Been doing a lot of rebalancing.

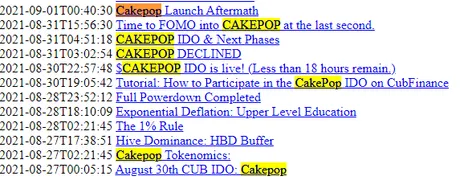

First off, dumped my meager share of CAKEPOP. Remember CAKEPOP?

Yep, it sure was fun telling everyone else it was a terrible idea only to FOMO in at the last second and then instantly lose 40% of everything I put into the "fair launch". Recently dumped my $1500 worth of CAKEPOP for LEO. Guess what happened?

At the end of the day reflection tokens are dumb.

Hyperdeflationary assets are self-defeating. We are creating frictionless economies here. So adding a 10% reflection tax on every trade is counterproductive.

Looks like I crashed the price by a lot huh?

If you run the numbers that's only a 3.5% slip.

Funny how graphs can be manipulated like that, eh?

Also the CUB/CAKEPOP LP pool is paying out 30% more APR now.

I was farming this pool for at least 3 months at 200% APR.

So I got quite a bit of my money back (if not all of it).

No more speculative trades.

I refuse to be a part of projects I don't actively use and participate in. CAKEPOP was the last token I own that I consider a shitcoin. Everything else I got is gold. Feelin good about that. Even added on some more SPS and DEC to support the top crypto game.

Much more comfortable with the market than I was a few days ago.

Today I've backed off of my hedges a tiny bit and am dipping my toes back into the market at a slight gain compared to where I exited. I still think we might dip a little bit more, so I've only moved about one third of the assets I'm going to move back into the volatile trades.

Many traders use this 1/3rd rule to great success. Never move over everything after making a decision. Move one third, then wait... then move another third and wait. Then one last time before you're out of funds for that particular trade. This is a great way to balance out DCA but still be able to FOMO in during certain price points and time targets.

Moon Cycle targets.

The market is still very obviously trading with the moon cycles. Has been for months and months. What happened last new moon on Jan 2nd? Only took 2 days after that for the market to nuke. Now we approach the full moon on the 17th and the market is already looking bullish. Also, look at how long we've been consolidating since the all time high at $69k.

Oh, would you look at that?

We peaked on November 9th.

What day did we reach the local low again?

Hm, January 9th, exactly 2 months later.

Does anyone remember what happened in May 2020?

We fully nuked on May 18th, then what?

Consolidated sideways for how long? Till July 19th. Again, exactly 2 months of consolidation.

This is too easy.

If you ask me it kinda seems like we are about to go on a massive 3-6 month bull run just like we saw the last two times.

January 9th was a crazy day.

When I saw BTC dip below $40k I was sure we were in for a world of pain. That was the entire point of my hedging in the first place. But on Jan 9th when I saw that bull spin up the market like a top I swear to you that I heard a sound. Let's see if I can find it on YouTube.

Hm yes, it was kinda like that.

A high pitched spinning-type sound is what I heard. Like if you hand cranked a spinning top really fast with a belt.

Two month consolidation wins.

It's very simple: Bitcoin can not go into a bear market without first having a mega-bubble market. We've never even come close to seeing a Bitcoin bear market without seeing a mega bull run first. At worst, it takes three months for BTC to collapse back to the doubling curve after a normal bubble. We've already seen this happen multiple times, the most noteworthy of which was summer 2019 when we went from $5000 to $13000 back to $6400 in the span of 7 months total.

Ashes to ashes, dust to dust.

BTC ALWAYS returns back to the doubling curve.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

And what have we seen so far?

We've been above the curve for over a year straight with no mega-bubble to be seen. The super cycle is real. IMO we just have to sit tight until the FOMO kicks in something fierce. Something tells me the FED is going to back off with these talk of tightening policy and send this market flying. Either that or we just continue on in this super cycle. Either way there can be no real bear market until Bitcoin moons.

Looking at the rampant fear we are seeing, there really is no way to catch this market off guard and send it dumping into the abyss. Jan 9th was a great indicator to show that these institutional hands have an infinite amount of money to throw at Bitcoin for the right price.

Yeah, but what if you're wrong?

Meh, then Bitcoin nukes to $32k in March and I have to wait till the end of the year for the doubling curve to push it back above $50k to break even. Honestly, this is not a big deal, even though it would be a little disappointing.

Also something of interest:

I hear Bitcoin options are expiring tomorrow, so I'm hoping for yet another dip so I can buy in for another 1/3rd.

Jan 17th - Feb 1 will offer critical information.

The higher Bitcoin gets during this time, the better. If Bitcoin is still trading under $45k by February, I will concede and re-hedge my assets, expecting us to nuke once again. If we are trading in between $45k-$50k, this would be an okay signal... but still not great. What we are really looking for is $50k+ BTC before the end of the month. If that happens I will double down on the newfound bull market.

Conclusion

The energy of this market obviously has me in a tailspin.

Clearly, massive volatility is coming.

Hopefully 2 months consolidation was enough, just like May's crash.

YOLO!

ThorChain (RUNE) just just added Doge.

Send it! Kek.

Posted Using LeoFinance Beta

Return from The Dip I've Been Waiting For & The 1/3rd Rule to edicted's Web3 Blog