So I finally sat down and gave myself a loan.

And the result was nothing short of amazement. I'm more bullish now on Rune and THORChain than ever, and now that it looks like we are about to sustain a 20% dip in the market it's going to be the perfect opportunity to load up more. The best part? I won't even have to pay for it. I'll simply loan it to myself.

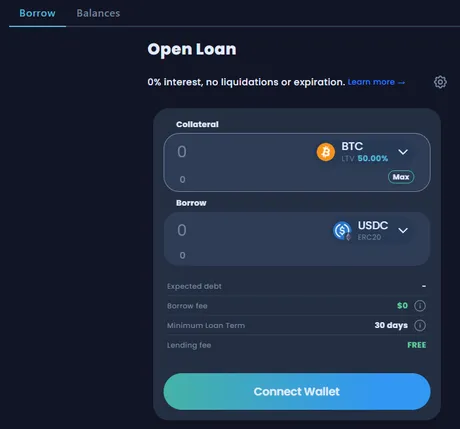

Step one: visit https://app.thorswap.finance/lending/BTC.BTC

Thorswap is just one of a couple different options to access the THORChain backend using a convenient frontend. It's the same as Peakd or InLeo or Hive.Blog or Ecency or Liketu. It's important to understand that all frontends are centralized and a certain level of trust is required when accessing one.

The difference is I have little experience with THORChain so I have only ever used this one frontend. A DEX like TC isn't as versatile as Hive in that it's only used for DEFI type things. No one ever gone build a game or write a blog post on TC as far as I know.

So you made it to Thorswap.

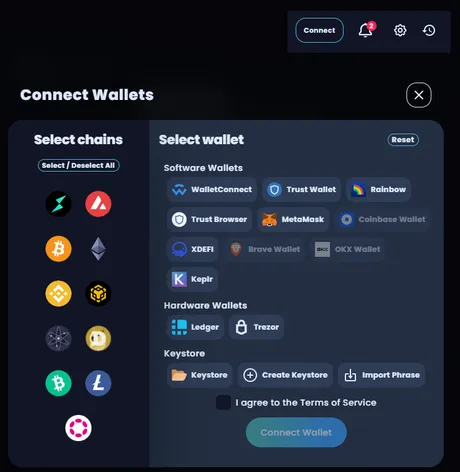

Now we have to connect our wallet to the website so that it knows our public keys and can ask our wallet to sign with the private key. The very first thing I notice when I open this panel is that TC has done a lot of work since I first started using it however many years back. There are way more wallet options and way more L1 chains to choose from. In fact back then they hadn't even listed BSC yet. Nice too see so many options. Shame Hive doesn't have a listing here; that would be an automatic x10 for Hive price.

In any case you select your wallet and connect it from here.

This is a very convenient and streamlined system they have going here. I'm personally using Trust Wallet via WallectConnect. All I have to do is scan a QR code with my phone and it connects seamlessly to Thorswap on my desktop.

Because I keep some Bitcoin on a Trezor and not my phone, I also chose to connect my Trezor in addition to my phone at the same time. This allowed me to post BTC collateral into the TC lending system and extract a loan out of it that was then deposited to my phone. Pretty nifty.

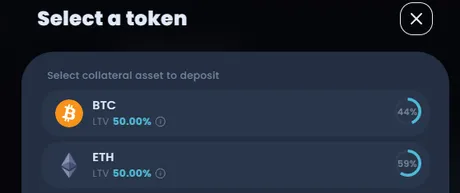

Chose your collateral

Because this is such a new system the collateral requirements are currently very strict. I'm personally on record explaining why adding Litecoin to this list would be a very smart idea (high liquid coin that doesn't moon), but it's not my decision. In fact I'm not even a member of this community, yet.

I picked BTC

We can see by how fast the ETH and BTC are filling up that ETH users are much more willing to use this system than BTC users are (59% vs 44% full). That's because ETH is already familiar with DEFI and BTC is full of a bunch of Bitcoin-only maximalists who would refuse to use something like this... even though it can be used to long Bitcoin with 0% APR.

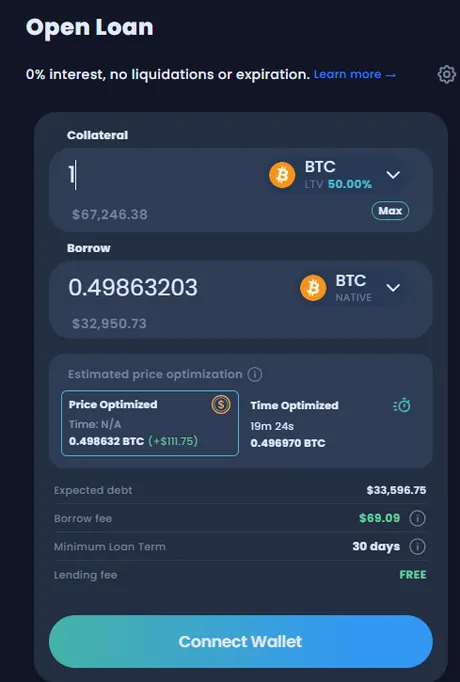

I'll trade you 1 BTC for 0.5 BTC.

This is not a joke; it really can be done. The user can borrow any asset they like. However, the user will owe back the dollar value of that asset (at the time of lending), not the asset itself. Not only that, the loan can be paid back using any other asset that TC lists. This is the magic of their backend ledger that measures the value of all assets with an internal non-tradable token called TOR.

If someone were to trade their BTC for half as much BTC they'd be going long on BTC for a 0% APR. In turn they'd owe back the dollar amount of the BTC they borrowed that day. I personally deposited BTC and borrowed RUNE because after using this protocol I've never been more bullish on TC.

The test:

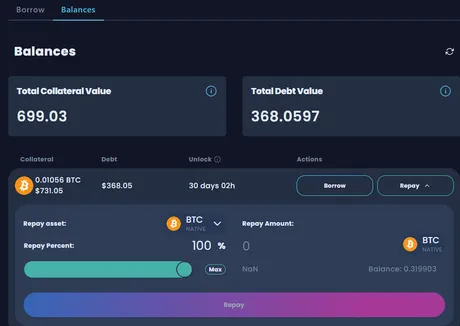

Yesterday I deposited $731 (0.01 BTC) and in exchange I received $368 worth of RUNE (39.4). This process was very easy but it took a while. All I had to do was send BTC to the contract using my Trezor and wait. I think it took like 40 minutes, but also note I did not choose the "Time Optimized" option because waiting longer didn't matter to me.

The loan was then deposited into my Trust Wallet.

It really was that easy. I sent the BTC and the Rune magically appeared in my wallet. If I want my BTC back I'll need to pay $368 sometime in the future. No problem.

Wow that's amazing...

Immediately after testing the protocol I wrote down a list of all the reasons why this system is superior to MakerDAO on pretty much every metric.

- fees

- speed

- streamline

- liquidation

- collateral

- L1

- slippage

- security

Fees

DEFI on Ethereum is trash because every single thing you do costs $80 these days. Comparatively this operation was extremely cheap. In fact the biggest cost was using native Bitcoin as the collateral (which ended up being like a $7 charge for on-chain BTC fee).

And lets not forget the 0% APR. MakerDAO and other lending protocols charge you interest on your own money. Not only that: they have a reputation of rugpulling this APR at the worst times and jacking it up to the moon. This platform does not, which is something I've been talking about needing to happen for years. THORChain is going to eat everyone's lunch by offering the best deal possible.

Speed/Streamline

The ability to take out a loan like this in a single streamlined operation is super convenient and incredible UX for a decentralized ecosystem. When I was playing with MakerDAO back in 2019 there were a ton of steps. First you had to wrap ETH into ERC-20 compatible wETH, then lock wETH into a CDP contract, then you had to pull DAI stable coins out of them, and finally you had to spend those stable coins on the thing that you actually wanted. These days I assume all these steps might cost $500 combined in fees or more. ThorChain circumvents all these steps and turns it into a single transaction on the frontend which is extremely refreshing.

Another big streamline of great significance is the fact that debt is stored internally on the ledger. On MakerDAO debt/collateral is stored as a token, and this token is transferable to other wallets. ThorChain positions are stored on the ledger and can be repaid by anyone using any token. The collateral is then automatically returned to the wallet it was originally from. This is a superior way of doing it, at least from a UX perspective.

Liquidation

On other lending protocols if the collateral value falls below a certain level your position gets liquidated. Last I checked Maker was 150% which is just ridiculous. This can in turn cause a cascading Black Swan event that short-squeezes all the positions. ThorChain is having none of that. Only 200% collateral required and guaranteed no liquidations. Again, superior UX. The systemic risk to Thorchain itself due to this mechanic is still untested, but I remain hopeful. All I can say is that it won't be a problem until the year after the next bear market ends (so target 2027).

Collateral

As already stated the LTV Loan To Value requirement of 50% (overcollateralized by 200%) is superior to all the competition. LTV will go up if the debt will become unstable, but for now it's 50% which is pretty great in combination with no liquidations.

L1

MakerDAO is built on Ethereum and only has access to the ETH EVM ecosystem. ThorChain is a cross-chain ecosystem that currently interacts with 11 separate Layer 1 ecosystems. This is a very impressive feat. This is the definition of interoperability and extremely noteworthy. It's exactly what crypto needs.

Slippage

TC has deep liquidity pools that are only going to get bigger. The cost to use the chain is highly competitive, especially when comparted to other DEXes. Streaming swaps (a new feature) make this process even more streamlined and painless. Billionaires will be able to trade here with ease, around the globe and without permission.

Security

The biggest risk to ThorChain has always been the liquidity pools. These are the honeypots. Being a liquidity provider can be dangerous.

However, using TC for the purposes of swapping from one L1 to another grants it superior security compared to other solutions like EVM where assets like Bitcoin are wrapped through a centralized agent to create coins like wBTC or bBTC that aren't actually BTC. These wrapped tokens inherent many risks including those from both chains and the wrapping agent. Meanwhile, ThorChain does not have wrapped assets which makes it much more secure and trustworthy.

Conclusion

I'm glad that the market is pulling back right now because once we bottom out I'm about to buy a whole not more Rune. In fact I don't even have to spend money to accomplish this goal. I can simply loan the Rune to myself with the expectation that the network will continue to succeed during the bull market (which it will).

After using this lending mechanism even one time I can tell it's going to eat the lunch of every single collateralized smart contract before it. The UX is superior in every way possible. I have no notes. It's amazing, and hardly anyone knows about it or how to even use it. I guarantee ThorChain becomes the talk of the town in a year or so as this function becomes the most popular way to go long, pay bills, or simply to create a tax-free loan without spending the underlying collateral. Zero interest rate, 50% LTV, no liquidations. It's pretty amazing. Keep stacking.

Return from Testing THORChain Lending to edicted's Web3 Blog