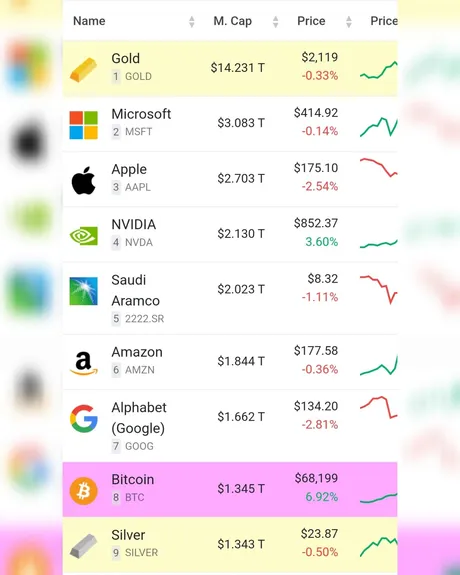

At a price of $68.2k Bitcoin flipped silver on the market cap making it the #8 most valuable asset on the planet. Of course this chart doesn't include things like real-estate, derivatives, bonds, fiat, or anything like that, but it does include securities and commodities, which is what Bitcoin is essentially classified as within the flawed legacy system that refuses to give it legal status as a currency.

Do I think that Bitcoin is a currency?

Ah well that's up for debate. Cryptocurrency does have 'currency' in the name. It can theoretically be used as currency but also isn't that good of a medium-of-exchange or unit-of-account thus far. However, these points are largely irrelevant since they have nothing to do with why or why not cryptocurrency would be considered currency on a legal level.

The reason why governments refuse to acknowledge crypto as currency has nothing to do with its properties and everything to do with the legal status given to currency. Nobody wants to allow crypto to be called currency legally because it would give crypto a huge legal advantage in terms of taxation and dozens of other legal nuances.

In fact these same nuances exist when classifying crypto as a security vs a commodity. A commodity, like gold or oranges, is a physical thing that can be mined or farmed by anyone. Nobody can patent a commodity or send a cease and desist order to someone else informing them it is intellectual property of XYZ corporation. Because of this fact, securities laws are much stricter than anything else, which is why so many governments are so keen on stomping their boot on the neck of crypto in this way.

How many cryptocurrencies are securities?

The answer to this is widely variable. I've done dozens of hours of research on this topic and I can safely say that most cryptocurrencies are not securities even if they are completely controlled in a centralized manner with a massive premine. There is a reason why Ripple won their lawsuit. They simply do not fit the definition of what a security actually is even in the worst possible scenarios.

This is a situation where crypto walks like a duck and quacks like a duck, so the SEC labels it a security. They simply don't have the tools, laws, or knowledge to differentiate it as a completely unique asset class. And honestly for the most part this is fine. Just because crypto isn't a security doesn't mean we shouldn't be classifying it as such anyway. Again, crypto isn't currency, commodity, derivative, or security. It's nothing the legal system has ever seen, and yet the legal system is forced to classify it as something regardless.

Rank #8 on the global market cap

Oh how far we've come from our humble floor of $16k in 2022. Now we teeter at all time highs on the verge of supply shock. What happens if BTC pulls another x2? It's going to flip Google, Amazon, Saudi Aramco, NVIDIA, and Apple in one fell swoop. Imagine the type of attention it will get worldwide once something like that goes down. It could happen in as little as 10 days if my theory of a blow-off top is accurate.

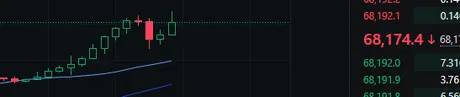

Last night when the ETF money printer got turned off and the East hemisphere was in charge we got a nice dump that wiped out the last 16 hours worth of gains in a single candle. This morning when money printer gets turned back on price goes brrr and even pierced all time highs a few minutes ago at $69k on Coinbase. Of course many bears are trying to foolishly short this "triple top" so we are still floundering, but also this fractal is impeccable.

It's perfect even.

Comparing to the 2019 BTC volcano.

The dump that we just got signals to me that we have just entered phase 2. These are six hour candles so if it plays out a similar way we'll be trading sideways for another two days. Struggle-bussing between the $65k-$69k channel while the bears get it all out of their system. They are gonna get wrecked... again.

Gareth, wrecked.

Capo, wrecked.

Cramer, wrecked.

Send it.

2 days

After around 2 days we should pump again and transition from phase 2 pressure to phase 3 pressure. The same type of thing happens with bears moving in trying to crash the market with leverage but they can't do it because the demand is too high and the supply shock is real. After another 2 days of sideways we hit the biggest pump in the cycle with a blow off top.

Notice how the timeline adds up perfectly.

I've been saying March 15 is a key date for a long time now. If we just entered phase 2 pressure. That's exactly 10 days away from peak. Ten days away from now is March 15. What a coincidence. It's possible that I called this thing from a mile away with perfect accuracy, which will obviously be insane if I'm right. Volcano fractal strong.

Day trading opportunities.

The last time the volcano happened in Q1 2021 there was a brief moment in time (maybe 12 hours) where volume dropped off a cliff and the price hung at the peak before dead-dropping into the "Eruption" phase. If we get a clear signal of this happening on March 15 it should be very easy to day trade. Say price peaks at $120k then we expect at least a 17% flash crash down to $100k unit bias and maybe even as low as $90k for max pain.

This flash crash can be as short as 24 hours and if timed properly is one of the absolute easiest places to make money day trading. Just go short for 24 hours and ride the red-candle down like a boss. After 24 hours buy back in at the $90k-$100k range and then sell the dead cat bounce 2 days later... ride that back down for 4 days... etc (notice how the timelines on the volcano eruption expand and get slower/weaker: 1 day, 2 days, 4 days).

Of course making a plan this specific is bound to not turn out exactly as planned... but it's always nice to have a plan in advance even if every little thing doesn't end up going our way. I only day trade this volcano pattern and bull flags. That's it. To me it's like getting AA in a poker tournament. I have to play those cards. I can't fold them. If I lose; so be it.

Conclusion

The concept of higher prices being the solution to higher prices actually applies to the economy and inflation. A higher price of raw materials means a higher price of end product, and in turn a higher price of employee wages to make up for it.

However, with Bitcoin during a bull market like this higher prices are also the solution to higher prices. The hype is real. Bitcoin's market cap is going to flip every single commodity and security on earth except for gold during this cycle (and maybe even gold). As it does, the flywheel will keep building and pulling more capital into the blackhole of this bull run. Be mentally prepared for this; it's of the utmost importance during an institutional run that we stay strong and smart to make sure they don't get the upper hand. Don't let the VCs and hedge funds win.

Return from Solution to Higher Prices: Higher Prices to edicted's Web3 Blog