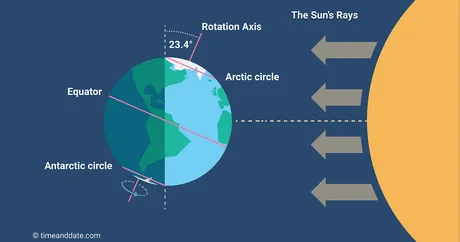

The longest day of the year has arrived.

Or the shortest day for those who live south of the equator; one of those.

Summer is officially here and won't end until September 22nd. Unfortunately we seemed to be primed for some trials and tribulations when it comes to our investments and other gambles. Sell in May and go away, as they say.

Luckily I actually took my own advice to a certain extent and sold a bit on the new moon to keep myself afloat for the time being. I also sold the top at $72k and paid down all my credit cards that I was using to proxy long... so I'm actually doing better than normal this time around within the current cycle. Perhaps I've learned something after all.

Unfortunately none of those wins change that fact that I can wake up on any given day ending in 'y' only to realize the market tanked and I'm down thousands upon thousands of dollars on paper. Such cringe. Such pain. These things happen. That's why we get paid the big bucks at the end of the cycle. Yada Yada Yada. #hodl

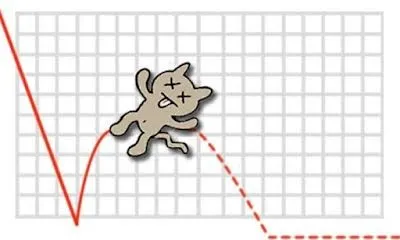

Comically enough the market still seems to be trading off the ebbs and flows of the moon and 2-3 week up and down cycles. The last dump in the alt market was a pretty big one and caused a huge shift in sentiment right when everyone thought we were going to breakout to the upside. The psychic vampire enjoys dashing our dreams and such. Deals with it.

That being said we have a full moon coming tomorrow, and all the crystals girls are making a big deal about how the "Strawberry Moon" is falling so close to the solstice. Does that mean anything for the markets? It's all voodoo nonsense but I was predicting a dead bounce regardless of all that anyway. It's a fun confirmation bias. Send it.

Basically summer just has zero momentum after a record breaking all time high before the halving event. We're out of steam and likely need to consolidate before getting an actual "recovery". And of course by "recovery" I mean screaming all time highs and the start of price discovery into rampant 2025 uncontrolable FOMO.

When the SEC randomly announces that their probe into ETH 2.0 & Consensys has been abandoned and the market just stands still... yeah that's a bad sign. Remember that the news has zero actual lasting affect on the market and is simply a catalyst for where the market wants to go. On top of Ripple being offered favorable settlements and Blackrock going hard and potentially even creating a crypto stock market in Texas we have all the news required to justify $80k BTC and a complete revival of the bull narrative. That's not happening, which is a bad omen for anyone who needs number to go up in the short term. If it was going to happen it would have happened already.

Counter trade... myself?

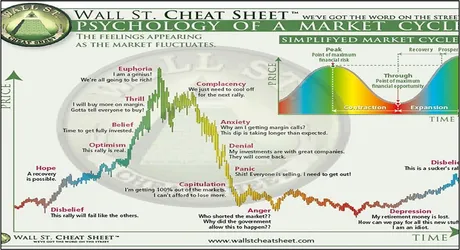

Of course having these feelings now means they'll inevitably be wrong in the ultra-short-term. Next two weeks are probably gonna be up and everyone will be back in "this time is different mode" even though the chance of breaking above $72k is pretty slim at this point... and if it does... a false breakout is just as likely as a rejuvenated rally. What does the cheat sheet have to say about all this?

It's pretty obvious the main emotion people are feeling right now is extreme anxiety.

Oh my god what if that was the top?

Why is number going down?

Why are alts bleeding while BTC ranges at all time highs?

Are we headed into an early and crippling bear market?

Of course the psychology is open to interpretation.

Just because we are at "anxiety" right now doesn't mean the fears of the top being locked in are actually true. The macro chart doesn't show it but anxiety happens on literally every 20%-30% dip... and then it just keeps going up. This is what inevitably causes the "complacency" stage right before the REAL bear market kicks in. People have been wrong so many times by then about the top being in they go into "this time is different" mode at the perfectly wrong time. The market is a psychic vampire looking to suck all your wealth away if it can.

The FED was also hawkish lately and declared their intent to keep interest rates higher for longer which has also seemed to put a temporary damper on the markets. It's a good thing the FED doesn't really have a choice and their predictions are pretty much meaningless at this point. The banks are absolutely cooked. The temporary bandaid measures that were keeping many afloat is now festering into an even worse problem. Something is going to break and force easy-money to flow back into this polluted river. The war on inflation was lost before it had even begun. Dollar Milkshake theory continues to play out.

So yeah basically this is all just a waiting game into the end of the year from what I can see. The plan is still to accumulate as many alts as I can come late September. The days of Bitcoin domination are coming to an end. Blink and you'll miss it.

I've also been sitting on a life insurance policy worth many thousands of dollars that I think about liquidating every single day now. I received this policy from my dad and should have cashed it out instantly and bought half a Bitcoin with it at the time... but didn't out of respect for my late Grandma (who's career was in life-insurance).

It's crazy to think that this money could have already gone x4 in such a short amount of time. It is what it is. I have no dependents. If I die nobody needs this money. Very much not looking forward to creating a tax event but these things happen. Soon TM.

Conclusion

Summer is signaling crab at best, which is annoying but also totally expected after such a good Winter. The news is good but a catalyst is worthless without anything to catalyze. Get ready for a bounce. Take a few gains. Then hunker down and buy back in come September. Stick to the plan... is what I have to keep telling myself.

Return from Summer Solstice Speculation to edicted's Web3 Blog