Looks like Hive Keychain added a cool little thing. Notice how it tells you how far into your powerdown (currently 0/52k HP)

Now I'm only going to allow this powerdown to continue for 1 week. I think I only need around 4k Hive to arbitrage the LEO market.

wLEO is going to continue to go up.

To me the chance of this is pretty obvious. Not only is wLEO at the bottom (because LEO has very few coins with extremely high liquidity at the moment), the price literally can't go down while the 300k bounty is so generous. Talk to me in 3 months and I'll change my story.

In addition, I think ETH is also at the bottom.

September has always been a bad month for crypto.

The market hates September. I'll bet on October 1st the market gets an "unexpected" bump up just because it's not September anymore.

The Bitcoin halving was in mid May, and if history repeats itself we should get a spike to ATH with a 30-40% crash in Jan/Feb. Never fear, again, if history repeats, we'll be back at all time highs as early as March as we head into the most epic bull run of all time.

All hail 2021.

So where does this leave wLEO? It can only go up at this point. The target liquidity was $100k and we are already at $230 in a couple days. Pretty good for a coin with a total market cap less than a million dollars. Think it stops there? It doesn't? I'm already planning on adding thousands to the pool when my LEO powerdowns complete.

What does that mean for arbitrage?

I means people who don't want to mess around with ETH because they are already just fine on Hive (aka all the people who earn blog rewards and just sell them on the market) are going to do so, you guessed it, on the market... at a loss.

I was somewhat annoyed that my 0.83 buy order got so aggressively undercut. Am I to blame for posting about this opportunity? Honestly though it's not a big deal. This buy wall is yet another factor that can only push the value of wLEO to the moon.

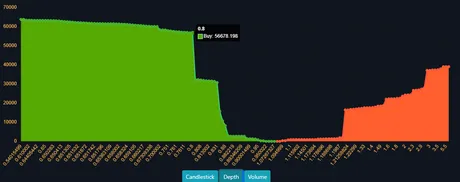

Notice the huge chasm between 0.8 and 1.2. This is the range it takes to make arbitrage worth it. However, I've undercut those buy orders to 0.9, because as wLEO moves up in value the buy wall becomes more and more profitable and competitive.

Already my 0.9 buy order has been undercut by 8000 coins.

The spiking of wLEO already makes buying at the 1:1 ratio worth it for arbitrage at a high enough volume. A 8.8k LEO sell order at 1.1:1 Hive just got posted and will be arbitraged if ETH or wLEO spikes up again.

Powerdown

In order to reduce overhead cost and gas fees, I'm going to need 4k coins at least to fund my buy wall. I'll get those 4k coins in a week and hopefully if people dump and I increase my stack through the arbitrage process to further secure the network and the epic buy wall.

Sell wall in jeopardy.

I've removed all my sell orders. LEO is far too valuable at this level to sell. If price spikes on ETH because bigger bankrolls enter the market (something no one has had the opportunity to do before now), this means the sell walls are at risk of being arbitraged during an ETH spike up, a wLEO spike, or even more likely a combination of both.

Example

The value of ETH spikes up 20%, and the value of wLEO:ETH spikes 20%. This increases the dollar value of LEO by 44%. LEO spikes from 17 cents to 24.5 cents. Now, all sell orders on HiveEngine can be bought out and arbitraged and the market won't even budge.

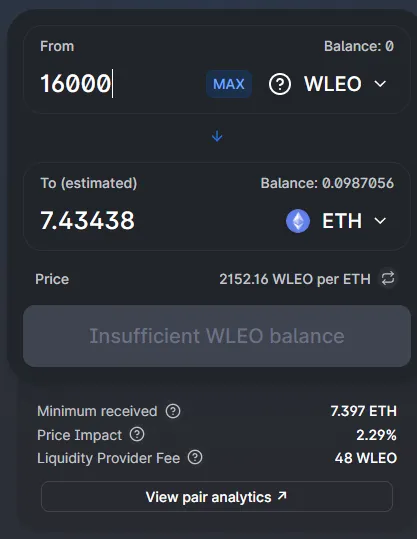

There's a big ass well wall for 16k coins at 1.2 LEO/HIVE ratio. Assuming 15.5 cent Hive that's only 18.6 cents. Because the chance of this sell order being a real person and not a bot (99% chance), there's a very good chance they might forget to remove the order from the books (or not even realize they should). This would allow anyone to buy the entire chunk for a 5.9 cent gain per token ($944 not including fees). So in that situation someone could literally make almost $1000 just from arbitrage for less than 15 minutes actual work done.

How would that affect Uniswap?

Not at all.

At our current liquidity, the price would only go down 2.29% from such a massive trade (over 2 whale's worth of stake). I say again, AT CURRENTLY LIQUIDITY. It's fair to assume that if a situation like that happens wLEO liquidity is far greater than the current $230k, implying that slippage could be as low as 1% if/when that time actually comes.

ICO?

This whole Uniswap listing is starting to feel like an ICO. LEO whales and orcas are basically broke as a joke; none of us has any real money to throw around. At this point, we can't move the price up or down. A community of zealous holders isn't about to sell their stacks now at the beginning of an epic LP farming situation.

We also can't raise the price, because again, no one in the LEO community is an ETH whale or even close to it. The only way our price can move is from the Ethereum moving in and out of the pool. Again, with Uniswap liquidity being x1000 better than HiveEngine, the derivative market now controls the entire market.

Yield farming coin targets yield farmers.

wLEO is currently targeting a community of Uniswap yield farmers. What does wLEO have that none of the other ERC-20 tokens do? A functioning website and 2 other ways to yield farm.

- Farm the liquidity pool on Uniswap.

- Powerup coins and upvote on the website.

- Start a blog on the website and start getting paid.

There are so few bloggers on LEOFinance right now, I'm just gonna say right now that if I see a bunch of new faces from ETH I'm going to upvote them just because they're here. I'm willing to bet people like @taskmaster4450 will as well. There's a reason why some are keeping their coins powered up. Upvoting content is another great way to generate hype and get the ETH guys excited for this 'new' coin.

Leo richlist

@dtrade @rollandthomas @taskmaster4450le @onealfa.leo @megavest @phython @plook @steemstreems

I would ask that these accounts be on the lookout for new users from ETH and upvote them over the coming months. Perhaps we should organize some kind of #introduceyourself upvote airdrop just to generate some more hype around here.

Remember, we are targeting a community of yield farmers with a coin that can be farmed in 3 different ways. This puts us way ahead of the curve in terms of all other ERC-20 tokens out there, especially with the social media communication aspect connected to everything.

Uniswap pool makes upvotes bigger.

The wLEO pool already has 679k coins inside it. Many of these coins were powered up before this development took place. Considering we only have 5M coins in circulation this is a huge chuck that is no longer leeching the reward pool.

We also have around 5M coins outside of circulation to be used for developments (things like the 300k token Uniswap liquidity bounty). You may not see these coins when looking at HiveEngine or LEODEX but they are there, lurking in the background, and they are all creating inflation. This is why 10k LEO can upvote for 2 coins a pop.

What's the math on that again?

10k LEO upvotes 2 LEO per vote, ten votes a day, 365 days a year. 10k LEO can yield farm 7300 coins a year just via upvotes!

How is that possible!?!?!

It's possible because many LEO whales (including myself) aren't leeching the pool 24/7 with their upvotes. Many LEO whales sit at 100% voting power and this allows the reward pool to grow very large. Now that wLEO is here and tons of coins are being powered down, the ratio is only going to get better.

So what do you think happens when these ETH yield farmers come for the bounty but then find out they can power up and continue yield farming 73% APR a year?

Can you say moon much?

I have many privileged conversations with @khaleelkazi and I can say that they are pretty much going to be working 24/7 over the next 90 days to make shit happen. The Ethereum community will be targeted. I guarantee it.

I'll be there on the front lines.

To be continued.

Return from Small powerdown to arbitrage the wLEO market. to edicted's Web3 Blog