Please sell the bottom bro, please.

I have been triggered hard once again!

As @taskmaster4450 and I can attest, there are a wave of users on Hive who believe that governing economic policy should be based on feelings and popularity contests. Why cite actual on-chain data to back up the theories being presented when you can just make shit up and talk out your ass?

Getting into the head of someone who wants to lower HBD yield.

In order to truly understand an argument one must put themselves into the shoes of their opponents. Luckily this is pretty easy to do considering all the arguments being made don't require any research or data to back them up. All we have to do is feel the feelz. Are you feeling the feelz? I'm feeling them!

Feelz Numero Uno: Hive is down bad; can devs do something?

Ouch this hurts and I'm uncomfortable.

Hive crashed over 90% from $3+ to 25 cents.

It's not fair that I only earn 10% APR on HP and HBD gets 20%.

20% is obviously not sustainable because competition offers less.

But I've already been over this a dozen times.

These arguments are not based in reality. If someone actually thought 20% yield on HBD was totally "unfair" then those people would be begrudgingly holding HBD while they complained about it. What do we see instead? None of these people are holding HBD. It's the most unfair tilted deal ever yet nobody is taking it? Make it make sense.

Please bro please, make number go up.

The simple truth of the matter

Hive holders want number to go up, and they think by lowering debt exposure their bags will increase in value. Unfortunately that's not how it works. If these people get what they want they're going to fuck up the economy and nosedive their own assets. In fact this is the same exact reason why we see so many people flirt with the idea of removing the reward pool entirely (an even worse idea that I have also talked about a dozen times).

Show me what number Hive would have crashed to without yield

There seems to be this overwhelming irrational consensus that if Hive did not offer 20% yields during the bear market then the price of Hive would forged a higher low than 25 cents. Do these people have access to an alternate dimension that proves this? Nope, just talking out your ass again? Very cool.

This is an insanely frustrating argument to even consider because anyone with half a brain can look at the chart and see that THIS COMMUNITY'S TOKEN HAS ALWAYS BOTTOMED OUT AT 10 CENTS. Hive posted a local low 150% higher than the previous local low and nobody considers that without the 20% yields that's exactly where we could have ended up this time around as well. It's maddening.

Please bro, printer go brrr bro.

When it really comes down to it this is all Bitcoin's fault. This entire ideology stems from the fact that Bitcoin is deflationary and has seen massive success, so of course every token should be deflationary by default. Correlation is not causation. Bitcoin is successful for a lot of reasons. Inflation is a double edged sword. Inflation is an investment. Investments can either succeed or fail. Bitcoin's only investment is security. Is this a good policy? Debatable.

Inflation as a measurement of growth.

Do you believe that demand for HBD can increase by 20% a year? Of course you do. Everyone does. Anyone who tries to make an argument to the contrary would look like a complete idiot. In what universe can Bitcoin grow by 100% per year and HBD can't pull out an easy 20%?

The point being here is the thing that @taskmaster4450 and I are going to tell you over and over and over and over and over again into the crowd of LALALALALALALALALA IM NOT LISTENING. If HBD can grow 20% a year then we never have to pay back the 20% debt we are printing. If we get more than 20% growth then the inflation of Hive goes down.

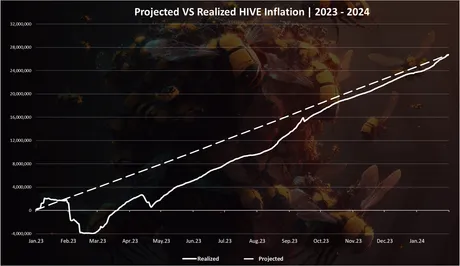

All of the on-chain data available shows that 20% yields on Hive have outperformed all expectations. Thanks to @dalz for such valuable insight. Hive's inflation hasn't gone up at all. Look at the area under the curve. We are printing less money than expected. This is a year's worth of data.

Not only that, the bear market years are supposed to suck liquidity out of crypto. HBD hasn't had any liquidity sucked out of it at all. Simply the fact that we traded flat and still have the same amount of HBD in circulation is an insane triumph and points to the fact that these yields can indeed be used to create elasticity of debt, which is something that nobody else has ever done in crypto. It's a huge deal.

Now we are approaching the raging bull market years of the cycle and users want to chicken out at the last second and rug-pull interest rates. Terrible idea: stop trying to sell the bottom. I'm so over it. Do you think that 30 cents is a good price to sell Hive? Do you really?

Creating debt is going long; removing debt is deleveraging.

Lowering HBD yields right now means you want to sell Hive at 30 cents. You think the network paying back its debt at the literal lows is a good idea. You've capitulated, right when shit was getting crazy and Bitcoin is about to make all time highs. You want to sell right before we get an alt market? It's embarrassing, and yet somehow perfectly on par with how people trade these markets on a personal level.

Isn't it painfully obvious that creating debt and flooding the market with easy money is exactly the thing we want to be doing during a recession? It's trading 101. Buy low and sell high. Everyone who wants to lower HBD yields is like yeah but hear me out what if we sell the bottom instead! Huh! Good idea amirite? And the crazy thing is that they don't even understand this is what they are doing.

Hive has debt.

And we should pay that debt back when the collateral for that debt is worth a lot of money. When HBD gets converted for Hive, we don't want to give that user 3 Hive for 1 HBD. We want to print at least less than 1 Hive for 1 HBD, which means the HIVE price needs to get higher than $1 or at least hit dollar parity. That's a great time to be talking about slowly lowering the rate. Not at fucking 30 cents like a frightened pleb looking to sell the bottom like a chump.

How do we stop users from converting their HBD into Hive?

We give them reasons to hold it. There are many reasons to hold HBD. 20% yield is one of them. Lowering the yield implies you want to lower demand to hold HBD, and thus convert more HBD into Hive to pay back debt. Why are we trying to pay back our debt at the lows? Just wait one year. It's not hard. The bull market is preprogrammed in at this point and there are a million badass projects on Hive that will go online before that. Do-nothing is the best option.

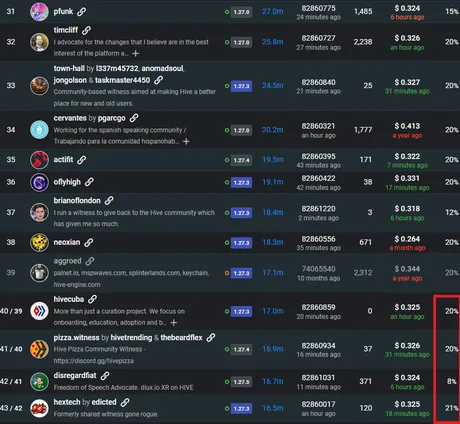

I'm so fucking over this whole discussion that I just now, while writing this, changed the @hextech witness to signal 21% APR on HBD. @town-hall and @l337m45732 should follow in my footsteps and do the same, because this is ridiculous. I'm really putting myself out here on this one. I'm the only witness on the entire network signaling for an APR higher than 20%.

I could lose votes over this, but the hope is that I can convince (or simply represent) others that this is the way to go. Stop being afraid of these yields at the literal worst time to be afraid of them. The market vampire is in your head. Stop trying to sell the pico lows. It's not a good look.

The ultimate metric: the debt ratio.

Hive's debt ratio has been crab-walking in the 5%-7% range for literal years. When you think about the fact that the token price collapsed by over 90% in the bear market: this is absolutely insane and quite incredible.

There's no fucking way our debt ratio should, not only be that low, but also stable at the same time. Again, every on-chain indicator tells us there are zero red-flags with 20% yields. I've been arguing this point for many months and not a single person has been able to present one shred of evidence to the contrary. You do not have the right to lord over economic policy like it's a popularity contest; get over yourself. I don't care if it's "not fair". Stop acting like the deal isn't being offered to you. It's absurd.

I hate democracy.

This is one of the big reasons I'm so bullish on Hive and the underlying governance model. I know for a fact that I can't change the mob's mind on topics like this, but I can change the minds of the people who actually run the network and have something to lose. There's a reason why direct democracy doesn't work, and it's because it puts the average person in charge of things that should be controlled by the experts of that particular field.

Economic policy is an extremely sensitive and complicated line of work. You change one thing because it "sounds right" and it can have the opposite of the intended affect or domino-effect other policies that were not even considered at the time. There has to be a very good reason to change policies like this simply due to the fact that manipulating economic policy on a whim makes us look completely incompetent to outsiders. Diminishing returns are high and we need to be sure.

Conclusion

Am I making much ado about nothing? It's possible. Only 3 consensus witnesses are actually signaling for yields below 15%, and two of those are 12%. All of these options are extremely competitive when looking at what's being offered elsewhere. They are all very good yields from the endpoint user perspective.

However, that doesn't really matter. The people in charge of economic policy need to understand the economic policy they're in charge of. It doesn't matter if they get it right on accident. A broken clock is right twice a day. When I hear about the false reasoning behind these decisions with absolutely no data to back them up I get extremely nervous. And it prompts me to make posts like this one.

It's very simple: Hive does not want to pay back its debt when the price of Hive is low. The only way to justify such an action means to admit that this entire experiment was a failure and we need to capitulate at the bottom and become distressed sellers so that it doesn't cripple us even worse. However, we already know this isn't true.

We can see the data. We can see that Hive isn't being printed. We can see the debt ratio is low & stable. We can understand that a growth rate of 20% per year is not unreasonable within the current climate. We can see that a massive bull market is just now starting. Every single point of data is yelling at us to not only keep HBD yields at 20%, but also that increasing it even higher is an option. Of course I can't argue that position because no one will accept it. But I will put my money where my mouth is and signal 21% on my @hextech witness.

Vote for @hextech if you agree.

Let's buy the bottom for once instead of selling it in fear.

Return from Selling the Bottom: Let's Lower HBD Yield! to edicted's Web3 Blog