But they aren't worthless, are they?

In fact, USD is the most valuable asset on the planet. It is the global unit of account; The product that every other asset is measured against. It is the most powerful and deeply liquid asset on foreign exchange (FOREX) and everywhere else. The DXY is used to measure its value against a basket of other fiat currencies. Everyone alive in the world today can rightfully say that USD has never failed them (inb4 even if the banking sector has failed). It has never experienced systemic failure within anyone you know's lifetime.

It is the most stable asset that humanity has ever created. There is no competition. USD stands alone, and is often a coveted asset in countries like Nigera where it's not even allowed to be traded at a fair price. That's how good it is: it annihilates the competition so badly that the competition has to ban it from being traded on a fair market using a haircut.

Where will we be when Ukraine is over?

Not only that: the incentives align.

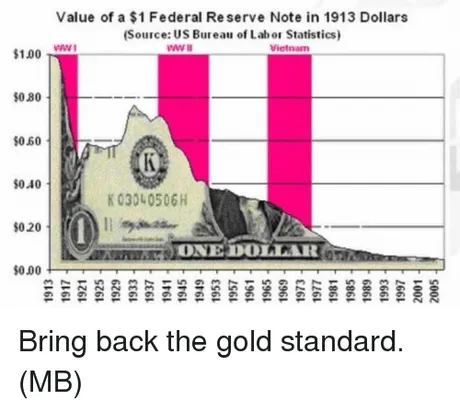

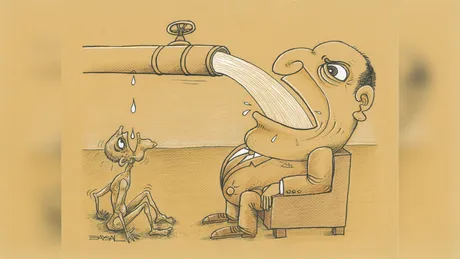

Everyone talks trash about USD and central banking because the value of fiat ever-so-slowly declines over time. Charts like the one above are shown frequently and aggressively.

If you held USD for 100 years it would have lost 95% of its value.

Uh, okay?

And if unicorn rainbows existed we could save 15% or more on car insurance! The fuck are these people babbling about? Nobody holds USD. Nobody is supposed to hold USD. The entire point of this asset is for people to spend it and create velocity and volume within the thousands of markets that exist worldwide. It was never meant to be held, and yet the examples against it always assume that people are holding it for ungodly amounts of time like complete idiots.

What if that USD was being held in a government bond that dished out 5% yield a year? Has anyone ever done the math on this? Yeah, you lose x20 the value in purchasing power but guess what? You gain x131 in terms of compounded interest per year. So even when USD is simply held over time it still makes money when managed properly within super ultra-safe "boomer" investments.

Slow siphon of value.

Ultimately the problem here is simply that the gap between the rich and the poor keeps getting bigger. Poor people don't have a lot of money, but they do have a little bit of money, don't they? So when a billion poor people hold a little bit of liquid USD that isn't held as an investment... well all that value just trickles upwards into the banker's pockets.

I think the hard question we have to ask ourselves is: is this unacceptable? Seriously though, is it? USD is a product. It is a privately owned product at that. How can we praise capitalism... and then expect the most important product of our entire lives to be run like a charity? Does that really make sense? Would money really be better if the government directly controlled it? With CBDC we might find out!

And so we have to come to realize that the world economy is in fact decentralized, and that we can play the blame game all we want and point the finger at these institutions and scream about how it's all their fault. But it isn't their fault, and it's never going to be. The problems with society are multi-tiered; a very sad onion indeed. It's everyone's fault, and it's no one's fault. That's why it's so easy to get away with "murder" when considering the shear economic scale of things.

This is why it's so easy to play hot potato at the top of the pyramid and act like the thing you are doing is not the problem even when it certainly is part of the problem. Anyone can correctly demonstrate that if you stopped them from doing the bad-thing the systemic problem would still remain; just like an athlete claiming they need to juice in order to compete.

"Everyone's doing it"

And so round and round we go until the music stops and some overleveraged sector of the economy blows up and needs a bailout. "Too big to fail," they exclaim! There's a pattern here: we always take the path of least resistance. We always sacrifice long-term gain in order to fix todays problem and carry on as if everything is business as usual. Zombie corporations wins.

Most All economists believe that it is impossible for a currency to have all three properties (MOE/UOA/SOV). After years of research and the recent DEFI bull run of 2021: I know better. How is it possible that I know better than a thousand 'experts' telling you otherwise? It's quite simple really: there's a forth variable in play that none of them ever talk about because that fourth variable is actually a constant for legacy economists.

The forth variable is: debt.

Indeed it is. Every economists operates within the bounds of a debt-based system operated by a centralized agent who needs to suck value out of the system for themselves. That's the entire core business model. This is simply the only way to scale a legacy currency and make it profitable for the institution doing all the work to bring the product to life.

But what if I told you about another currency that didn't have this centralized agent gobbling up value like a greedy goblin?

USD is a great medium of exchange and the best unit-of-account the world has ever known. However, the store-of-value side is lacking, is it not? Within this context it becomes painfully obvious that if currency itself was altruistic in nature and the elite and their cronies weren't sucking up every last drop for themselves... then it would OBVIOUSLY be a store-of-value and tick all three boxes.

Meanwhile if you tried to tell a Keynesian economist this fact they'd look at you like you were a fucking moron. The idea is so out of the realm of possibility for them it doesn't even compute within their own scope of reality. That's how valuable crypto is: it doesn't even make logical sense to most people. They just assume it's too good to be true so therefore it isn't true. This strategy is not going to age well, that's for damn sure.

Bitcoin will never be a unit of account.

It really is as simple as that. Maximalists are delusional and think that BTC will become stable as the market cap ascends into the $100T range, but the entire concept is founded on delusion. Bitcoin can never be stable because Bitcoin has zero elasticity. In fact Bitcoin has negative elasticity due to the halving event every 4 years that continually chokes the supply and creates deflation where there should be inflation.

Luckily decentralization ensures that other networks will pick of the slack and Bitcoin's niche can continue to be security/collateral rather than an actual currency. BTC is an important piece of the puzzle. The backbone; The anchor. But to assume that a person is just a backbone or that a ship is just an anchor is beyond foolish.

But it will be the collateral in which unit-of-account can be derived.

I'm not sure when this clicked for me but when it did it was quite the "Eureka" moment. Fractional reserve systems will be able to collateralize debt using Bitcoin in ways never before thought possible. Everyone seems to think that "disruption" means the "annihilation" of fiat. Contrary to this popular belief nothing could be farther from the truth. As a neutral platform Bitcoin can only empower the banking sector. El Salvador will be an excellent case-study.

"Disruption" in this context just means that central banks will be using Bitcoin as collateral for their main business within a few decades, and that's fine. In fact, that's much better than the alternative which involves an Apocalyptic event that wipes the entire legacy system off the map. Again, the path of least resistance will always be taken. Go with the flow.

The value of a dollar is unknown.

Another thing worth mentioning before I wrap this up is that it is not possible to measure the value of a dollar. I find it so comical that people were freaking out over BUSD "breaking the peg to the downside". Really? I looked at it and the peg had broken like 0.1%. Do people not realize that USD itself is more volatile than this? They have no idea because again, as the unit-of-account, they have no idea how volatile USD is because they measure everything in USD.

1 USD == 1 USD is WAY more accurate than 1 BTC == 1 BTC

When the price of BTC goes up or down, it is quite obvious. We can see the new spot price reflected across all the markets. No one measures anything in the value of BTC because BTC is too volatile (and it always will be).

When the value of USD goes up or down, we have no idea how or why this happened. As @taskmaster4450 and I have been trying to point out: the money supply absolutely is not expanding right now. In fact it is deflation that is tanking these markets. Liquidity is being sucked out of these markets with higher interest rates. That is the definition of deflation.

The value of USD could drop because of an expansion of the money supply (real inflation), or it could drop because demand for products and services is going up (demand-pull inflation), or it could drop because of supply chain disruption (cost-push inflation). What has been happening since 2020 is so obviously cost-push inflation, but everyone wants to blame the federal reserve and tell them to fix it. They can't, but that won't stop them from playing the politics game and shining everyone on like they have power over this situation.

The inflation target for USD is 2%

Getting back to the whole BUSD comparison, imagine thinking a peg break of 0.1% is a big deal when USD is designed to lose 0.005% of its purchasing power every single day. After 30 days USD loses 0.16% value by design, and that assumes that the system is working perfectly... lol. It's not... if you haven't noticed. Most people don't think of it this way. "Price of eggs went up now I'm pissed," is how they frame their thought patterns. It's not a good way to understand what is actually going on here, that's for sure.

Conclusion

USD is the most important asset on the planet, and BTC isn't going to magically dethrone it. BTC will empower USD by giving our debt based economy exactly what it needs: pristine collateral that skyrockets in value every year on average (+100%).

The only way to dethrone fiat is to make a cryptocurrency that is superior in every way to fiat. It must be a UOA, MOE, and SOV all at once. Many think this is impossible, but I have very clearly explained why they are obviously wrong. When the unsustainable debt variable is taken away from currency everything changes.

In addition, the borderless and interconnected nature of crypto means that medium-of-exchange is the new constant for all currencies from here on out. MOE has become a non-issue. SOV is a non-issue as well when no centralized agent exists to siphon value into their own pocket. Unit-of-account and stability is the only problem we need to solve going forward. Solving it will have no effect on SOV or MOE. This is something economists can not understand given their previous knowledge of legacy debt-based systems.

Stability and reliability are key in building any economy of scale. Until crypto can prove that it can provide said stability without piggybacking on top of USD: crypto will always simply be collateral and USD will remain the dominant currency. I believe we will accomplish this feat, but the pushback from the legacy economy could result in actual warfare. Whether that war is worth fighting for (on either side) is yet to be seen. Hopefully peace will be the path of least resistance for all parties concerned. Somehow I doubt it, but maybe I'm just jaded.

Return from The Value of a Dollar to edicted's Web3 Blog