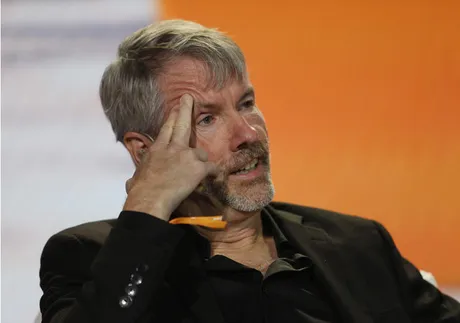

Ten days ago I saw this interview...

Or rather it was originally a snippet of the interview. I had to go out and find this one because I was curious as to how it ended. The snippet starts at minute 28 and is a story about how his strategy was received within a business school at Harvard. Apparently the students had studied what was done (after it had already succeeded), and still denounced the idea as a risky gamble that shouldn't be done.

The company was at the end of the line; we were gonna have to sell the company [$600M]... and we were at our wit's end: we tried everything we could possibly do for a decade; it didn't work, so finally we adopted the Bitcoin Standard.

Even in the face of this preamble and favorable outcome the responses were overwhelmingly negative.

I don't know... seems kinda risky.

It seems like an inappropriate use of shareholder funds.

This isn't normally done...

It kind of violates convention and corporate finance.

"The world is full of conventional wisdom and conventional thinkers; you can give them the answer and take the risk and they will still stare at it and not do it."

I thought this was pretty interesting sentiment so I decided to watch the entire 43 minute interview... and I will have to watch it again now so I can summarize the highlights as to what I found the most interesting about all of this. The goal here will be to keep this as brief as possible... otherwise what's the point? Just watch the interview yourself amirite?

Capital as economic energy.

The interview begins talking about fiat currency and the estimated half-life of certain assets. As a business or individual there's a strong motivation to avoid this type of currency debasement often referred to as "inflation" (although Saylor purposefully doesn't use that word). We might trade our Peso for an ice cream cone. The Peso loses value quickly, but the ice cream loses its value within a matter of minutes, so it's all a matter of perspective.

Another interesting point he brings up is the idea of investing in the S&P 500 to avoid economic debasement. Apparently there's a law in place to ensure that companies can't do this with more than 40% of their reserves, and it's also just interesting to think about that a company would choose to store their value as a representational derivative of the stock of other companies. We jump through many hoops to avoid the debasement.

Bitcoin as the "perfect" asset.

Obviously any non-maximalist disagrees with this sentiment, in fact I would argue that Bitcoin is flawed by design and "perfect" is always a moving target within a changing environment. A changing environment requires evolution and always chases perfection, but can never catch it (nor should it).

The main point being that Bitcoin has an economic half-life of infinity because number is going up and not down. Later in the interview I remember that Saylor also talks about how he thinks BTC's value will stop going up 50%-80% when it gains a lot of adoption and will be reduced to 20%-30%... which again I don't really believe and I'm not even sure he believes... only that he's trying to have the appearance of being a reasonable businessman. If anything I think we have to assume that inflation will just get worse and Bitcoin will maintain its trendline against fiat.

21M

The emphasis on the 21M hard-cap making it "perfect money" is just maximalist propaganda and not very interesting, but they never stop bringing it up so it's hard to ignore. But I digress.

Real Estate

Then he goes into the idea that property is one of the best stores of value behind Bitcoin. A "building on Park Avenue" is not a defective capital asset, and the goal is to have a diversified portfolio, but often that diversification involves a negative percentage of fiat currency. If we have an asset of value the best thing we can do is take out a secured loan against it for a lower APR than the inflation rate. Then we can spend that money on whatever and owe back less over time in comparison to the other assets we hold (essentially going long on assets vs fiat in a roundabout way).

It means that if you're a Bitcoiner you need to embrace fiat currency.

This is something I have said many times over as well and trends against the grain of the maximalist crowd. Bitcoin is collateral and fiat is debt. Debt and collateral go hand in hand and synergize together when used properly in conjunction to great effect.

Liquid programmable energy.

He then starts going on a bit of a tangent trying to mash up capital markets with a Nikola Tesla quote, "Think about the world in terms of energy, frequency, and vibration." There's definitely something there but it's very difficult to put something like that into words. Main point being that most industrializations are not programmable and often have logistical trouble being mobile and liquid. Even electricity has a half-life as it travels through resistance over miles; it can't be stored. Bitcoin has solved this issue.

All the physicists that make fun of me...

There are many humble moments in this interview in which Saylor recognizes and acknowledges the naysayers in a very specific and mature way. He never exudes the classic I-told-you-so attitude, but rather is more interested in why people think the way they think and do the things they do... even if they directly contradict what he is doing... especially if they directly contradict what he is doing. It's very clear that he considers himself a perpetual student rather than the master of the maze, which is a good sign, especially after having so much success.

Maybe people hate capitalism because they're using a defective capital asset.

He then goes on to talk about zombie companies and why they are zombie companies... and a lot of it has to do with defective currency and low liquidity of their own stocks among other things. He admits that Microstrategy was also a zombie corporation and Bitcoin completely fixed all the problems he was having.

The question I have from all of this is... is this good for Bitcoin? If a bunch of zombie corporations barnicle themselves to the Bitcoin Standard... is that good for all parties concerned or will the corporations be acting like some kind of parasite on the currency? It's hard to say and arguments could be made on either side. My guess would be that any adoption is good adoption when neutral currency is involved but it's definitely worth paying attention to and thinking about going forward.

Bitcoin is the universal merger partner of every zombie company.

Got damn!

That is such a wild statement to make on so many levels.

Everybody gets Bitcoin at the price they deserve.

Microstrategy just borrowed $700M for the next 8 years at 2.25%

Yep... that's how it's done gentlemen.

Sweet deal if you can get it!

You need clarity and courage.

That just explains why 99% don't do it [but 1% do].

31 minutes in:

I went on a podcast and said:

- You should convert your Pesos to Bitcoin.

- If you have a business you should mortgage it.

- You should mortgage your house and buy more Bitcoin.

- Bitcoin was $45k at the time.

And then 4 weeks later Bitcoin dropped to $35k and all the talking heads on Twitter gleefully, "Look at Saylor that idiot he told everyone to mortgage their house [ha ha ha]. He's lost all their money..." All they could do was fixate on the fact that over the course of 4 weeks it's possible that maybe the trade wouldn't work.

Two years later the mortgage rate went from 2.75% to 6.5%. The Peso went from 180 to 1000 on the dollar. And Bitcoin went from $45k down to $16k up to $65k. All the people that thought that was a stupid idea: they all disappeared.

Classic social media.

The reason why MSTR can borrow such huge quantities of money at a low interest rate to this day is exactly because everyone is betting against him, and he recognizes that. He's on the other side of the trade. Comfy in not-spot.

Sometimes you'd think people who wouldn't get it: get it immediately. And some people you think they ought to get it and don't.

But what I do think is true: Bitcoin insight is limited to those with a need to know.

Which is the entire reason and title of this post.

During these highly unconventional and early stages of Bitcoin only the crazy maniacs like Saylor are the ones out there making moves while everyone else is still resting on their laurels. People often do not take risks unless they are forced to take those risks due to unfortunate circumstances and uncomfortable positioning. They aren't looking for a solution when they don't have a problem. Crypto is there for people who need it, not want it.

Your choice is roll over and die or embrace a new idea. You MAY decide to embrace a new idea.

Maybe

No guarantees.

The digital transformation will not be denied.

It will dwarf the transformation of all other digital products (like pictures, books and video).

Conclusion

It's not till your faced with that mortality event that you're willing to embrace the idea.

But I never saw anyone on a sinking ship argue against the lifeboat.

It's only the people walking through the boat show looking at the yacht on a sunny day that say: "Wow, that life raft is an ugly orange thing on the side of this ship; it impairs the view; remove it, now."

That's the way people think.

Return from Saylor Interview: "Need to Know" Asset to edicted's Web3 Blog