Ah so that's what a normal 30% retracement feels like.

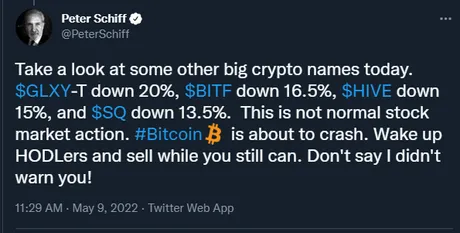

Bitcoin has crashed from it's $48k local high in late March to the $33k doubling-curve support trendline in six weeks, and most of us are feeling the burn. That's a 31.25% drop, but it feels like a lot more considering all time highs capped at $69k and we find ourselves in a full-blown 50%+ retracement from that level.

Then again, it shouldn't be that bad because we already did this last May when the market crashed from $60k to $30k in a matter of nine days. Any price over $30k is pretty much heathy and there's basically no way we go under $30k at this point unless it's a flash-crash sparked by a recession-level event. Even in that case it's not a big deal because Bitcoin will recover within a quarter like it always does.

2000 Sats

That's how much it costs to buy 1 Hive.

In 2020 I was aggressively buying in the 300-400 sat range, which is obviously a magnificent discount compared to where we are today. If we look at the chart above, once again we see that all the death-crosses are in (just like the USDT chart) and all we can do is Golden Cross from here.

50 cent Hive is still the golden support line at this point. However, Bitcoin is basically already at support, while Hive can still drop another 25%. This is true for a lot of alt-coins. Bitcoin has hit support but they haven't. Should Bitcoin start grinding under the doubling curve alts are going to get hammered as BTC sucks up liquidity from the "lesser tokens".

We can already see the chart above looks exactly like a volcano blow-off-top. If this is indeed the pattern that means we have one more 25% drop to go in relation to Bitcoin before we start bottoming out at 50 cents. Luckily things like the HBD haircut don't trigger until 25 cent Hive, which is a great place to be. Hive is neither oversold or overbought. The same is true for Bitcoin.

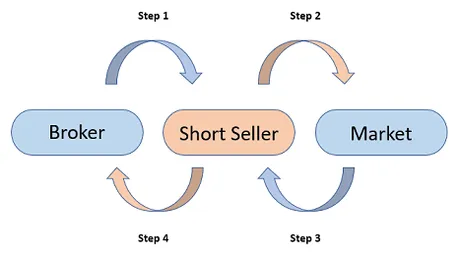

Shorting the market

The real topic I wanted to discuss today was the ability to short markets and how it actually adds value to that market. Many make the claim that precious metals like gold and silver have been manipulated by futures and derivatives for decades, and to some extent that is true. However, the way in which it is false is a huge point of contention.

Gold and Silver have not gained any value over the years. At best these assets, as a store of value, simply do just that. At best they store the value and hedge against inflation. But gold will only be gold and silver will only ever be silver. These are archaic forms of value storage, and the reason they don't perform as well as we like them to over long periods of time has nothing to do with manipulations. Manipulations only work on the short to mid term scale.

Unfortunately, the reason why gold and silver are suppressed is because the legacy system has built way more value than we care to admit. For all the flaws of fiat and the banking sector, legacy finance has been building utility, while gold and silver have no utility (at least no more than they did 1000 years ago).

Most people who know how corrupt the system is fail to admit that the system still has value. If society didn't exist, 99.9% of the population would just die off in a matter of months. That's how dependent on the system we are, and that's why the system is allowed to get away with such atrocities and corruption. There aren't any other options.

Crypto is building the alternative system.

It's hard to see in its current form because crypto, like everything else, currently fully depends on the legacy sector. However, this will not always be the case. A transition is occurring, and just because that transition is slow doesn't mean it's not happening. Everyone could stand to have a little more patience in these regards.

I got into an argument with someone the other day about allowing crypto to be borrowed. The premise is a simple one. On one side, most people think that crypto shouldn't be allowed to be borrowed, because the main purpose of borrowing an asset is dumping it on the market and shorting the network. Ironically, being short on shorts is a very narrowminded and short-term perspective that focuses on the price of the asset today.

In reality, a fully functioning futures market doesn't hamstring crypto or allow it to be controlled; it gives crypto more value, not less. If I let someone borrow 100 Bitcoin for a year at 20% APR, at the end of the year they owe me 120 Bitcoin. If I was going to hold Bitcoin for a year regardless no matter what... wouldn't it be actually stupid to not loan it to someone so they can gamble on the market at a 20% average loss?

It's a two way street.

While shorting the market lowers the price today, it increases the price farther down the road by more than it lowered it. That's just the nature of how loans work, and borrowing crypto is extremely risky business because not only are the interest rates sky high but also crypto has been going up for over a decade straight without fail. The people who short the market are getting absolutely crushed on average and their value is ironically bleeding into pumping the price, not the opposite. I'm surprised more people don't realize this. Everyone has their blinders on in one way or another.

Conclusion

Shorting the market doesn't extract value from a network. The more tools that a market has, the more valuable it becomes. The idea that crypto will somehow be tamed by the institutional shorter sellers is absurd. They're going to have to buy what they borrowed off the market, plus interest, and the interest is not only massive, but also more than 100% overcollateralized. It's crazy people are even willing to take such a bad deal the vast majority of the time.

The ability to short the market also makes the market more stable. Higher highs and lower lows. Less volatility is a good thing, but don't tell a degenerate gambler who feels entitled to 10x gains year after year like that's actually possible to do. None of you are going to be richer than Elon Musk. Stop trying to make it happen or ya gonna fall flat on your face over and over again.

Posted Using LeoFinance Beta

Return from Short the market to pump the price. to edicted's Web3 Blog