The Security Exchange Commission recently issued a rare no-action response to a social media site for issuing a stable coin. This means the site will not have to register as a security, avoiding a lot of regulations and hassle for the company.

https://cointelegraph.com/news/sec-gives-ok-to-social-media-platform-to-issue-stablecoin-without-registering-as-a-security

To abide by the no-action letter, IMVU needs to keep its new stablecoin from looking like an investment opportunity, which, for example, Facebook got tripped up doing with its Libra stablecoin.

The letter stated IMVU would need to make the token “continuously available in unlimited quantities and at a fixed price” of $0.004, and would not “promote or support listing or trading” of the token on any third-party platform.

Let this serve as yet another example of the SEC losing complete control of this situation. There are hundreds of coins in circulation today that would have been slapped down a decade ago. How is it possible that digital currencies that would have been (and indeed were) slapped down by regulators are all of a sudden allowed to exist today?

Bitcoin

Bitcoin creates the breeding ground that allows all of this to happen. Bitcoin can not be regulated, so the regulators don't even try. It's already been deemed "not a security" along with Ethereum and many others (despite the offensive premines). The more decentralized projects act as regulation blockers for the more centralized ones.

The digital currency market was easy to slap down when before it put down any roots. Now the roots of Bitcoin are even know entering legacy institutions, further sealing the deal. As time goes by, this space will only become harder and harder to regulate, to the point of forcing entirely new and simplified laws to be created in order to deal with it.

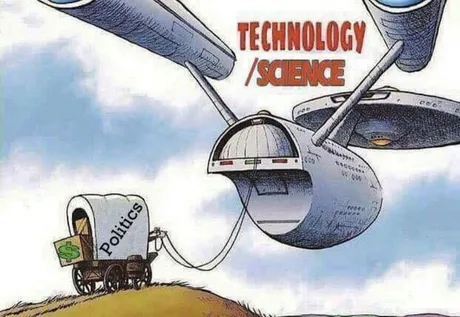

However, these new laws will still have little effect, because in the time it takes to reformat the legal system as it pertains to crypto, crypto has already had more than enough time to evolve and make those new laws irrelevant as well. There is simply no way that the legacy system is going to keep up with exponentially expanding technology.

Pocket Full of Quarters

So I must have missed this one or just ignored it at the time, but wow the ramifications of this development are astounding.

The United States Securities and Exchange Commission (SEC) has cleared a crypto gaming company to issue blockchain tokens without registration, deeming the tokens to not be securities.

Pocketful of Quarters (PoQ) was co-founded by George B. Weiksner, an eighth-grader who is listed as the current CEO.

Summer 2019

Why do people talk about this stuff like it's normal? Why don't they say what it actually means? Seriously, this is crazy. If the SEC has to spend resources confirming (or even more hilariously taking action against) an 8th grader trying to be their own central bank, how in the world do they expect to be able to keep up with the rest of the space?

I can't wait until I start seeing propaganda like this against currency. YOU WOULDN'T STEAL A CURRENCY WOULD YOU???? WOULD YOU!!??! WHY DON'T YOU WANNA BE OUR DEBT-SLAVES ANYMORE!?!? WHY!?! PEDOPHILES, TERRORISTS, DRUG DEALERS!!! OMFG! Lol seriously though.

Remember how hard they tried to fight against movie and song pirating? That was a disaster, and every company that tried to fight that coming storm of abundance was swept off the map. The only ones who survived adapted to the new paradigm. Even then, it opened the door for new companies like Hulu and Netflix to actually thrive in the space.

The above anti-piracy video is older than Bitcoin.

Posted in 2007, yeah, it didn't age well. Crypto regulation isn't going to age well either.

Because you can't regulate it

As time goes on, more and more extremely profitable crypto templates are going to be built. These templates will create products that are impossible to regulate. There will be no corporations to sue. There will be no official dev teams to go after. Not that they can even go after dev teams because they are protected by freedom of speech.

It's the nodes.

Anyone can code whatever they want under the protection of free speech. It doesn't matter if that code could be used to steal money or property, melt servers or extort corporations, or do any other manner of illegal activity. Writing the code is not illegal, but executing the code might be depending on the action that was actually performed.

In the context of cryptocurrency, all of the code that might be deemed illegal in one country or another is executed across every node (server) of that network. There is no way to censor the operations. Like it or not, this is happening.

Unlike movie/music pirating, crypto node operators have a huge financial incentive to keep the ball rolling. Instead of movies and music files being created out of thin air, money itself is being created out of thin air.

This x1000 incentive makes it x1000 times harder to stop than pirating. If the fight against intellectual property theft failed, you can be damn sure the fight against crypto is going to fail. We can always count on tech to smash barriers. This is especially true if that tech is decentralized and has no head to cut off.

There are so many centralized services that are about to get disrupted, and regulators will have no idea what to do about it. The biggest one that I can think of is gambling. Once done correctly, state lotteries and brick & mortar casinos are going to be made completely irrelevant.

Again, the vacuum created by this irrelevance will be filled with services that would have been slapped down instantly ten years prior. Imagine again an 8th grader running their own legit casino. It's not really a question of if but rather when it will happen.

Conclusion

It's clear to see that crypto is still in the Dark Ages as it pertains to overall current progress on the way to mainstream adoption. The closer we get the more pushback we'll see from those who are threatened by this abundance technology. Like trying to stop a bulldozer with a bucket of sand.

It's already pretty much guaranteed that tech companies will embrace crypto. They stand to generate trillions. Lines will be drawn, and anyone standing on the wrong side will find that there really isn't anything they can do about it but accept reality. In the end, everybody wins, just like with the Internet. Luddites lose every time, guaranteed.

Posted Using LeoFinance Beta

Return from SEC: You know you're hosed when an 8th grader becomes a central bank. to edicted's Web3 Blog