I find myself on vacation and missed a couple more days of blogging.

Seriously it's so weird because it seems like on paper I should have all the time in the world to crank out a post but that is quite simply not how it works. I tend to be ironically more busy on vacation out of the house than I am otherwise. Zero quiet. Zero chill. Always running around doing something. These things happen.

I've been watching number-go-down in somewhat of a zen-like state. I didn't sell much but I absolutely did sell basically the top a couple of different times in March/April... so that's a nice change from previous cycles. Market sentiment is absolutely abysmal which is great to see. Always bet against the market.

The plan remains in place: just wait till late September to continue allowing Q3 to do its thing. These are standard movements. Judging by momentum $50k BTC is looking pretty good right about now. Then again judging by momentum it's very possible we hit the bottom long before September. Doesn't matter though. Just waiting.

MT GOX FUD?

Could this be any more of a sell the rumor buy the news situation? Oh no what if all these creditors sell? Then... good? The MT GOX thing has been hanging over the market for over a decade. That's how slow the courts move.

I hear Germany is dumping a bunch of confiscated coins as well... which is even more funny because people act like they want nation states to hold their token. It's also just offensive because these governments are stealing from everyone by draining liquidity and they act like it's their god-given legal right. Legal according to the law that they wrote. Very official.

It seems a bit petty to continue writing about price action during this time but that is certainly the thing that everyone is focused on. It's hard to imagine how big of a deal it is when a lot of crypto users are living in countries with a completely broken economy and hyper-inflating currency... so they turn to crypto and then it crashes however many percent. Sometimes 30%. Sometimes 50% or 80%. Just another reason to hold BTC I suppose. Avoid the bigger pumps/dumps and reduce volatility. BTC/USD liquidity pools are even better for stability but are accompanied by the counterparty risk of the exchange (even if that exchange is technically decentralized).

There are people running around calling less than a 30% retracement in Bitcoin a BLACK SWAN event. Were these people not around for actual Black Swan events like COVID and the collapse of 3AC/UST/FTX? Again, it's nice to see this level of delusion and detachment from reality when it comes to the markets. The more flailing the emotion the more we should be willing to bet against it... in both directions.

I knew I didn't liquidate that policy for a reason.

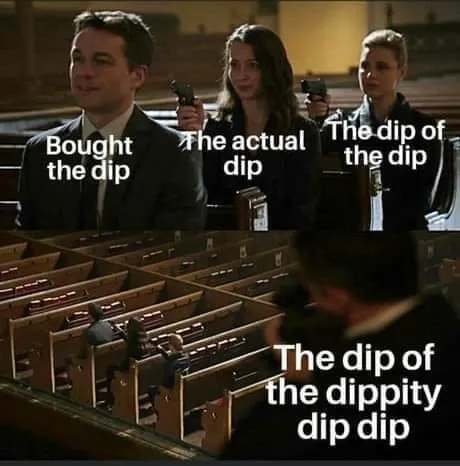

My rainy day fund is still sitting on the sidelines. It's weird because I'm not even sure exactly how much it's worth; only that I can borrow a maximum $10k against it. But why am I going to pay 5% interest on my own money on a secured loan when I can simply liquidate the policy outright? Whole term life insurance is an odd financial instrument. No one is financially dependent on me. I'll be buying the dipitty dip dip soon enough.

I think I'm going to actually have to call someone on the phone to make this happen. This policy has been in effect since before the year 2000. It's weird to see that 19XX date on an official financial document that's for sure. I thought the 90's were over a while ago.

The bottom?

Well this overreaction to MT GOX could have marked the bottom but there's no reason to buy here unfortunately. If the market is recovering and higher by September so be it. Buying in 2 months is simply a safer thing to do no matter what the price does up until then.

Happy America day?

So I found out recently that the great state of PA basically has zero fireworks laws. You can basically buy and use anything here. Roman Candles. Mortars. Bottle Rockets. Gigantic firecrackers. 500 gram showstopper aerials. Anything. Quite the culture shock coming from states like California and New York that crack down hard on such things. Apparently firework culture in PA is a thing of legend. I watched multiple dudes with shopping carts full of fireworks spend like $500-$800. Crazy stuff. Murica.

Of course the vibe this year is pretty muted considering the most abysmal election year possible. Options are Trump and some guy with dementia that likely won't even survive another 4 years. That's fine though it's not like we can rely on this system to fix itself. We're well past that. Politics is a bloated corpse being eaten by maggots, and I won't be voting for either of those.

Conclusion

Price price price! Just remember that the price going down is awesome for the buyers and bulls that actually have dry powder. If you find yourself in an extremely uncomfortable position every single time this happens: the problem is with you and your portfolio balance and not anything else. I get the feeling I'm starting to get the hang of this and welcome the dip... but I'm still waiting till the end of Q3 no matter what. Stick to the plans.

Return from The Dip of the Dip (one more inc?) to edicted's Web3 Blog