People don't like being told they need to pay for things that were previously given to them for free.

If you never give the baby the lollipop to begin with, then it would have nothing to cry about.

Oh, and the tears are a thing of legend.

Musk spent a lot of time yesterday arguing with people about why $8 a month for a checkmark is justified. Well, not so much arguing, but reminding them that they are ridiculous and have no power over the situation. There is now a sub-faction on Twitter that claims the $8 is worth it just to watch Elon troll everyone. And troll he does.

Calling out the hypocrisy of it all.

AOC selling a sweatshirt for $58 is pretty lawls in the wake of all this drama. The same people that said it was totally fine to basically blacklist right-wing rhetoric on Twitter, making the claim that it's a corporation and thus not subject to the 1st Amendment, are the same people who are complaining about $8 in exchange for "free speech".

This is wrong on so many levels is hard to begin. I have another post lined up about a Pomp podcast that @anomadsoul had me watch. There's a lot of intriguing statements made within, particularly about the government's ability to circumvent the Bill of Rights using Big Tech, in addition to several Geo-Political issues involving China. It's probably going to be a long post so I can't wrap it into this one but, it is worth mentioning that yes, government getting into bed with Big Tech does in fact allow them to break all the rules without getting into any actual legal trouble. Not great.

I'm not paying for Twitter... are you paying for Twitter? Who on Hive is actually going to pay money to KYC themselves? Seems a bit counterproductive considering what we stand for here. I could see big players like @theycallmedan or @blocktrades doing it to get more reach on the platform, but smaller fish really have no reason to go the distance in that respect.

The idea that Musk's takeover of Twitter is some kind of Deep State Paypal elite way of circumventing the banking sector is also a bit delusional in places. Well, not that part, but using Twitter to implement a social credit score or digital ID or whatever. There aren't enough people on Twitter for that to be a viable solution. You'd have to assume Twitter was going to flip Facebook in terms of users. While it's possible, it doesn't seem very likely, especially in the face of throwing up paywalls that are pissing the current userbase off to no end. I'd say we have to assume that Twitter will bleed users over the next year or two, not acquire more.

That being said it will be interesting to see how it all plays out. Clearly Elon is not dicking around, and will attempt to turn Twitter into a technology that merges with his other tech companies. After all, social media is the glue of the Internet. Makes sense to acquire one if you already own multiple tech companies. There's a certain kind of dormant synergy there that nobody has actually tapped into yet.

We also have to consider the hubris of the situation. Billionaires are human after all. They are subjected to the same dopamine rushes and user experience as everyone else. It's quite possible that Musk is severely overplaying his hand right now and it will all end up crashing into the mountain a bit. Again, we just have to wait and see; play it by ear. Elon isn't much of a quitter, to be sure. All these variables factor into the end result.

FOMC meeting was interesting as well.

Again, all the statements from the FED indicate that they are going to wait for some random sector of the economy to implode before actually reversing course. At the same time, Powel said the target was 5%, and we are approaching that target. In that sense, nothing has really changed. They did what they said they were going to do.

I still find it quite comical that low unemployment is "bad" for the markets because good news is bad news when you want the FED to pivot. The market wants the FED to lower the fund rate back to 0% and then do QE all over again. If the FED capitulates and reverses course back to 0% rates... yikes. I mean, either way is bad, but perhaps it's better to just deal with a recession now rather than kick the can down the road yet again and allowing it to snowball even further.

I still get e-mails every day across the board offering me deals on tech and whatever else. Black Friday is coming, and I'm guessing the deals will be even better after Black Friday and into January when all these companies realize that even though everything was on sale people still weren't buying non-essential products.

When we look at this on a worldwide scale it gets even crazier. Yeah, USD might be down 10% on the CPI, but currencies like the Euro and Quid are down 30% in comparison to USD. Think about what that means for Europe this year. People live paycheck to paycheck. They aren't going to be able to afford anything except essential products. Compound this with an energy crisis and the situation gets even more insane.

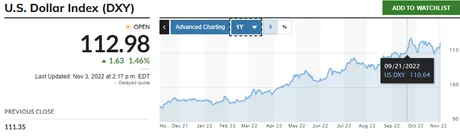

DXY still peaking

With a high of 114, we are still trading sideways on the dollar in relation to other "high quality" fiat currencies. The global dollar shortage continues, despite what inflationists have to say about the matter. Whatever pain the USA is feeling is compounded by quite a bit across other nations... except Russia of course who are doing just fine despite the sanctions and the proxy war. I'm not even sure where to begin unpacking all that nonsense, so I won't. Bottom line there is that Russia is more grizzled than the rest of the world, and they seem to be in a position to outlast other countries in a game of attrition.

US Senators Are Calling SEC For “Regulatory Malpractice”; Here’s Why

According to recent reports, the SEC’s staff are leaving the regulatory body like never before. This trend is interestingly running a parallel with some of the outgoing SEC officials joining crypto companies.

As per a recent Reuters report, the SEC staff are leaving the watchdog “at the highest rate in 10 years amid a flurry of proposed rules.” Referring to a public report on staff attrition, six U.S. senators wrote to Gensler seeking an explanation.

In what could be a shocking revelation in the current circumstances, an independent study reported huge outflow of SEC officials to crypto companies in recent times. As per the findings of the Tech Transparency Project, as many as SEC officials have recently quit to join crypto companies.

This is in sharp contrast to the SEC’s efforts to bolster its workforce in its unit focused on crypto markets.

Think about what that means... lol

Not only will these SEC officials know exactly how to evade regulations within the crypto industry, they will also possibly even be given a free pass on infractions based on their previous connections with the SEC. I don't know whether this is a good or bad thing long term, but certainly it points to more and more disruption within regulatory agencies and the economy at large.

Conclusion

Never dull. Will Twitter fizzle out and die after being taken private by a delusional madman, or will it be a critical piece of the tech empire? Hard to speculate on such things at the moment. We'll just have to see how it plays out. Either way, big changes are coming.

There's a lot of disruption going on in the world these days. That's good for crypto. Cracks in the armor of the hulking Goliath that is the legacy economy can only be an advantage to us going forward. This is something I've discussed at length years ago. Governments are trying to disrupt central banking with CBDC (not working very well). Corporations are trying to disrupt governments and banks with tech. Banks are constantly vying for power all well. Everyone is scrambling, and within those cracks Hive and Bitcoin will be able to create a massive wedge and carve out a place for themselves within this next phase of humanity. Even though the recession sucks it's still an exciting time to witness.

Posted Using LeoFinance Beta

Return from The Results are in! to edicted's Web3 Blog