Yesterday right before work I watched as Ethereum fell to $408. I thought to myself: this is the bottom. Just at that moment some money cleared my bank account and appeared on Coinbase. What luck! I bought Ethereum at $408, transferred it to Metamask, and logged into https://dai.makerdao.com/. The goal here was to lock up my Ethereum as PETH in a CDP and draw stable coin Dai from it as a loan. Using this loan I would invest in more crypto, effectively margin trading.

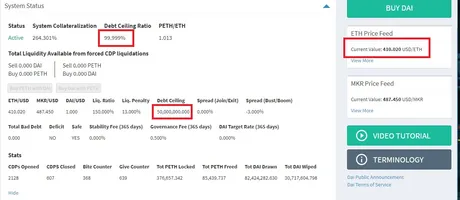

Wouldn't you know it, I wasn't the only one with this idea. Usually I see the debt ceiling for the Dai at 90%. Yesterday it was 100%, and remains so today. The platform is totally capped out. This means within the last couple of days 5 million dollars has been loaned from the MakerDAO. This is an obvious sign that everyone thinks the market is going to bounce back up. When you consider that the value of Dai has been slightly less than $1 for the last 5 days this becomes even more obvious. No one wants to hold Dai stable-coin right now.

I believe another sign that the market is ready to make a comeback is the value of SBD. SBD might end up being a very good indicator for when the market calms down after a huge pump. When crypto gets pumped to the sky and becomes extremely volatile, many people wonder when the market will calm down. I believe that SBD getting very close to $1 is an indicator that lets us know this.

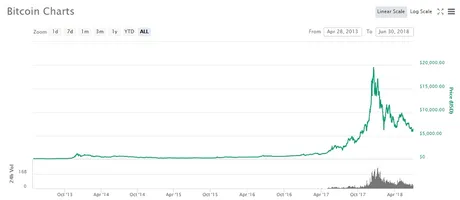

Most of the analysis I see for crypto graphs involve the usage of linear straight lines. However, whenever I look at the graphs I feel like they are highly parabolic when you zoom out and look at them on a more macro scale. I read an article the other day that confirmed this. Many professional analysts use parabolic indicators over linear ones.

Many graphs look exactly like this, mirroring the price actions of Bitcoin. You can see a parabola forming and it looks like we are just about half way through; very near the bottom.

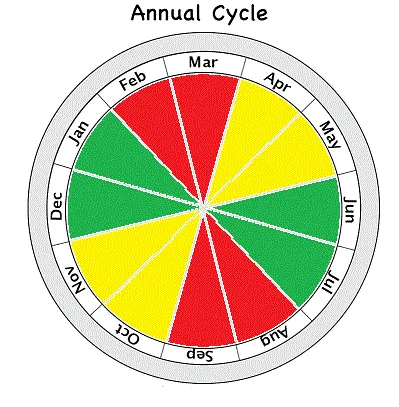

I've been subscribing to this idea for six month now, but it's time to let the dream die. I've been very hopeful that crypto would start getting two bull runs a year; one in winter and one in summer. However, this last bull run was so huge and created such big waves that there just doesn't seem to be room for a summer bull run. It isn't just analysis that brings me to this conclusion either.

I was very hopeful that fundamental investing would take place in the summer. Meaning, the technology/regulation would have advanced enough to merit more funds. It hasn't. Software development is notoriously slow and frustrating across all fields and crypto is no different. I was hoping SMTs would be here already. I was hoping Ethereum would be proof of stake by now. I was hoping the Lightning Network would fix the scaling issues of a dozen coins. No dice.

Therefore, I expect that the parabola will continue to emerge. We'll bottom out soon (or have already) and slowly ramp up to another crazy Christmas time bull run. Hopefully all these technologies the space has been promising will be up and running by then. Some regulation couldn't hurt either from an institutional investing perspective. You also have to wonder if it's in America's best interest to promote this winter bull run, especially when you consider the whole tax debacle that forced investors to pay taxes on money that didn't even exist anymore.

Whenever the price of crypto moves, the news is often blamed for the movement. Good and bad news comes out about crypto everyday, so it's pretty easy to simply just pick something that fits the narrative. However, a lot of good news about crypto has been pouring out lately, and nothing has happened. For example:

- Coinbase support for ERC-20 tokens.

- Bitcoin and Ethereum are ruled commodities over securities.

- Facebook stopped banning crypto ads (only ICOs banned now).

- Blockchain patents keep pouring in (solidifying corporate interest).

- Lax regulation keeps getting implied.

- Binance doing cash to crypto pairs.

- Coinbase CEO starts a charity.

- Microsoft announces blockchain payments on Xbox.

- Tether created 250M more coins

- India reversing crypto ban and adding regulation.

- Iran and Venezuela using Bitcoin in the face of hyperinflation.

- Bithumb recovered half of its hacked coins.

- Tron burns 100 million coins, mainnet launch and updates going well.

- Many analysts believe we are close to the bottom.

- Development continues across all blockchains despite price action.

- Etc. Etc. Etc.

All this news, and the market isn't really doing anything other than fluxing between $6300 and $5800 (Bitcoin)

Recent breakout

I wanted to write this post yesterday, but I only do one post a day. Can we pretend I wrote it yesterday? LOL. Because the breakout is much more obvious now.

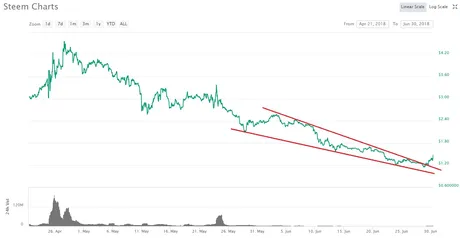

So a lot of people saw this coming. Steem was #35 on the market cap. This is really low for Steem. Because of this, just a few days ago, I aggressively traded half of my Binance coins for Steem. I literally just this second traded all that Steem back to Binance, because Steem is up 15% on the Steem/BNB pairing in the last 24 hours. I now have 10% more BNB coins than I used to and BNB hasn't moved at all... it's still at the support line. So what I'm hoping for here is a double run-up. Wish me luck.

I'm not that good at this prediction stuff but it's fun to try. I'll get better as time goes on. One thing you have to remember is that with trading fees as low as 0.05% you only have to be right like 51% of the time to make money on average. Also, by hedging your bets and not going all-in/all-out you can lower the variance of your gambling.

If I had to guess I'll say that Steem comes up to around $2.50-$3.00 (within 1-2 months) and then falls back to $1.50-$2.00 after. Are the signs of the bull here, or are we witnessing another "dead cat bounce"? We'll see.

Return from Signs of the Bull to edicted's Web3 Blog