Wife Changing Money

So I watched this YouTube documentary by this guy with the handle of @foldingideas. I took his account on Hive just now for good measure, not that he's going to want it anytime soon considering his content. A few minutes into the video I was like, "Wait I recognize this guy's voice how do I know this guy?"

https://peakd.com/@edicted/debunking-viral-anti-crypto-youtube-video

Oh... yeah...

I spent like 5 hours creating this 4222 word monster post debunking half of his takes on a documentary he made on NFTs back in early 2022 as the market crumbled into definitively bearish territory. This guy really likes to kick people while they are down, doesn't he?

This character does a very good job of pointing out scams and the groupthink that goes along with them, but not such a great job of understanding the global overall picture, especially when it comes to crypto because it's such a complex space.

Luckily this particular documentary wasn't about crypto, but the content was highly crypto-adjacent. Instead, the topic at hand was the Gamestop GME short squeeze and the fall of Melvin Capital hedge fund. More importantly: it's about the insane events and delusional takes that came afterward.

Because I knew very little about this topic coming into it this video was much more tenable to watch, as there was never a moment where I kneejerk reacted to what he was saying (whereas in the crypto video this was constant happenstance). To be fair I should probably watch it again because there is a ton of underlying content to cover (150 minutes) and it was mostly just on in the background and my focus was often elsewhere.

So I definitely won't be doing a review of the documentary because I wasn't paying enough attention to actually give an honest assessment, but there were several reoccurring themes that kept popping up over and over and over again. I realize now that these themes very much apply to crypto, and even more specifically: Bitcoin Maximalists.

I've been seeing a lot more BTC maxi content on Twitter lately, and the greed and delusion are still a thing of legend. After watching this documentary, I realize just how similar the WallStreetBets bros are to the Bitcoin Maximalists.

- Hold forever and never sell.

- We're all going to be billionaires.

- We are the chosen ones.

- Generational wealth.

- Wife changing money.

- Our collateral will be the basis of all future currency.

I must admit I had no idea that the meme-stock bros say the exact same stuff as the BTC maxis. Pretty wild when you think about it. So unbelievably toxic and unreasonable.

Hold forever and never sell.

It was thought that holding GME stock forever would result in billion dollar payouts. This is kind of insane to me for many reasons, the most obvious one being: wouldn't the companies that needed to cover their naked short positions simply declare bankruptcy? Paying that kind of short squeeze ransom isn't just impossible, it's simply bad business sense. Better to let an institution simply die than try to pay off debt like that.

At least with Bitcoin maxis the logic makes a bit more sense. Crypto can be used as collateral to mint other assets. Bitcoin has an actual use-case whereas stock does not and can be legally printed out of thin air or the rules simply bent or broken by the establishment itself.

We are all going to be billionaires.

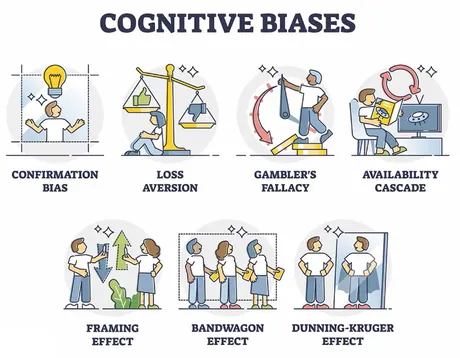

I had no idea that the stock-meme bros were this delusional. It's no wonder they never diversified into crypto, because the narrative they were running with was so deeply entrenched in these messages that they believed this was the only legitimate path to success. This ideology drew in gambling addicts like moths to the flame and constantly fueled the fire of making a big score.

Just one more gamble until victory; buy the dip; please and thank you. The ironic thing here is that this totally irrational and (more importantly) predictable behavior was exploited by the very hedge funds that the meme-stock bros we're so convinced they were winning against.

While Melvin Capital may have been annihilated in the first wave, it's almost certain that many institutions wised up very quickly compared to their unknowing opponents. The most obvious evidence of this was the Bed Bath & Beyond implosion and subsequent stock printing to infinity. Now we are in a situation where Maximalists are cheering over Blackrock adoption. Foreshadowing much?

Maximalists constantly take this idea to the extreme by implying that every person in the world needs to own Bitcoin and there are only 21M tokens and 8 billion people. We see this ridiculous math on a daily basis within the maxi echo chamber. Infinity divided by twenty one million.

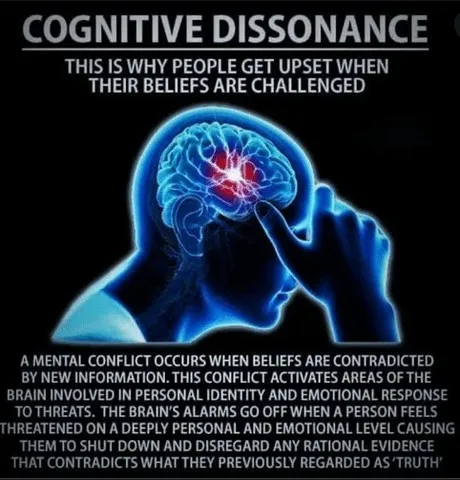

We are the chosen people.

And everyone else that doesn't horde as much of the asset as possible will become our slaves in the future. This is an even more delusional take for maximalists than it is for meme-stock bros because it runs contrary to the very tenants of crypto. Crypto is supposed to be creating a system that is fair for everyone, but maximalists constantly engage with rampant cognitive bias that runs contrary to itself. The entire vision is an oxymoron.

Generational Wealth

As a subset of thinking one has been chosen for greatness, this theme of generational wealth comes into play often. These people are running around thinking that not only will they be masters of the universe, but so will their children and their children's children's children. Again, within the context of crypto this is massively hypocritical because the systems being built are supposed to be fair and sustainable for all players involved, not a "new boss, same as the old boss" situation. And yet both meme-stock bros and Bitcoin maximalists blindly believe these concepts to be self-evident and undeniable.

Wife Changing Money

Again an extremely toxic sentiment spewed by all manner of delusional finance bros. It is mind-blowing to me that so many men actually exist in this fantasy land where having some trophy wife that literally only pretends to like you because you have money is the best possible option. Of course they'd never admit that this is the case, but they are just lying to themselves. It really speaks volumes to just how shallow-minded a very significant amount of the population really is. My advice? Go to therapy or something.

This is the next foundation of money.

Again, I had no idea that the meme-stock cult actually believed that somehow the securities they were holding were going to one day rule the world just like Bitcoin maximalists. How insane is that? At least with Bitcoin it almost makes sense because Bitcoin actually is money and exists outside of the current system. Meme-stocks though? lol wtf. How? Wild.

Conclusion

I may one day rewatch the video and do a full analysis on it, but I feel like I've already gained some real insight from it in terms of how finance bros can get sucked into these cults and then saturate themselves within these delusional echo-chambers of persecution and grandeur. These are clearly psychological patterns that will continue to propagate themselves going forward. I have a feeling that as the legacy economy crumbles and the average person gets more and more desperate we can count on the exploitation that desperation and intensify this already festering problem within the current zeitgeist.

Return from The Finance Bro Cult to edicted's Web3 Blog