I'm not sure what black hole I fell into yesterday, but I couldn't bring myself to do anything. Couldn't even think straight. I'm sure we've all had those times where we're just done and waiting for the next day to begin. All I could seem to do was hop on and write a short blog about how the communities rollout was confusing. Grandpa problems.

Ah well it all makes sense now. Essentially we're just adding more organization to the site so it's a bit easier to navigate (separate feeds for separate topics). Truth be told, I wonder if I'm oversimplifying all the work that's been done because it seems like we should have been able to develop communities a bit faster. I guess I'll find out as we progress through these trying times.

News

Two bits of crypto news really stood out to me today. The first was about a Irish drug dealer who had $58M worth of Bitcoin confiscated from him by the police. I remember hearing about this a few days ago. However, there's been a twist. Apparently the cops never had access to the private keys and the drug dealer says they've been stolen. Hilarious.

The Criminal Assets Bureau (CAB) had confiscated 12 accounts holding the BTC with each holding 500 BTC, but cannot access the accounts as the codes were stolen from the culprit’s house.

Okay... so how is it that you thought you had confiscated the Bitcoin without actually having access to the keys? Police are hilariously inept, and stuff like this is going to keep happening and keep getting weirder and weirder.

How did he get caught?

The same way any money launderer gets caught: by being an idiot.

Clifton Collins is convicted of selling marijuana and using the proceeds to buy BTC in its early formative years in 2011 and 2012. Collins also accepted BTC as a form of payment, amassing over 6,000 BTC in that time. As the price of Bitcoin exploded, Collins used some of the money to buy lavish items including a two-seater gyroplane.

Look at that! We all thought this guy was a big time drug dealer. Turns out he was just selling weed in 2011-2012 when Bitcoin was $2-$6 a coin. The real "crime" here was not paying capital gains tax. Citizenship is slavery, friend. Pay your taxes.

How do you think he went about buying these "lavish items"? We can't know for sure exactly, but it's quite obvious that buying big ticket items like that involves KYC/AML protocol. The guy laundered money without paying taxes and then bought an airplane... what an idiot.

In any case, it's situations like this that really speak to Bitcoin's anonymity. This is actually how white-collar crime prevention is fabricated by design. The law is designed to catch the low level bottom feeders while allowing all the real crime at the top is either hit with a slap-on-the-wrist fine or completely ignored altogether.

Bitcoin is very anonymous. It's only when you start siphoning funds through centralized exchanges and other bank accounts that the law has any idea of what's going on.

So do we believe that this guy magically had his Bitcoin stolen right when he gets picked up by the police? Of course not! But it's situations like this that really shine in court. "Beyond a reasonable doubt," is going to be called into question so many times because of this new technology. Just ask Craig Wright.

On the more sinister end, the cops can't be trusted either. They tried to frame Ross Ulbricht for hiring a hitman for god's sake. Several of those agents were brought up on charges for trying to steal the Bitcoin they had confiscated.

Truth be told, these honeypots are just too tempting to steal. It's one thing to try and steal a duffle bag full of cash from an evidence locker, but what if we could just steal that money by taking a picture of it? With Bitcoin private keys, we can. Police aren't honorable enough to be trusted with that kind of responsibility, and it think it's obvious that shady situations like this are going to happen more and more as we get closer to mainstream adoption. Technologies like Monero atomic swaps are going to further complicate the issue when Bitcoin gains a full suite of anonymity features.

https://coingape.com/binance-ceo-responds-claim-exchange-not-authorized-malta/

It has been revealed that Binance is not authorized to operate in Malta. This was confirmed by the Malta Financial Services Authority (MFSA). According to the watchdog, Binance does not fall into its regulatory oversight. Binance has responded stating that its office there is for customer service and not a headquarters in the normal sense but a “spiritual headquarters.”

I find this news of particular interest because we've been led to believe that Binance has been headquartered in Malta for quite some time now.

This comes after moving from Beijing, Hong Kong, and Japan. However, this is not a view that many traders will appreciate.

More recently the exchange confirmed that it had applied for an operational license in Singapore. The recent events have made it clear that Binance might not have a headquarter of which it is regulated.

Looks like Binance is engaging in some very interesting shadow banking practices. By having footing in so many countries they are likely able to get away with a bunch of illegal stuff and just say it's happening in another country without being specific about it. Interesting.

Personally I think this is actually a smart way of going about it seeing as many of the laws of the legacy economy stifle innovation and seek to keep the old powers in charge. I'm still pretty bullish on Binance. I even still have access to my old account and never made a Binance US account, which I appreciate. Hopefully this charade continues.

The market in general.

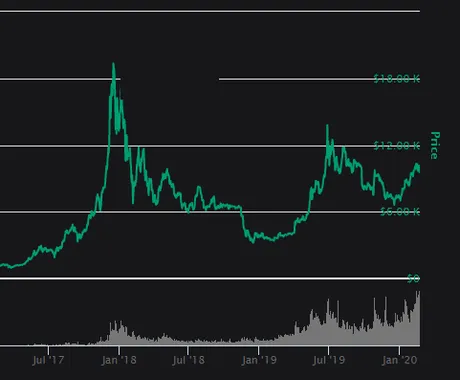

We've taken some hits in price action lately which has made many question whether we are still in a bull market or not. I "assure" everyone: we are still in a bull market at least for another 5 weeks. In fact, we are at the level that I believe will crash to after the bull market is over.

2020 Bitcoin baseline values.

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

In my opinion, the absolute lowest Bitcoin could possibly crash to at the moment is still higher than $7000. When we take into consideration that the halving event is on the horizon and February has always been a historically good month for Bitcoin, we honestly probably can't even go sub $9000. We are at a support right now and primed to explode out of this position.

The month of February has always ended higher than it started. Where did we start? $9400. We are only $250 (2.7%) higher than that right now. In my opinion, the chance that we see a nice run up over the next week is pretty high. All this obsession with the 10k level is largely unit-bias fantasy in my opinion. OMG 5 digits! It matters! (it doesn't)

Sell the news.

A lot of traders out there seem to think that the price of Bitcoin will be spectacular during the halving itself. I don't understand why so many people have this view. Bitcoin has been getting record-breaking hash rates lately. In terms of a halving event, this is actually bad because the income for mining will be cut in half in an instant. Hash rates are bound to fall because mining is no longer profitable in the short term, and greedy miners who didn't have the forethought to pay the power bill in advance will find themselves selling everything they make for a few months.

I still believe all this is leading to a situation where the peak of a pump/dump will occur 4-6 weeks before the halving event takes place (Early to mid April). Unfortunately, timing the peak will be extremely difficult. Selling even a week too soon could miss out on all the gains. For example, last pump/dump saw a price increase of $9200 to $13800 during the last week up to the peak, and price action was mostly above 10k for the 2 months after the top blew off the volcano.

I think the smartest thing to do will actually be to wait for the peak to hit and then try to time the dead-cat bounce that follows it. Unfortunately, if we look at the last time this happened, it only happened for Bitcoin and not for the rest of the market.

Proving once again that Bitcoin price action is much more forgiving than its altcoin counterparts.

To anyone who might think we've lost our momentum on this latest bull run:

Does it really look like we've lost any momentum when you zoom out and and take off the tunnel-vision glasses? I think not.

Either way, Bitcoin continues to double in value every year in spectacular fashion, regardless of the volatility that is displayed above that legendary support line.

Return from Status Updates to edicted's Web3 Blog