In my previous post I made the claim that there's a time for decentralization and a time for centralization. A person only has one heart, which is a centralized point of failure, but at the same time there are 8 billion people and 8 billion hearts in the world, which is decentralized. The argument is all a matter of scale and context. We should employ robustness and backups where they are needed, and not where they are not.

On another weird side-note, crypto is very much in a Lord of the Flies situation. Imagine if you were stranded on a deserted island and the oldest person there was 14. Surely this would lead to a lot of messed up situations. Hell, a lot of messed up stuff would happen even with a group of fully grown adults.

Bitcoin is only 14 years old, and thusly the network oozes with a certain level of immaturity. Rather than seeing the other people on the island as potential allies, supporters, and assets: we instead see the opposite. The Bitcoin child has decided that these other entities are actually threats, competitors, and resource gobblers; just hungry mouths to feed with nothing to offer in return. After all, 'How hard could it be to completely rebuild society from the ground up by oneself,' the Bitcoin child babbles to himself.

Looking at a network like Hive, we are 7 years old at best and 3 years old at worst (depending on the importance of branding). We aren't old enough to pick up a machete and forge a path through the jungle, nor do we necessarily want to in the first place. We basically have to follow Bitcoin's lead no matter how toxic of a leader They may be. It is what it is. This is simply the path of least resistance at the moment.

Whether Bitcoin likes it or not, they are very much the protector of the realm. Simply the act of Bitcoin existing is a declaration of defiance. As long as Bitcoin exists, it serves as a shield that others can take shelter behind. Most crypto networks that exist today could have never bootstrapped themselves into existence without Bitcoin defending them in this indirect manner.

Bitcoin is allowed.

Why isn't my thing allowed?

Because of the tech stacks in play, it is much easier for a network to build a bridge to Bitcoin than it is to build a bridge to fiat (unless they get the greenlight from legacy systems). Regardless, as we are all well aware, a bridge to fiat can be easily burned by the regulators on a whim, while a bridge to Bitcoin can not be destroyed so easily, especially if such a bridge has been built in a robust manner. It's certainly not easy to do but it is possible. Even a rickety bridge that could collapse at any moment can still be easily copied and cloned: with a new centralized agent to take the place of the old one.

Many of the biggest players on Hive are all starting to collectively realize the problem that faces us. It's impossible to ignore the blatant censorship that completely saturates WEB2 and other media outlets to the bone. It would be quite foolish to think that HBD will ever get a listing on any kind of prominent exchange given the current regulatory climate. Hive itself doesn't stand that much of a chance either. Our best option seems to be to build that bridge to Bitcoin itself. There are a few dev working on such things and I have high hopes in this regard.

The truly funny and ironic thing about Hive is that we are so decentralized that we can't even get exchange listings. Bitcoin was able to sidestep this problem with first-move advantage. No one expects anyone to be in control of the Bitcoin network. Platforms like Hive are not so lucky, and we are asked constantly, "Who's in charge here?" when trying to get the same benefit. Then when we correctly state that no one is in charge they simply decline the listing. Hilarious. See @crimsonclad for more details as that rabbit hole runs quite deep.

What gives?

Do they not believe us or do they just not want to deal with that kind of headache? Probably a bit of both. All the regulators seem to act under the premise that if there isn't someone to point the finger at and blame when something goes wrong: then the product must be inherently risky, or even worse a scam. The gaslighting is never-ending as we all understand that the exact opposite is true.

On top of all this the Hive tech stack is completely different than what most devs in this space are used to (Solidity and EVM). This results in a three-pronged blockade that makes it very hard for us to expand into the rest of the cryptoverse.

- Rampant WEB2 censorship and the need to control the flow of information.

- No centralized development team in control.

- Foreign tech stack.

Bitcoin doesn't have to deal with any of this stuff, so if we just piggyback off of Bitcoin we should be able to sidestep some of these issues or at least mitigate their negative affect on the network.

Linked Pools

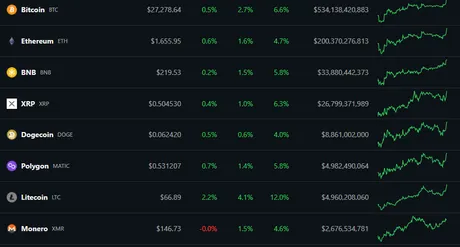

Today we see a slight increase in price and of course everyone in crypto WEB2 makes a big deal over the less than 3% move. Must be a day ending in 'y'. Classic signal that we are still in a bear market... or at least the mindset of the average crypto user is still drowning in scarcity and fear. What's the reason for this 'pump'? There doesn't need to be a reason. Be serious.

Of course I would be remiss if I didn't mention that pairing one's fate to Bitcoin seems to double the incurred volatility. Volatile asset + Volatile asset = x2 volatility. If Bitcoin loses 10% of it's USD value and all our outer liquidity is paired to BTC, our coin loses 10% just from the liquidity tether. Many wrongfully assume people are "dumping coins" when in reality the exact same amount of tokens can be traded for the exact same amount of Bitcoin on the primary exchange.

This is why often alts will bleed twice as hard than Bitcoin because both BTC and the other token are being dumped simultaneously for USD. It's a double edged sword that can easily go the other way, with alts getting a second "alt-market" pump after BTC has already pumped hard and stabilized. But all of this seems to be mostly common knowledge at this point for those of us that have been around the block a few times.

Conclusion

Bitcoin is the eldest brother of the crypto family, and while they seem to be a quite toxic teenager: they're still the only eldest brother we have. That at least counts for something, and hopefully they'll grow out of this phase and gain a bit of maturity over the next ten years. Until then they seem to be a bit of a salty bully: reminiscing over the 'good ol days' of being an only child and getting all the attention.

The jungle is no place for children to be lording over themselves, and yet that is the situation we find ourselves in regardless of what "should" and "shouldn't" be. This is very much a survival phase, and we are in need of new tools that allow the group as a whole to flourish. Hard to think about building a yacht when the village doesn't have running water. The lack of infrastructure is blinding, and all we can do is chip away at the work that needs to get done one day at a time.

Bitcoin deserves a lot more respect than it often receives from the rest of the space. This is understandable from many points of view. Grudges and justifications float in the wind of resentment like leaves. But none of that is beneficial to anyone. Eventually we'll have to put down the pitchforks and work together if we really want kick this movement into high gear. Until then keep stacking (Bitcoin and otherwise).

Return from The Blessings & Curses of the Firstborn to edicted's Web3 Blog