In yesterday's CTT:

Matt and Dan talked a bit about... well a lot of things actually.

The episode ran for 3.5 hours which was a bit cray.

But it was a good show.

LordButterfly and the director of the Freechain documentary were in there as well.

Apparently a clip will be played at the next Hivefest, among other things.

Marketing was discussed heavily, and also a book is being written.

Matt and Dan are humbly pet-naming the book the "Bible of Decentralization".

Which organizes their thoughts into the correct chronicalogical order.

We're all pioneers here, and very few people are actually talking about this stuff.

Let alone understand it.

So I'll allow it.

However the opening topic was of particular interest.

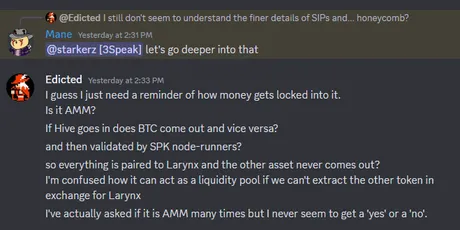

As the title of my post suggests, the SPK network and the SIP liquidity pools were brought up first, which immediately made me glad I tuned in this week because I still wasn't grasping the finer points of how they might actually work. I've asked if these pools would be AMM about half a dozen times over the past year and never really got an answer until yesterday. So I pushed the issue, and the answer was, "Actually we haven't decided yet," which actually surprised me quite a bit, but it does give me something to work with... as ironic as a non-answer being an answer seems to be on the surface.

Maybe!

If you're so inclined you could go to that timestamp 2:33 PM (hopefully recording started at 2:00 PM so 33 minutes in) and you'll see that I was getting answers in between some of these questions. Alright I just checked and it's 36 minutes in exactly.

Listening again it's interesting because it's a bit similar to how my own project Magitek would distribute its inflation: as a competition in which a static amount of tokens are minted every day and then distributed to anyone who puts money inside of the liquidity pool. The only problem I have with the explanation at this point is that they never seem to talk about how tokens can exit the liquidity pool.

It's not really a liquidity pool if we can't extract the "locked tokens" that they are always talking about. I'm always hearing about how tokens like Bitcoin and Hive and LEO would get "locked in" to the SIP as liquidity "forever" but never how they are able to get exfiltrated and actually act as a legitimate liquidity pool. The obvious assumption to make here is that if the tokens on the opposite end are dumped then the other token pops out. How else could it possibly work? Tokens would be extracted by the multisig dex solutions that Disregardfiat has been working on in tandem on the DLUX network... again a big assumption but would make sense.

But assumptions like this just bring up more questions.

Like... does 1 Larynx = 1 Larnyx? Is the token fungible? Because we've also heard reports that it's a virtual mining solution in which old miner tokens become outdated and less effective. Again, to keep the system fungible and simple I assume that by "outdated miners" what will actually happen is that inflation/emissions will increase and more Larnyx tokens will be distributed every day, which is a good thing because if Larnyx was deflationary like the SPK governance token that wouldn't make for a very good liquidity solution.

So back to the AMM viewpoint.

The non-answer I was given as to whether the system would be AMM or not was interesting because the crux of AMM is yield vs volatility. On traditional AMMs users will not provide liquidity to the pools unless there is something to be gained (yield). This yield has to be enticing enough to offset the risk of "impermanent losses" and other things like hacks and whatever else.

However, if SIP pools were AMM (and I highly recommend that they should be), then liquidity providers theoretically wouldn't even have to exist. It would be an asymmetric liquidity scenario in which the network itself is providing 100% of the liquidity and the liquidity is actually coming from people trading the tokens back and forth.

The reason why this is so fascinating to me is because it made me realize that this AMM solution could completely get rid of the need to provide yield to the liquidity providers (except for trading fees). LPs get rewarded $0 because they don't exist. The network itself is the LP and if I recall correctly the incentives to actually run infrastructure on SPK are paid out as SPK tokens (based on miners as a multiplier). It seems like quite a unique solution that we've never seen before... which could obviously work out great or have some unforeseen consequences.

Potentially Foreseen Consequences

We've been told many times that these SIPs are going to be huge liquidity pools. In my opinion this is why they need to be AMM because AMMs force all the liquidity to be up for sale an a sliding scale price point. AMMs increase liquidity by 10x or more compared to orderbooks... and if the system was an orderbook who would be creating the orders? As the network itself controls much of the liquidity it would make no sense, whereas the sliding scale of an AMM sets the price automatically with the ratio of the tokens inside the LP.

Listening again to the CTT broadcast right now from 36-40 min.

Alright so there is a ton of information crammed in there that I must have not fully absorbed the first time around. Users will be allowed to add liquidity to these SIP pools in addition to earning yield on that position. The yield that gets earned by the network's large position (from trading fees) will be spent by the network using governance votes. Although not explicitly stated it's known that all governance votes on the SPEAK network are SPK tokens themselves (not Larnyx or Broca).

What kind of listings?

One thing I just got very alarmed by upon re-listening was the declaration that there will be LP pairings like SPK/Hive, Hive/Bitcoin, and perhaps even something like Hive/Monero. I've been around the DEFI block enough times to know that these kinds of pairings can needlessly introduce a point of failure into the system. I would highly recommend to @starkerz and @theycallmedan to reconsider this strategy and instead pair all tokens directly to the asset that incentivizes them (in this case Larynx).

- Hive/Larynx

- Bitcoin/Larynx

- SPK/Larynx

- Monero/Larnyx

These are the pairs I want to see.

Why? Because I don't want to see a token being inflated and incentivizing a pool unless it has something to gain. @anomadsoul can attest that most recently Morphswap was a brilliant project that crashed to zero for this exact reason. They had LPs like BTC/Monero that actually worked (using oracles like chainlink).

Inevitably the Morph token crashed to zero because it was allocating yields to a bunch of LPs that provided basically zero value back to the main governance token. Oops! Seriously though it was a bit of a tragedy; Morphswap was an extremely promising network. I'd hate to see something like happen here (oops it already did with CUB and POLYCUB on LEOfinance). It's a very common occurrence in DEFI as the balance between yield and liquidity is quite tricky to get right.

There's no reason to not do it this way.

If I want to get from Hive to Bitcoin... then I just trade the Hive to Larnyx and the Larnyx to Bitcoin. The value of the stability and sustainability this creates in relation to the inflation rates and incentives is worth the inconvenience of being required to make 2 separate trades to get to where users are trying to go (in fact these double-trades could get automated into a single trade on the frontend quite trivially; EVM solutions like 1inch and paraswap already do it in an even more complex [parallel] manner instead of a [series]).

But what about Synergy, Utility, and UX?

I can see what Matt and Dan are thinking here. It would be amazing to have a direct line from Hive to Bitcoin and Monero. The UX of making two trades to get to one place is a bit annoying, and the secondary (or primary) utility of Larnyx is to mine SPK tokens. Surely, the fact that Larnyx can be used to mine SPK tokens can prop up its own value while being inflated into the LPs. I mean... maybe... but I personally wouldn't risk it is all I'm saying. I don't think it's worth the risk, especially during genesis.

It's also potentially a conflict of interest, as the holders of Larnyx are not necessarily SPK holders. Because SPK holders get to make the decision about where Larnyx inflation is allocated this could create a sovereignty issue unless all Larnyx whales are also SPK whales. Again, a lot of that drama melts away if every LP is paired to Larynx. In that case no matter which pool is created and no matter how much inflation is allocated to it: people are going to buy Larynx no matter what. The same can't be said if a Hive/Monero LP is approved or any other LP not paired to the token incentivizing it.

Creating a centralized hub of liquidity is exactly what we need if we want to complete with centralized exchanges. For example, what if I want to go from SPK to Bitcoin? Well then I have to make two trades anyway because there isn't a SPK/BTC LP. Centralizing all liquidity to the Larynx token ensures that every move will only take two jumps maximum (1 if you want/have Larynx) while keeping the total number of LPs that need to be incentivized to the bare minimum. It also makes sure that LPs don't step on each other's toes and won't split liquidity up into multiple pools (like Hive/Bitcoin Hive/SPK Hive/Larynx Hive/Monero). All that Hive liquidity can be consolidated into the Hive/Larynx LP and will end up being much cheaper to incentivize with more fees generated. Centralization is efficient.

In this niche case centralization is good because it create bigger and more robust (consolidated) liquidity pools. Needless to say if it comes down to a vote everyone will know where I stand on the issue, and I will continue to be vocal about this. I've seen too many DEFI networks crash 99%+ due to this exact reason to stay silent.

Conclusion

I was going to continue on with this conversation in terms of EVM solutions, oracle solutions, and what my personal solution would be to decentralized liquidity issues but this one has already run its course and I'll have to do a follow-up post tomorrow about it.

Long story short: this entire interchange has made me realize that it would be possible to create an AMM liquidity solution without ever having to incentivize users with yield to provide liquidity, as the liquidity is automated and comes directly from the heart of the network. Not sure if this would actually work but it seems like it would be worth a try. Theoretically this also means that trading fees could be zero and the only cost of these transactions would be measured in resource credits, which are currently "free" as we all know. Sort of like a decentralized Robinhood exchange (minus the blatant data collection on users). In any case, this has given me a lot to think about.

The other sections of the CTT where very interesting as well, especially all the bits about the Freechain documentary and the real-world difference Hive is making in places like Ghana. In fact it even sounded like Hive ended a literal war just by providing water to these communities... which is just... wow. Okay then. There's much more going on under the surface of these events than meets the eye. Times might be tough, but I'm grateful to be a small part of it all.

Return from SPK Network: Liquidity Between Hive and L2 to edicted's Web3 Blog