved substantially after the last hardfork and the ability to convert $1.05 worth of Hive to 1 HBD, setting a soft cap at $1.05 maximum value.

Having this maximum value is very important, because like I said before, when someone buys a stable coin, they expect the price to not dip. By setting a soft cap to the upper limit this helps HBD to lose significantly less value after being pumped, because it can't get pumped nearly as high to begin with.

I've made my stance pretty clear on HBD. Our unique mechanics for pegging the token act as a nice buffer and support, but they aren't good enough in the long run. HBD needs a lot of help.

The first way to support HBD is to convert the internal market from a legacy order book to an AMM yield farm. This will increase liquidity exponentially and allow anyone with Hive/HBD to trade back and forth with very little slippage.

The second way to support HBD is to copy what other algorithmic stable coins are doing, and allow users to lock Hive in a smart contract to pull HBD out of it. This is a lot of work and potentially adds attack vectors to the network, so I wouldn't be expecting such a development to roll around for quite some time. Our developers are quite busy as it is.

But even more importantly, we should be able to do the opposite of this contract, locking up HBD to create Hive out of thin air. Having both of these contracts would allow us to have a fully functioning decentralized futures market, where anyone could go long or short by printing more Hive and dumping it for HBD (short) or printing more HBD and dumping it for Hive (long).

At the end of the day it's almost certain that some other token built on Hive will have to test these features and prove their worth before they are implemented on the main chain. Perhaps if this mega-bubble rolls around as planned I'll have the full resources to make that happen. One can hope. Until then it's a very slow grind.

Conclusion

People think there are rules for stable coins and pegging tokens. There are no rules: we make the rules. Stable coins do not need to be pegged to $1, and the only reason they are is to avoid user confusion while building up a brand that makes sense. However, I think its safe to say that many of those reading this message today know that USD's days will eventually be numbered.

What happens when fiat currency is no longer a stable source of value? If crypto keeps doubling in value every year the total market cap will be over 1 Quadrillion dollars in ten years. At that point I think it should be obvious that crypto isn't exactly going up as much as USD is going down. This thing is going to crash into the mountain eventually. Who wants to rule the empire of dirt?

When USD is no longer stable the need for stable coins will increase exponentially. Pegging the tokens with dollars in a bank will no longer be an option. I expect to see the evolution of this tech increase exponentially, just like everything else in this space. When crypto becomes a unit-of-account, fiat currency will become completely worthless. Stability is the key.

Posted Using LeoFinance Beta

Return from Rules for Stable Coins: Foundations of decentralized futures market. to edicted's Web3 Blog