#### The SEC has "protected investors" once again! Funny how protecting investors always seems to end with investors losing money!

At the end of the day we just have to assume that the SEC has now turned into this ridiculous money grubbing agency hellbent on refusing to do their own stated job. It is the SEC's job to provide regulatory clarity. They refuse. It's the SECs job to protect investors, yet no one in crypto feels protected by any of this. Gary Gensler is a snake and a liar. The words coming out of his mouth simply do not match his actions.

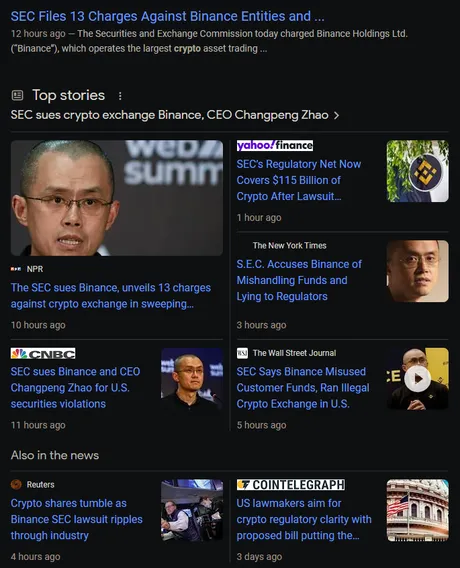

Most recently we see that the recent dip in crypto was caused by this nonsense. Of course it's not complete nonsense as we've all seen how shady Binance can be. Shame the SEC refuses to acknowledge what Binance did during our own hostile takeover, because that's a grievance actually worth addressing.

Among the allegations presented are "co-mingling funds" like FTX did (except FTX was much much worse) while at the same time allowing users to still use the service with a VPN. Of course what the SEC never addresses is why Americans would want to continue using Binance in the first place given that everyone has already known these things for years.

People want to use Binance because it provides a service that people want:

- cheap trading fees

- deep liquidity pools

- access to hundreds of assets

The SEC and other Binance poo-poo-ers are always quick to point out that Binance "makes Billions of Dollars in transaction fees". Yeah... duh... that's their entire business model jackass. What they seem to forget to mention is that Binance has the lowest fees in the entire business. Protecting investors by forcing them to pay more fees? Yeah... very smart. And it's not a small amount more either. DEXes cost triple and Coinbase costs x6 the fees of Binance. It's absurd on every level. Isn't it just far more likely that the motives at play here are tainted and corrupt?

Of course this is all well-deserved.

There are legitimate reasons to take CZ to task, but a lot of these accusations, even if true, just feel like mudslinging to me with very little evidence to back it up. Considering the SEC's crusade against crypto and their refusal to do their own job: that narrative makes a bit more sense than actually trying to "protect investors". This is all feeling a bit political and corrupt across the board at the moment.

OMG WHY DID BTC CRASH $25k!?!

I think it's a bit comical that people are flipping out over the price... I've been talking about $25k since February. $25k was the resistance line to beat for the entire month. Of course there was a great chance we'd retest this level as support. In fact I expect the price to dip slightly under $25k and cut into the $24k or even $23k range before the FUD gets lifted. The fact that crypto is as high as it is shocks me to the core.

If we look at how bad everything actually is with the economy and the regulators and the fudsters honestly Bitcoin should be like $8k-$10k right now scraping the bottom. Hive should be like 8-10 cents in an environment like this... and yet the price towers above the gutter numbers but everyone still manages to flip out and panic sell a 5%-10% dip. Craziness. Have some perspective fam! We're honestly not doing that bad.

Crypto can't get weaker.

As much as the government loves to stomp on it right now, political corruption is just one more reason why crypto needs to exist. The value of crypto will continue to grow, and the players therein will continue to grow more powerful. At a certain point the SEC is going to step on the wrong set of toes and they are going to get slapped hard (assuming they actually win the Ripple lawsuit and we have to wait longer than the outcome there).

It's quite inevitable that given this blatant overreach combined with in the intrinsic need for crypto to exist that eventually the SEC will lose a gigantic case which will dwindle their reputation to all time lows. Once that ice is cracked their own tarnished reputation will lose them dozens of more cases in the years to come, and more importantly embolden the victims of these cases to fight back knowing that they can actually win legitimately. And perhaps even more importantly than that it will finally force the issue of the SEC actually providing clarity... a thing they refuse to do because it guts their own regulation by enforcement power-play.

It's a bit funny that Gensler calls crypto the Wild West under the context that he'll be the one to bring everyone to heel. LoL, good one buddy. As if a single person or agency can prevent a tidal wave of decentralization from sweeping across the entire globe. Over and over again we hear this: crypto is the "Wild West" and this phase will not last very long... except the entire point of decentralization is to break all the established rulesets and put communities in charge of their own sovereignty.

The "Wild West" phase of crypto is never going to end...

In fact it's going to escalate to levels that most people would have never dreamed of. Again, that's the entire point of this technology: to break the chains of imperialism and controlling communities using centralized authority. Anyone who thinks we've already peaked is fooling themselves. Even during the gold rush the Wild West of America lasted several decades. The train robberies and saloon shootouts will continue on unabated, and agencies like the SEC can only add fuel to the fire, not the other way around.

Conclusion

Well we made it past the 4-year cycle bear market year of 2022, but the economy is still jacked and the regulators are still flexing hard and kicking us while we are down. Luckily no amount of regulatory peacocking could possibly hold a flame to the LUNA collapse into the FTX collapse. Crypto has already bottomed (at least Bitcoin has) and sits well below the doubling curve trendline (which will be $100k EOY). All we have to do from here is hunker down and wait for the skies to clear. The risk-on environment we're looking for is much closer than it appears on paper.

Return from SEC Sues Binance on 13 Charges to edicted's Web3 Blog