As we head into tax season, it's quite clear that many crypto users are going to have complaints this time around. Crypto is evolving exponentially faster than regulators or tax agencies could possibly keep up with. The laws used to govern crypto from a nation-state perspective were invented before the Internet even existed. This makes for some very awkward conflicts.

Refusing to accept cryptocurrency is currency

In America, the IRS classifies cryptocurrency as "property", which is a huge slap in the face really. Again, the law makes zero sense when we start to look at the edge cases. In fact, many traders were using this classification to their advantage by wash trading their losses because there are no laws against wash-trading property. This is due to the fact that property is often considered to be an illiquid asset with high overhead costs that make it extremely difficult to wash trade.

Now there is new legislation coming out that prevents traders from employing this tactic. Did the government reclassify crypto into a category that makes more sense? No, they just added a new law onto the old spaghetti factory legal system we have now. It's easy to see how embroiled in ridiculous red tape the legal system can become when looking at the strategies employed to fix "problems" like this.

So why is cryptocurrency not currency?

Plain and simple, they want to tax and control it to the maximum. If it was classified as currency, they wouldn't be able to tax it except under sales tax, just like USD. When we spend USD on something: that is not a taxable event (unless sales-tax which again, is imposed by the state and not the federal government).

How we got the USD in the first place is another story.

Most people get USD by working a job, and the income there is obviously subjected to standard income tax. However, if we take out a loan this is not a taxable event because we technically owe the USD back, with interest.

This is why people like Michael Saylor say everyone should buy Bitcoin and then never sell the Bitcoin. Because Bitcoin is a deflationary asset, and the vast majority of coins have already been printed, this means we can leverage our store-of-value into debt, and this debt doesn't incur any taxes whatsoever.

Though personal loans are not tax deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted...

In fact, paying off the interest on the debt can be tax-deductible, so if you wanted to make a payment but only had Bitcoin that was up 100% to do so, you could sell the Bitcoin to make the payment, and still have deductions leftover. That's because the interest payment is 100% deductible but the Bitcoin has gone x2, and thus only half of it will be declared as a gain when we sell it.

We can see that this wouldn't work with personal loans used to pay for day to day expenses, but it would work on mortgage payments, meaning anyone could buy a house using Bitcoin collateral and pay very little (if any) taxes on it even though Bitcoin is being sold to make the purchase.

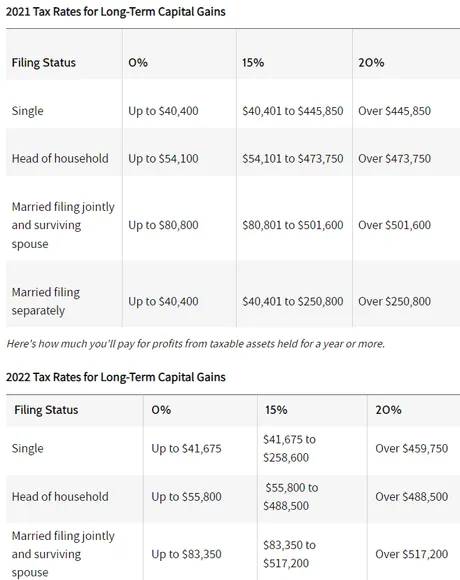

Another issue of great note is long-term capital gains.

Anyone who is living solely from long-term capital gains on crypto can take a salary of $40k a year without triggering a federal tax event. Again, you'd owe 0%. That's a pretty big deal, especially people who weren't even making that much a year before they got into crypto. With the 15% tax going all the way up to a quarter million dollars on single-filing, that's still a hell of a lot better income tax or short-term capital gains. Again, the correct strategy becomes to hold the value for at least a year so it becomes long-term.

Leveraging this into debt.

Therefore, given this information, we can see how easy it would be to sell $40k BTC a year while incurring very little taxes. However, when we add debt into this equation that means that this $40k a year could be used to be making payments on debt instead of living off of directly. Meaning we could take out a huge loan and spend way more than $40k a year, and simply use the $40k to make payments on the loan, all the while incurring very few (if any) taxes. This is especially relevant if we have a bunch of BTC that needs to be held longer to acquire that coveted long-term status: simply lock it as collateral and pull a loan out of it.

But what about hyperinflation?

As we all know, some of the coolest tokens out there are not deflationary like Bitcoin. This is when all the tax laws become completely non-sensical. That's what this post is about: the edge-cases.

Crypto hyperinflation

So imagine a yield farm that does hyperinflation on purpose. They are printing x10 more tokens every year, but the community doesn't care because the liquidity pools are generating four digits worth of yield. Why would anyone care that the token is being diluted by 1000% every year when they can earn 2000% within one of the liquidity pools?

This is a classic example of how inflation doesn't matter. What matters is who controls that inflation. When the community controls the inflation it matters a lot less how that money is allocated because there is no centralized agent draining everyone's bank account into their own pocket.

The problem with all of this are the taxes this strategy incurs. Because cryptocurrency is not classified by law properly, the IRS would look at this situation and be like, "Oh you owe us income taxes, you see all that yield you are making? That's income. You owe us." Which is obviously ridiculous in many contexts.

The context that it is most ridiculous in is if the person in question actually lost money while farming hyperinflationary yields. Imagine turning $100,000 into $50,000 and then the IRS now says that you owe income tax on $45,000 of the money that's left. That is obviously ridiculous, but that is exactly how the law reads today. This will not end well.

I've made this prediction before, but there are going to be a lot of weird court cases going forward.

Imagine someone getting locked up for ten years while refusing to hand over their crypto to the government. They get out a decade later and are now a crypto billionaire. Wow, that's weird... it's almost like they got paid to go to jail. This is akin to mafioso movies were someone in the gang is willing to take the fall because they know when they get out they'll be taken care of by "the family". It's going to be very hard to get people to cooperate when there are massive incentives with crypto for them to do the exact opposite.

Lies

- I lost it in a boating accident.

- I mined 50 BTC on an old laptop.

- Privacy coins.

- Joint accounts.

- That isn't me.

- Possession is 9/10ths of the law.

There are so many lies that people are going to tell the IRS when it comes to tax evasion. The classic one is: "I lost it in a boating accident." It's a joke, but it's also not a joke. This meme basically points out the absurdity of the entire situation.

If possession is 9/10ths of the law (a phrase often stated about law enforcement) then surely the government must prove that a person owns the private keys in question to prove that they control the crypto. Meanwhile, anyone can just say they lost their keys or they got rug-pulled or whatever else. Even if a warrant was issued and the government found the keys buried in a hard-drive, the defendant could still easily claim that the keys were lost as far as they knew. The old "I do not recall" defense.

This creates a weird Catch-22 situation with the government. To prove you own the crypto they have to find your private key, but if they find your private key they can just confiscate the crypto straight up and don't really need to go through the motions of proving you owned it... because they own it now. Their keys: Their crypto.

Also, what about joint accounts?

What if someone on Hive gets put in jail, and then that person's account continues posting and interacting on the blockchain? Couldn't that person then claim, "See? I told you I didn't own that account." This is especially true if the government never found the private key associated with that account.

In this case, even if law-enforcement gets their hand on the private keys, they still can't take the money because anyone who controls the account will change them. This also brings up a huge can of worms in terms of ownership and how taxes on crypto can possibly be collected when government can't control these ecosystems whatsoever. These ecosystems are self-governing and exist outside of government on a digital landscape. Meanwhile, the government acts like citizens are their own personal Matrix battery to be drained whenever they so desire. The conflict is real.

Oh right yeah I mined 50 BTC in 2009.

How hard would it be to claim that questionable value originated from mining old blocks? Oh yeah, right, that $100k was on a flash-drive that I forgot the password to ten years ago, but suddenly I remembered! Like... lol, so many ways to lie that are difficult to prove otherwise. This is especially true once we add privacy coins to the mix where wallets don't even exist on the blockchain to provide evidence to the contrary.

Eye witness and video surveillance?

Nah, wasn't me.

So in this case there isn't a joint account but a person could easily claim it was (or perhaps even say that it was hacked, moving back to the "boating accident" defense). Again, I predict that very weird things will happen once cryptocurrency is actually used like currency and the wallets start linking up to multiple identities and money is just flying everywhere. Tracking crypto is going to be exponentially harder once it's actually used like a currency would be used. Again, privacy coins amplify this by exponential margins.

And that all assumes that we are still operating under a system of KYC in the first place. What happens when crypto city-states pop up that don't have KYC? The wallets inside of such a place would all be anonymous and impossible to track even as they purchased real-world goods and services, because the people themselves are anon.

Fiat hyperinflation

@louisthomas did a nice post on why capital gains are a scam a while back. On a certain level we don't know if the value of our assets went up or if the value of the currency went down. The government acts like the value of the currency never goes down, and thus you owe taxes on gains that actually don't exist, but appear to exist on paper. When fiat hyperinflates, this becomes much more pronounced and obvious to everyone.

"Why should I have to pay for the government's incompetence?"

Unrealized capital gains

The Biden Administration has even gone so far as to propose that all investors should be forced to realize their gains every year even if they don't sell them. Again, this is ridiculous sentiment that would create impossible situations in crypto, like owing more in taxes than the total value of the asset in question. If crypto goes x100 at the end of the year and then dips 99% by the time tax season rolls around, it would be easily possible to owe millions of dollars in taxes that don't even exist.

low liquidity

This is another issue with crypto taxes. What if the market has little to zero liquidity? Then you go to try to pay taxes but the price drops to zero. Tax law assumes infinite liquidity priced in USD, which again, is obviously absurd within the cryptosphere. USD never even enters the equation half the time, but taxes are expected to be paid using a unit of account that a lot of crypto users aren't even interacting with.

In addition, this liquidity issue opens up a huge attack vector into the legacy economy. Imagine "troll airdropping" people you hated on December 31st for "millions of dollars" with a random coin you just launched on the same day. Then you report these people to the IRS as tax evaders. The law doesn't care that the market doesn't have the liquidity required to pay the taxes. Again, the law assumes infinite liquidity, which is obviously ridiculous and creates these hackable scenarios.

Foreign Currency Status.

El Salvador is really making waves with their "Bitcoin is legal tender" play. If a dozen more countries do this as well it will be impossible to classify crypto as property when it is quite legally a foreign/local currency. Again, none of the laws are going to be able to handle this transition, because all law assumes that currency is fiat only.

Currency invasion

At the core of all this struggle is an invasion of currency into every bordered regulated government. It used to be that governments could stop currency from entering their borders. It used to be that they could force people to use their currency while within their borders. Now this is no longer the case, and the systems we've built are not ready to handle this kind of disruption.

Conclusion

Not only is cryptocurrency currency (shocker) but it is also exponentially more advanced currency than fiat. Not only that, the potential is limitless and expanding every day. Thus, it is quite foolish to believe that classifying this high-tech programmable money as "property" or "commodity" or "security" or anything else is even mildly appropriate. Even "currency" laws do not make sense for crypto.

We are approaching a time of mass adoption in crypto, and things are going to get very weird. Crypto is not compatible with the old system, but its value is undeniable, and thus it will be accepted into the fold regardless of how well it plays with these legacy systems.

As decentralized exchanges become more popular and there are more ways to transfer crypto peer to peer (including buying goods and services directly), it's going to become painfully obvious that the government can not regulate these self-governed autonomous networks. Hard to say what happens then, but I'm guessing it won't be pretty, on both sides. All we can do is hope that this digital war doesn't bleed into the real world, but somehow I doubt it. Imperialists only know how to do one thing well: subjugate.

Posted Using LeoFinance Beta

Return from Taxes and hyperinflation don't mix. to edicted's Web3 Blog