Let's be honest...

It seems like the market should have pulled back by now. Yesterday was a moment of weakness and volatility in the market. The price was going down and everyone was like, "Here it comes... brace for impact." And then what happened? Bitcoin spiked up to almost $24k, flushing all the overleveraged shorts down the toilet and then dumping back down almost immediately.

"Market Manipulation"

Of course bears have been crying foul during all of this. Saying that this pump "lacks volume" and is "artificial". Ah well, I've been looking at volume this entire time, and it has been very high. Lot's of people are selling into this demand and the price is going up regardless.

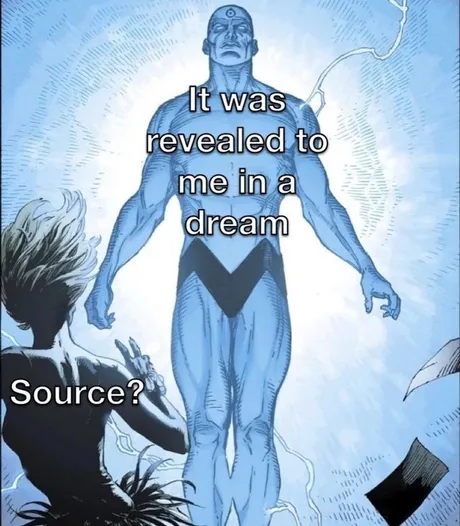

Yesterday's pump and dump totally did feel like short-squeeze manipulation, but the previous pumps have not. That being said I'm not a day trader so I'm also not paying attention as much as some of these other people. However, the "other people" in this scenario have clearly lost money on their short position and they provide zero evidence or numbers of any kind, so I have to assume they are just salty.

Bitcoin Dominance

Something else I noticed from yesterday's dip is that alts got hit WAY HARDER than Bitcoin during the downturn. Bitcoin was down like 2% on the daily and everything else got hit by 5% or more. This triggered me really bad because it reminded me of 2019 and how badly Bitcoin sucked up liquidity from the alts and outperformed the entire market. It very well could happen again in 2023, but there hasn't been a ton of evidence yet to suggest this is a thing.

All speculation, and Bitcoin is once again under 41% dominance today. Of course on Coinmarketcap.com it's at 42.3% because Coingecko lists more tokens and market caps as "valid" based on listings and volume. If you recall Hive wasn't listed on Coinmarketcap until we were able to get 3 exchange listings. Thems the rules.

Thinking more about market manipulation and "insider trading" and whatnot, if someone was going to use insider knowledge to buy crypto or stocks now would be the time to do it. What if someone knows that the FED will pause rate hiking on the next meeting? Even if they announce one more hike after this one, as long as they announce when the pause will happen the market will react positively to it in a big way.

It's pretty clear that deep pockets have been buying recently. It feels like no amount of downward pressure can break the current trend, as if there is an infinite amount of money to back it up. If we were going to dip: we should have done it yesterday when shorts got baited and liquidated in one fell swoop.

At the same time there are very few bulls willing to turn bearish at these levels, and in fact the recent price action has likely convinced many that now is the best time to hold ever. We see very little weakness in the charts even though the economy looks abysmal.

There's also the issue of all these tech companies laying off workers. This has made headlines because of how poorly Big Tech has handled this downturn. This is a great thing because it's loud and in everyone's face. This is exactly what the market wanted to hear.

We are still in the "bad news is good news" phase of the game. Everyone wants to hear that people are being laid off and that the recession is kicking into high gear because that means the FED will pause and pivot as deflation kicks in. As weird as it sounds, the worst of this recession (on the market side) very well may be past us, even if people who work for a living (paycheck to paycheck) are about to get hard by the harsh reality of a deflationary environment.

Ripple lawsuit

I'd like to speculate that someone knows Ripple is going to win the lawsuit against the SEC and that is also driving some of this price action... but alas that clearly is not the case because XRP would probably go +50% instantly. In fact if I was a day trader I'd set up a stop loss with stable coins that would buy XRP after spiking.

If XRP spikes like 50% out of nowhere it means someone knows they're going to win the case and they are getting in before the announcement is made. I would legit set up a stop loss to buy after a 25% spike and it would still probably go x3 after that. Winning the case would be a massive blow to regulators and a huge gain for the entire industry. Many networks would be able to crawl out from under their rocks without having to worry about getting stepped on.

Conclusion

Does someone know something? Is market manipulation happening? Or is this the same shit we always see after 1 year of bear market? It's hard to tell; maybe it's a bit of everything. In an environment where all logic points to the bearish scenario, the market spikes up. Again, the market is a psychic vampire ready to trap the masses into doing the opposite of what they should be doing.

Everyone is bearish, and the price goes up once again like clockwork. It's so absurd that this kind of stuff keeps happening, but it does. The best way to trade these markets is to either be an expert or simply HODL for dear life and stop worrying about where the roller coaster is going in the short term. Onward and upward.

The next FED meeting is in a week, and it may set the tone for the entire month of February. It's a bit annoying to be so focused on what the government and the central banks are doing, but there's no getting around it when everyone else and their mother is doing the same. They all know "don't fight the FED". Well what happens when the FED pauses and legging back into the markets is no longer fighting higher interest rates? It's all speculation.

Posted Using LeoFinance Beta

Return from Somebody Knows Something to edicted's Web3 Blog