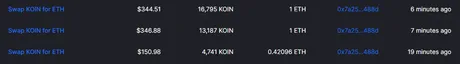

That infamous contract (that I still don't know what it is) that was selling wLEO onto the market just started dumping Koin 15 minutes ago.

The value of Koin has crashed 50%, and 25% of ETH has been drained from the pool.

This is great for me.

This is exactly what I wanted and what I expected. Miners are starting to realize they can mine for a very high profit and drain the Uniswap pool. This not only puts Koin into my liquidity account, but I also get to make these 'purchases' free of exchange fees.

In fact, not only do I not pay exchange fees for these "purchases", I pay zero slippage costs AND I actually collect fees from the dumping miners. It's like a win-win-win. Factor in the fact that I'm risking less than 1 ETH on this 'gamble', and you can add another win to that column.

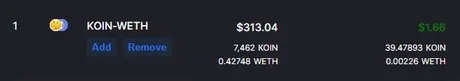

I've put in total 5775 Koin into the pool and 0.548 ETH. However, at this ratio, I now control 7462 Koin and 0.427 ETH. For this snapshot, I've "purchased" 1687 Koin for 2.6 cents a pop.

Not bad.

We can also see that I've farmed 39.5 Koin just via Uniswap yield.

Again, this is the best way to "buy" Koin.

Given the math of this mining process and the fact that people are starting to rent servers to plunder the pool, Koin miners are starting to realize they can just rent CPU power and dump the Uniswap pool at a profit. Expect this trend to continue.

We can also see that after this "crash" that total liquidity is actually less than 24 hour volume. This means that more Koins are trading hands per day than even exist in the uniswap pool. This is great for yield farmers such as myself. This might even be a good time to double down, buy Koin with ETH and pump the Uniswap pool even further... however, I'm a little burnt out from doubling down due to the wLEO hack. Maybe some other time.

New AMD chipset November 5th

There's also another post I need to write about the upcoming AMD chipsets coming out. I've never wanted to buy a piece of computer equipment ever before it released. This is the first time ever I've waited in anticipation for a chip to hit the market.

https://www.theverge.com/2020/10/8/21506447/amd-zen-3-ryzen-5000-processors-gaming-cpu-price-release-date

I'll to a full report later, but these chips are going to straight up beastmode Koin mining. Is it smart to buy a $800 CPU to mine Koin? No. But I have a friend that wants to do it anyway, so I'll help him build the rig and report the benchmarks.

SO MUCH VOLUME

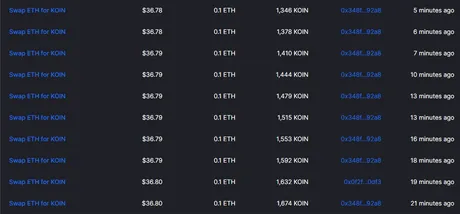

No sooner do I say this stuff when someone comes along and pumps ETH back into the pool!

LOL

8 transactions for 0.1 ETH? Does this guy love paying gas fees or what?

In any case, onto the entire point of this post!

THE HOUSE ALWAYS WINS

As a Uniswap LP provider, I am the house, and when volume is just as high as total liquidity, I'm making out like a bandit with exchange fees. Sure, traders can get luckier than I can. They can go all in and go bullish and go all out and go bearish and theoretically make a killing. However, the risk associated with those plays is extremely high. As an LP provider my risk is much much much lower. I am betting against the traders/miners and even charging them for it just like a real gambling establishment.

Conclusion

As Koin continues to wash back and forth due to these crazy mechanics only one entity wins on average, and that is the LP providers of Uniswap. Uniswap is now a centerpiece of decentralization. Anyone can be their own exchange and charge others fees accordingly. The world is changing fast, and the LEO community is primed to keep up with the times while the rest of the world remains dangerously oblivious to these developments.

In the time I took me to write this post I farmed another 4 Koin just from Uniswap fees. 8 if you count the ETH side of the equation. My yield from CPU PC mining is even better than that. Good times.

Posted Using LeoFinance Beta

Return from The House Always Wins to edicted's Web3 Blog