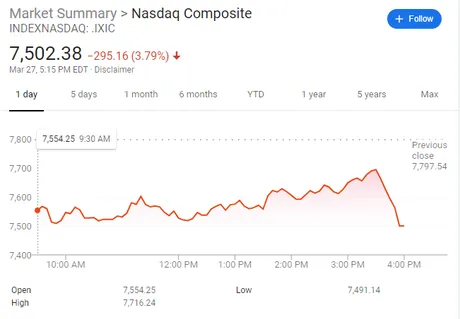

Bitcoin Still "Correlated"

Stocks go up; Bitcoin goes up.

Stocks go down; Bitcoin goes down.

It's no secret that Bitcoin is a risky asset to hold, no matter what the circumstances are. Obviously in the face of complete global meltdown a lot of investors are going to panic sell, close out their margin calls, cancel their longs, and perhaps even short the market.

The problem with that...

Bitcoin isn't correlated to anything. It's literally impossible. I know this for a fact.

How?

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 | $3200 | $6400 | $12800 | $25600 | $51200 |

Bitcoin is the only asset in human history that's had a track-record of exponential gains in value.

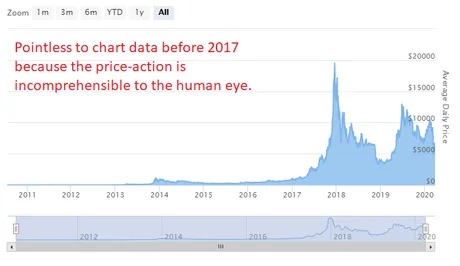

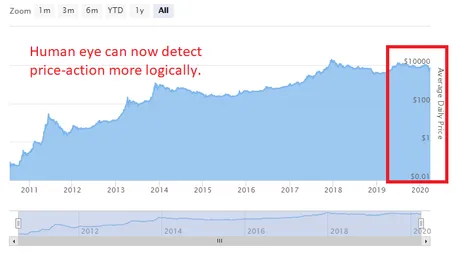

To say that it is somehow correlated to another asset is ludicrous. You can't even chart Bitcoin on a linear graph if you zoom out past the 4-year market cycles because the gains won't fit on the graph. Logarithmic is used instead.

https://99bitcoins.com/bitcoin/historical-price/

A lot of people out there ignore what a big deal this is.

- Bitcoin is not a "store of value".

- Bitcoin is not a "safe haven asset".

- Bitcoin is not a "currency".

- Bitcoin is not a "correlated asset".

- Bitcoin is not "gold 2.0".

Bitcoin is a Unicorn that shits Rainbows.

This is a more accurate statement about Bitcoin than what anyone else is saying about it. Bitcoin isn't like anything we've ever seen. Not by a long shot. I've been meaning to make a post to this effect since March 20 (the age of that JPEG). Simply too much to do and too much to talk about.

We all know where this is going, don't we?

Bitcoin stays insanely correlated to other assets... until it doesn't... and spikes up x20. The vast majority of gains Bitcoin makes in a single year or two can often times be localized to a few weeks or less. If you miss the pump up you literally have to wait a year for the next one. Even worse, if you enter after FOMO has set in, you'll get burned... every time.

Rather than fretting over whether Bitcoin is going to double bottom at 4k, or even crash to 2k in the short term, we need to be asking where it is going to be at the end of the year and at the end of 2021.

Four-year market cycles.

Bitcoin creates its own boom/bust cycles based on its own halving event. It's a lot more predictable than we give it credit. It has a history of retaking all time highs 3 years after the bubble (2017-2020). It has a history of spiking out of control in the forth year (2021) creating a new bubble. Why would this time around be any different?

Never in a legacy bear market.

This is the ultimate wildcard. There's just so much speculation out there about what's going to happen during this bear market. On one side, Bitcoin was built for this very purpose (controlled inflation). On the other, Bitcoin is so connected to the legacy economy and corporations many think it will sink or swim with traditional assets.

What do you believe?

Personally I'm willing to go all in constantly on Bitcoin, especially at times like this. I'll only change my mind if Bitcoin hasn't mooned come Winter 2021.

Retail investors

We've all been told time and time again that retail investors play a huge part in the price-action of Bitcoin. So, what's happening with retail investors right now? UHHHHH, they're totally fucked. Many of them would obviously be forced to liquidate Bitcoin at any price just to make sure their business doesn't go under. I put the current fair market value of Bitcoin at 8k at the moment. The market is oversold for the first time in 7 years, and we know why.

Trying to figure out if it's going to be oversold more than it already is a fool's errand. This volatile market is wholly unpredictable. It all depends on when the economy opens back up and how much risk people are then willing to take.

Miners are getting thrashed.

I knew that so many mining companies were going to go under come halving time, but now that Bitcoin is trading under fair market value, it's way worse than I could have ever imagined. Time and time again, we saw hash rates reach all time highs week after week, pushing the difficulty up higher and higher. What on earth were they thinking? lol...

Come halving time it's going to get a whole lot worse unless price makes a huge reversal. Heat is a huge byproduct of Bitcoin mining. The vast majority of centralized miners simply waste all that free heat being generated. I've spoken to this before, but the heat byproduct of Bitcoin mining will help it become more decentralized in the future. Why pay money to heat your home when you can run miners that generate free heat?

Once again, we see that the infrastructure for such endeavors simply does not exist at the moment. We are still in the extremely early adoption phase. This upcoming bear market could be the necessity that rapidly develops our infrastructure a thousand times over.

Conclusion

Will Bitcoin crash in the short term? Doesn't matter! If it doesn't thrive during the next two years of this bear market (the entire reason it exists in the first place) then there is no point of it to begin with. The worst thing we can possibly do right now is be focused on short term gains/losses. Play the long game.

Return from Terror in the Markets; Terror in the Streets! to edicted's Web3 Blog