A lot of people (especially Americans) think that fiat currency is a stable source of value.

Ask them what they think in Venezuela.

If water is scarce, the price of water goes up. If food is scarce, the price of food goes up. If currency is scarce... INSERT RESOURCE HERE You get the idea.

Fiat

The thing about fiat is that it's never scarce. The people in charge will just print more. They avoid printing too much by raising interest rates. This adds a whole new can of worms to the mix, because it means that more money is owned back to the FED than there is money in existence; a clearly unsustainable economic model.

Well, guess what?

The FED is trying to raise interest rates, and the economy is bucking under the pressure.

https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

LOL

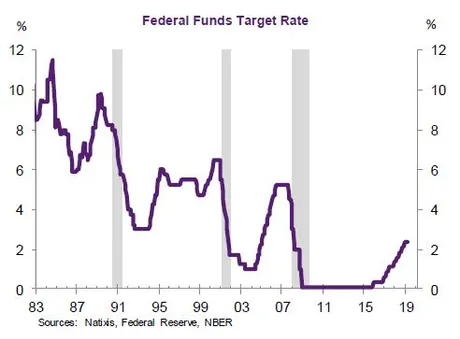

Are we seeing a pattern here? Every time there was a recession interest rates were peaking and they had to bring them back down to soften the blow.

There is no cushion left.

What do you think is going to happen during the next financial collapse? We literally had interest rates at 0% for seven years because of the last one. There's no place else to go.

This is happening.

All of the signs are here, but most people ignore them or are completely in the dark. The next financial collapse is going to be even worse than the last one. Rome is falling. Finally. The masters of borrowed time are at the end of the rope.

Ten years

If the economy can somehow prop itself back up (negative interest rates?) then we MIGHT make it another ten years, but after that, it's all over. Think about where crypto is going to be ten years from now. We can't even imagine it. It's going to be wild.

The need to develop this superior asset class is going to increase by a hundred fold during the next Depression. It's potential is superior to the old system, and with the old system weak and unable to defend itself crypto will act as the tip of the spear for the killing blow.

Business model

The original reason I wanted to bring this all up was due to stable-coins and retail. I've gone on quite the tangent. In any case, we have to ask ourselves: why are stable-coins so "necessary".

Well, retail operates from razor thin profit margins. Therefore, if they accept the volatility of cryptocurrency they could easily go bankrupt. No one wants to bet the farm on crypto.

However, what if retailers knew that on average Bitcoin always doubles in value ever year. If they had enough money to get through the bad years year then they would no longer have any need for a "stable" asset that loses value every year. Instead, they would be making money hand over foot with crypto.

Nothing is stopping this from happening.

When Bitcoin spiked to $14k, what did we all do? We cheered? Why did we do that?

| Application | Decentralization | Inflation | Speed | Community |

|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 | $3200 | $6400 |

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $3467 | $3733 | $4000 | $4267 | $4533 | $4800 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $5067 | $5333 | $5600 | $5867 | $6133 | $6400 |

Even if Bitcoin was doubling in value every year (it is) then its price today should be $5000. Why did we cheer for $13.8k? Because we are greedy bulls. We don't care about stability; we care about profits.

You see, the more people in the community who buy low and sell high, the more stable the asset becomes. Therefore, we can all get straight up paid to keep an asset stable, yet no one is organizing to do this.

Why?

Well, first of all, this is war. Spikes in the value of Bitcoin are not to be celebrated. They are an attack against the network.

The rats aboard the U.S.S economy are taking their bags elsewhere.

If any cryptocurrency created a stable asset that was doubling in value every year, what would happen? Correct: that currency would be bought out by billionaires. If you're dedicated to "selling high" then someone is going to come along and buy you straight out of business and you'll no longer be in control of the project. This is why the price of Bitcoin has to spike up and then crash: untrustworthy rich-ass people are trying to corrupt it.

Conclusion

There's no such thing as stability, especially at this day in age. When the economy collapses and interest rates are at zero and that's not helping because the world is full of rampant corruption, what do you think is going to happen? Hyperinflation. Then we'll all see the world reserve currency spiral out of control. My advice? Watch what the billionaires are doing with there money around that time.

This truly is a crazy time to be alive. The signs are all around us. Change is coming, and with it, chaos. It's up to us to reign it in and create a new order; a better one. Are you financially responsible enough to make it through the bad times? I hope so.

Return from There's No Such Thing As A Stable Asset to edicted's Web3 Blog