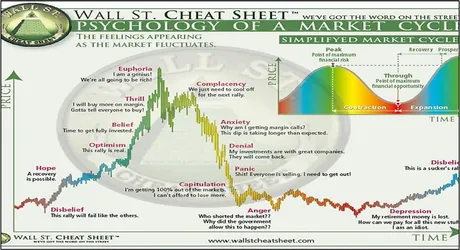

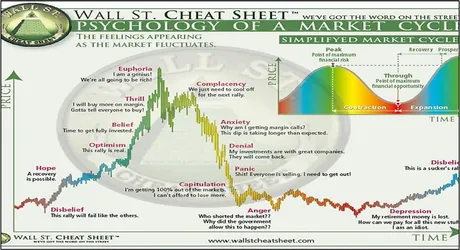

Market psychology is very important

Even if we refuse to trade and prefer to HODL for dear life, the often irrational emotions that continually rampage through the four year cycles in crypto is nothing short but legendary. In fact, it is exponentially more pronounced than the stock market, which is the environment that this chart was created for in the first place. Regardless of any of this, hodling itself is a skill the requires the mastery of this full spectrum of emotions... if only to stop us from becoming paper hands.

Why is this?

Because crypto is both insanely volatile and also just as profitable over time. Whereas one might expect a 20% gain in the stock market year over year, with Bitcoin it's more like +100% every year, with some years being up 1000% and others being down bad 80% from the peak.

Following the breadcrumbs

I've been closely paying attention to this emotion chart for quite some time, and I've posted it many times throughout the years. However, now more than ever, the crypto community is following this cycle to a tee. I first realized this back in November 2022 when FTX collapsed.

Anger: Sam Bankman-Fried must die!!!!1

Kill him kill him kill him!

November 2022 was the ultimate anger event witnessed in crypto; Like nothing I have ever seen. The bottom was in. To me it was obvious the bottom was in because FTX crashing should have decimated the market. Instead we didn't dip that much (like $20k to $16k) and volume was massive but spot price stayed flat. The buy walls were a thing of legend at this level. Of course this is easy to say in retrospect without having to live it. Even though I was pretty confident I still ended up being a distressed seller "just in case". Probably ended up losing 0.1 BTC with that lost conviction... which wasn't too much back then but gets more cringe as number goes up.

Nothing stopped everyone in crypto from channeling all their bear market rage onto the last imprint available to them in that moment of extreme vented catharsis. There was no resistance to this hate to be found. Perhaps it was especially aggravating because SBF essentially campaigned on a platform of "effective altruism" in which he assured everyone he was going to give all his money away to charity. Yes well, what's the point of giving money to charity if you have to steal it from your own clients first; that's a little counterproductive, wouldn't you say?

Nobody was that angry when Three Arrows Capital collapsed, and that was the event that catalyzed everything and kicked off the entire bear market. From here, TERRA LUNA crashed to zero because of the unsafe conversion process of UST >> LUNA in real time with no debt-cap haircut or imposed time limit average like HBD. But still, people were not furious, just disappointed. This period was a mishmash of 'complacency', 'anxiety', 'denial', and 'panic', but never anger. All that changed when FTX went under and everyone realized what Sam had done.

In a sentencing submission, Bankman-Fried's lawyer Marc Mukasey told U.S. District Judge Lewis Kaplan that a guidelines range between 5-1/4 and 6-1/2 years would be an appropriate prison term.

On March 28th SBF will be sentenced.

Will he get six years? I certainly hope so, and I hope he gets off early for good behavior as well as early parole. Something like this has what I've been calling for all along. It's a white-collar crime, and seems likely to happen now that Bitcoin is already trading at all time highs again; a testament to the speed of crypto vs the speed of justice.

At the end of the day the people who were angriest about the FTX collapse were the ones who knew better. These were the people who knew it was stupid to hold that much on an exchange and they did it anyway knowing full well it was a terrible idea. Rather than take accountability for their own actions they redirected all that rage onto Sam and might have well demanded he be executed in the streets by firing squad. Watching the mob react like that was quite a surreal and telling experience.

Depression

After the mob was done hating on Sam and calling out for his blood on a daily basis, many started to realize that it didn't matter what kind of revenge would fall onto the head of our fellow autist and degenerate. This led us into the depression phase. It's hard to say just how long this phase lasted, but it was potentially short lived considering the market began aggressively recovering right at the beginning of 2023. Member?

Disbelief

Now clearly this is not 'depression' and is an obvious case of 'disbelief', but at the same time not everyone experiences the bear market the same. For some people depression lasted longer, but for the most part when we started moving up in February, March, April, and even into the summer... pretty much everyone was in this 'disbelief' stage.

Anyone who remembers what I was talking about during this time knows that I was personally not in disbelief at all. In fact, as soon as FTX collapsed I was pretty much like that was it, this is the bottom. Bear markets last one year: that was one year. During all of 2023 I claimed that the bear market was over, but regardless of the truth the vast majority of crypto users were in complete 'disbelief' until the pump in October. That's when everything changed.

Hope!

October until ETF approval in January definitively marked the 'hope' phase of the cycle. Hope is a weird moment in time because it blends pretty seamlessly with disbelief. We HOPE that the bull market is back, but we still reserve the right to be disappointed. That's kind of the definition of hope is a way. We can see the light at the end of the tunnel, but how long will it take to actually get there?

And now: Optimism

The hope phase would have lasted a LOT longer if the ETF result had been less bullish. But now that we are where we are and a billion dollars are pouring into BTC every day there's no way around it: this is optimism. Meme coins are mooning. The lottery winners are up thousands of percent in a matter of days. Bitcoin is already at all time highs before the halving event for the first time ever. AI shitcoins are running. Even Hive is starting to make moves. The altmarket is here. Etc. Etc. Etc.

There's basically every reason to believe that we've shifted much earlier than usual into this phase of the market. Many are taking this to mean that the bull run will end early because it has started early. That is not the case. This party is going to last all of 2024 and into 2025 as well, just like always. In fact if we actually take a look at the chart it's pretty clear that all the timelines and distances between phases is completely off.

It's a 4-year cycle.

We got past anger, depression, disbelief, and hope within a relatively short timespan. The longest one was certainly disbelief. The keyword of that phase was "bear market" even though BTC was actively going x2 from the bottom. That phase lasted over six months. We cranked out all the rest in short order. So how much longer do we have to go?

Q4 2025

Assuming that the peak is gonna come at the same time that it always does we still have 20 more months of craziness. Complacency in crypto comes at the tippy top of hubris. Everyone is so rich that they simply don't care if the market can crash because they figure even a 50% loss is no big deal. It's a shame actual bear markets are actually more like a 90% loss especially when altcoins are concerned... otherwise it really would be fine to lose half once and a while.

Optimism, Belief, Thrill, and Euphoria.

By my count we still have quite a while before we get through these four phases. If we get another Wyckoff pattern or two distinct pump and dumps complacency can last quite a while and we might even go through all 4 phases twice in a row.

Wen Belief?

It's unclear how long optimism will last, but 'belief' begins when most of the bears finally capitulate and realize that we are indeed not going back to $20k. Certainly there may be a few straggler permabears out there that never get converted, but they will be few and far between and they won't have very big followings, for obvious reasons.

Wen Thrill?

This is when everyone in crypto feels like a genius and we are all making money no matter which assets got picked. Traders who are consistently underperforming holders will still be making a ton and do a mental backflip to convince themselves they can go pro and quit their day-job. Top signals will trickle in from the edge of the Matrix and no-coiners will gain a sudden interest once again as the hype and FOMO infects their very soul from a distance by proxy.

Wen Euphoria

Pretty much just an extension of thrill, euphoria marks the peak of all irrationality and absurdness. Crypto jokes are being made on Saturday Night Live. Commercials are everywhere. JPEGs minted five seconds ago are worth more than a house. The shitcoin casino offers gamblers a new token to pump and dump every couple of days. Nothing makes sense, and none of the business models are sustainable, but we tell each other they are and that this is the new paradigm of all things. The silver bullet has won. Of course we all know what happens next... just not in the moment.

Conclusion

The market psychology cheat sheet is particularly valuable because in crypto we understand the timeline perfectly and don't have to guess. It's not like the Dot Com bubble or Tulip Mania where it only happens once and then never again. This thing happens in crypto every four years like clockwork.

This allows us to set correct expectations and speculate much more accurately than any other market. However, the difficulty of speculation increases because the risk and reward is exponentially greater than any other asset humanity could have ever dreamed of. Second-guessing is as common as breathing. Don't let the psychic market vampire into your head.

It's a four year cycle. Don't forget this fact during euphoria and complacency. There will be signs.

Return from The Transition from Hope to Optimism to edicted's Web3 Blog