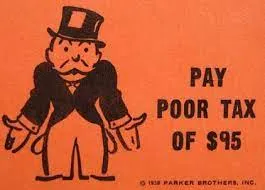

Stop being greedy.

Just stop.

Stop putting so much money into random defi yield farms (a little is fine). Stop margin/leverage trading on debt. Stop increasing your risk when you should be lowering it. Full stop.

You know who doesn't care about this dip? The people who actually had balanced positions and still have fiat to buy back in. And guess what? After they buy back in they STILL have money to buy in again if it dips lower. That's how it works if you actually have a balanced position in the market.

But that's no fun, amirite?

You gotta go all in and make those millions. How's that working out for you? Let me tell you, as a former professional poker player, this is not a sprint. This is a painstaking grind, and if you don't have the mental fortitude for a painstaking grind, you're going to end up losing money rather than gaining it. Simple as that.

Losing money was one of the big reasons I could never advance my skills in poker. I was afraid to play, especially after being up thousands of dollars in a short time period. I knew I was going to lose most of it, perhaps all of it, and I would often avoid playing because I didn't want that to happen. The emotional terror of losing all that money I had just won was too much to continue on with the grind. Don't let that happen to you in crypto: as crypto is much more forgiving than poker. I guarantee it.

Everyone can win here. It's not a competition. This is a cooperative economy. The synergy we create here is forging an abundance of money and resources, something the world hasn't seen... perhaps ever. Money and technology are finally merging after eons of scarcity.

Wow, would you look at that...

Hive has essentially completed an entire volcano pattern within the span of 5 months. Crazy stuff. 20 cent Hive is on the table, and no one is buying. Laughable, but also business as usual.

Hive has always had hardcore support at 10 cents, but it looks like we are going to bottom out at 15 cents minimum. Hopefully we will never hit 10 cents again, but if we do I know for a fact we have hardcore support there. All the big players start buying at that level. I look forward to the day that we forge a new support line, but I've yet to see that hope materialize. Soon™

Trade against the market.

No one was bearish at $60k Bitcoin, and no one is bullish at $30k Bitcoin. Stop listening to the mob and just do the opposite of what they do. The more they cry, the more blood and tears in the streets, the more you buy. The greedier they get, the more you sell, even as the price keeps going up and it feels like you're missing out. Stop the FOMO. Stop the FUD. Stop going all in at the first sign of a dip and make the adult play of DCA in both directions. Yield farming allows us to do this algorithmically without even thinking about it. Stable coins have a lot of power when it comes to high liquidity high yield pairs.

It's a shame I was right.

A lot of my predictions are coming true, unfortunately. Prepare to get dominated. Bitcoin dominance is going up. It is maintaining support here at $30k but it is doing so by wrecking the alts. Too bad so sad, dominance was low and now it's going back up. This was predictable. I expect it to get back to 50% or higher before we get another real altmarket. Even as BTC goes up in value the alts will be afraid the pull the trigger for quite some time. We need another consolidation phase near or above all time highs once again to make it happen.

Fantasy Bitcoin

Remember this? Remember my Venti 20-point trading system? I've been playing this entire time. I sold one point at $40k, $50k, and $60k. I gave myself 20 BTC in this scenario (one per point), so that's $150k fiat on the table. I shoved all in back at the $30k support. Let's hope it holds. I just turned 3 fake BTC into 5. Pretty amazing considering my track record for trading. Perhaps there is something to this style of DCA trading after all. I really need to work on this project more. Good thing my database suits this purpose perfectly.

Playing with FIRE

Speaking of my Magitek token project, I've realized a bit more how fire, lightning, ice should interact with the system.

Fire can only be created by destroying Hive, so I really want to keep it this way. At first I was thinking I'd like to create inflationary and deflationary pressures here, but now I realize I can take an even better direction. Fire will be used for any and all gambling dapps built on the system. For any application where the price doesn't have to have unit of account (volatile) I'll use fire as the base currency. Fire will never be destroyed or created (apart from burning Hive to convert it to fire). Rather, it will be used to gamble on dapps like Fantasy Bitcoin and Pentaskill.

Lightning is the energy of the network. It will be created and destroyed much more liberally than fire. When you want to mint and NFT, lightning will be destroyed. When you want to farm Aether, lightning will be destroyed. When you want to do anything that destroys a resource, lightning will probably be the go-to asset. On the flip side, multiple assets will be able to create lightning. At first it will just be HBD/mana but the plan is to add additional burns from outside the network. Also stable coins are non-volatile so lightning should be pretty stable and cheap as well for the most part.

Ice, being the official stable coin, is the coin used for unit of account. If you want to sell an NFT, it will be priced in ICE to maintain that ability to price values without having to do conversions on a day to day basis. Anything that needs to be priced in this way will be done with the ICE asset. By default, the network will bend over backwards to maintain this stability if necessary using governance voting to tweak the numbers.

Conclusion

There's a helluva lot more to crypto than number go up. Those who focus on price get tunnel vision and find themselves counting chickens before they've hatched. You can't see the forest from the trees. Keep your head down and avoid all this noise. The stress isn't doing anyone any favors.

This is a grind. This is not supposed to be all sunshine and rainbows. Funny how everyone forgets that. How is that even possible? How is it possible that people don't even understand what the terms HODL and diamond-hands mean? How is it that these terms are only employed at full-force when the market is doing well? I think the answers lie somewhere in delusion.

Stop trying to get rich quick.

Even if it works, the risk it took to get there wasn't worth it.

Posted Using LeoFinance Beta

Return from Scrambling to get rich quickly is ironically the thing making you poor. to edicted's Web3 Blog