If there is one thing this last market cycle has taught us it's that no one on the planet is immune to the FOMO that crypto has to offer. Michael Saylor dragged Micro Strategy (MSTR) into the FOMO and look what happened. They longed the top. Hell, they were likely one of only a few whales that actually created the top. And now he's been "promoted" to "not-CEO" to focus on Bitcoin.

However, funny story about MSTR... they were founded in 1989 and went public on the stock market in 1998. They've been around the block a few times. Look at their stock price from the last five years.

lol, yeah...

They're up x10 in five years and up x2 since they went apeshit on Bitcoin. Was their Bitcoin long the ultimate failed experiment as many are claiming? Ah well, they haven't sold yet... and watch what happens in another five years. People very well may remember it as the smartest investment of all time in retrospect. People tend to focus on success and forget what it takes to actually get there. Not very many citizens are willing to deal with the work and mental fortitude and perseverance it takes to get there.

And what about Elon Musk?

He was literally openly manipulating the markets with this Tweets, laughing about it the entire way. He sold at a massive loss presumably because Tesla needed immediate liquidity to expand. They still have a huge chonk of BTC left, but most was sold. But that's the thing about BTC isn't it? One day it goes 10x and your small chunk turns back into a huge chunk. Remember how everyone says to put 1% of your portfolio into Bitcoin? Yeah well it never stays at 1%: not because people put more than 1% in, but because on a long enough timeline Bitcoin is going to outperform everything else by exponential margins.

So what happens when the likes of Amazon and Google and Meta and Apple and every other tech stonk out there FOMO on Bitcoin? Seriously, they are all going to do it. I didn't think they were. I thought professional institutional investors had their shit together, but they don't. This last cycle has proven that everyone is a full on degenerate. You're either a bear and you're 100% out, or you make the decision to leg in and that cascades to bigger and bigger buys in the middle of a bull run rather than waiting for the inevitable crash. This will keep happening.

Oh shoot, did I forget to mention governments?

El Salvador recently paid back their bond that they used to buy Bitcoin, with interest. No problem. And yet the mainstream media remains unimpressed. Wasn't that loan supposed to bankrupt the country?

As the president of El Salvador has said himself many times (and backed it with a treasure trove of evidence): they are under attack by the powers that be. The banks hate what they are doing. They're being blacklisted on multiple levels, and it's obvious. No one gave two shits about El Salvador before they made this move, and now they get talked about all the time. Bad publicity is still publicity.

Why should anyone care what El Salvador does? They are a nothing player in the grand scale of the economy, but there are many entities that act like their decision to make Bitcoin a national currency is somehow going to infect the legacy system with a deadly volatility virus that will hurt anyone it touches. Hm yeah, I'm not buying it, and as the market recovers they might find themselves at the Big Boy table of politics. What a weird thought.

So again...

What happens when countries themselves begin to FOMO on Bitcoin? They are the greediest goblins out there. We've all seen what happens. You're up 10x flying high as a kite, thinking the dips will only be 30%-50% tops, then you get hit with one of these year-long bear markets that wipes you out right when you went your longest. Happens every cycle I tell ya.

Conclusion

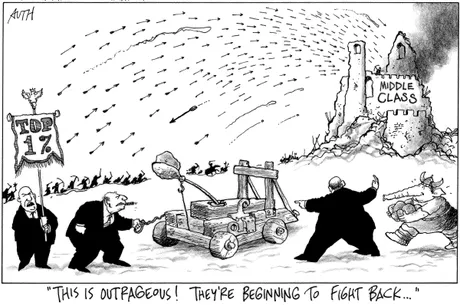

At the end of the day greed fuels the economy. People want more, and they are willing to do anything to get it. Many would claim that this is a terrible thing and we should fight in direct opposition against it. "Greed is the root of all evil," after all. Unfortunately, this is a loosing strategy, and we must instead lean into it rather than boycotting it entirely.

The biggest changes to society come not from force or fighting head-on into a tidal wave that is bound to crash to matter what, but rather from going with the flow and making small changes that can lead to a big difference over time. A butterfly flaps its wings on one side of the country and creates a tornado on the other.

If this bear market has taught me one thing, it's that we got off easy this time. We are headed into the most volatile markets of all time. Technologies are beginning to converge.

- Crypto

- Artificial Intelligence

- 3D-Printing

- Infinite Energy

- Space Travel

I can not even imagine what's going to happen during The Coalescence of all this tech. Last time we got smartphones, but the technologies being merged in that case were not nearly as impressive as this time around.

In any case, do not trust that billionaires, governments, and corporations are going to be more reasonable than retail. Every single example we get proves otherwise. The volatility has just begun. Always be ready for chop. The real storm is still on the horizon.

Posted Using LeoFinance Beta

Return from The Power of Greed to edicted's Web3 Blog