Whelp that didn't last long.

Stars Arena was hacked a while back, which basically forced me to exit the avax position I was holding and move back to BTC. Although at this point I wish I had bolstered my tiny Rune bag a bit more, but whatever Bitcoin is for sure the safe play at a time like this. Can't go wrong with BTC until the bull market year of the cycle kicks in and one get's accosted by never-ending FOMO.

The trend of decentralized social media being a big narrative of the next run is still continuing on strong. However, I'm not too sure if this reflection model has any staying power whatsoever. Giving every user their own token is a cool idea in theory, but it's hard enough to build value with thousands of users rallying behind a single token, let alone trying to do it by oneself. Such models will certainly prove themselves to be a fad unless they are somehow adapted into a frictionless model that makes actual sense. Oh wait that just sounds like Hive with extra steps. Never mind.

Interestingly enough Stars Arena has basically rug-pulled recently with the CEO bailing and the dev team unresponsive. What a shocker. If only we could have seen this coming! I mean it was obvious from the business model on day one but let's not get caught up on details.

Friend.Tech also seems to be a pretty dead platform and sentiment seems to be at continual all time lows. I see a tweet like this and I have to ask myself, "Wait, how does that even happen." So I start reading the comments below for more info.

Oh yeah!

I forgot it's actually impossible to secure these accounts with a hardware wallet. The entire platform just sits exposed with nothing but a username and password protecting the cryptocurrency. It kind of blows my mind that any EVM dev would deem a blueprint like this acceptable.

How is it possible to be a Solidity developer on EVM and not create a product that connects to metamask? Like, what? If it can connect to MM then it can be secured with a hardware wallet by proxy. That's the only way I use MM these days. Been like that for years. There's no reason not to.

This guy ended up losing 7 ETH, which at these prices is $12600. Woof! There was also some chatter about diverting the airdrop to another account so the hacker doesn't get it, but the response was something along the lines of, "You really think they're going to do an airdrop still? That's cope." So yeah I don't know much but from an outsider looking in the situation looks pretty bleak for that crew.

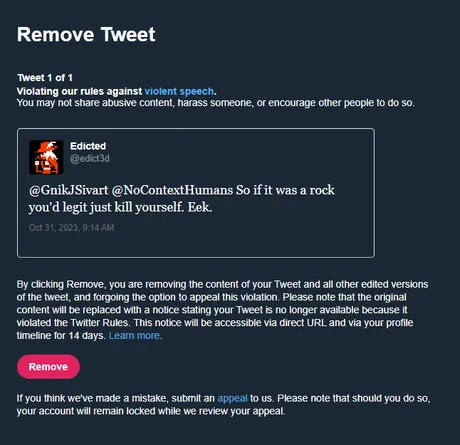

I also quite randomly had my Twitter account suspended for 12 hours today because of "hate speech". I was commenting on a video showing a woman using a huge slingshot to launch a watermelon and it backfired and exploded on her face.

After careful consideration...

I guess the definition of "careful consideration" is that the algorithm scanned "kill yourself" and immediately suspended me. What a joke. I deleted the Tweet and did not contest the suspension, which I am now regretting just because of how stupid and parental this situation is. The nanny state knows no bounds.

What day did the bear market end?

Well that would be November 9th, 2022 of course.

This is the date that everyone will look at on the chart and point to as the obvious end to the bear market. The collapse of FTX was the end of the pain, not the continuation like so many assumed. Of course this is all in retrospect and doesn't take into consideration actual market sentiment. Such things can not be shown on a spot market. The entire year of 2023 will obviously be seen as a quite successful bull market with an ending price more than double the starting price. And obviously I'm speaking too soon here because I still think this rally has legs into the end of the year. So I guess we'll see how that all works out over the next 2 months.

Uptober ends today

Happy Halloween and salutations and all that. I seem to have forgotten that it's also the 15th anniversary of Bitcoin Whitepaper day. Wow, 15 years. Time is flying by isn't it? I like to think of cryptocurrencies as people, so I guess now Bitcoin is a sophomore in high school? Puberty has not been kind but Bitcoin is getting used to it. The awkward transitional phase continues.

Talk about awkward transitionings...

The man with the personality of a saltine cracker has spoken. It's like a terrible dad-joke but if your dad was like this perpetual gaslighter with way too much power over things they don't understand (or actually do understand but get it wrong on purpose). Sorry to anyone who actually had to deal with a parent like that. Although I suppose at one point or another all teenagers feel like this is the reality of the situation regardless of the truth.

Many people are speculating that this Tweet is a stark tone change and further signals ETF approval is right around the corner. That's actually the vibe I got when I first read it but who knows with this guy. I guess we'll confirm by January 10th one way or the other. 10 weeks is not a very long time and I'm sure we'll have plenty of volatile price action to keep us occupied until then.

Will the price go up, or down?

Yes!

No, will it go up or will it go down?

Yes.

Conclusion

Will Hive be able to get any real traction in a bull market with a social media narrative? Common sense says "obviously", but actual rallies from the past have already proven that's not a given. Honestly I'm glad to see Hive slightly down in price today because I want BTC to outperform it like it did in 2020 so I can ape in at 300 sats knowing what I know from the last cycle. But also that's just me. I think a lot more of us need to be stacking a lot more BTC for potential moments like these. But I digress.

Protocols like Friend.Tech and Stars Arena are always going to be unsustainable cash grabs. The only reason they get any momentum whatsoever is they pay famous people to participate and shill the network. Surely Gary Gensler will have a field day with these protocols however many years after the fact when all the damage has already been done. Thanks for protecting us, Gary. We are so thanksful. 🙏

Return from Stars Arena & Friend.Tech Vapor to edicted's Web3 Blog