Ramping up to peak absurdity.

The human brain does a very bad job of processing exponential growth. The process of doubling something, and then doubling it again and again is not something that happens very often. More often than not there will be limited resources and logistics that will prevent such growth, but in the digital realm growth is seemingly limitless, which really tends to throw us off when trying to predict where this is all going. Chaos doesn't like to be predicted.

https://en.wikipedia.org/wiki/Moore%27s_law

Even as far back as 1975 Gordon Moore realized that transistors on chips were doubling every two years, while at the same time halving their cost in the same amount of time. Just like Bitcoin, tech has been going x2 every year on average. I expect this will continue on for quite some time.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

Shortly after 1975 the Byzantine's General problem was posed.

Imagine divisions of a Byzantine army, attacking a completely encircled city. To proceed, the generals of each division, who are dispersed around the city’s periphery, must agree on a battle plan. However, while some generals want to attack, others may want to retreat.

While this riddle sounds like something based in the real world, it absolutely is a networking problem posed by the greatest minds right at the inception of the internet itself. Yes, those math ninjas knew this was a problem before I was even born, and the Byzantine Generals problem was thought to be unsolvable for more than three decades.

But now the problem of consensus has been solved, and we already have more than three valid ways of 'solving' the problem (POW/POS/DPOS). While these solutions have many flaws and attack vectors, Bitcoin has proven that they are good enough to move forward from the forty years of centralization we've been building up since that time.

Behold: the ultimate absurdity!

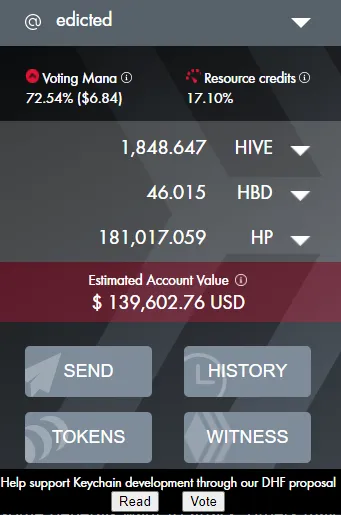

Even after crashing down to 75 cents, my account still puts me well within the six-figure range, and that doesn't even count my 41k Hive delegation. That's just Hive, and I find myself counting the bags I have elsewhere and reaching a staggering number I would have thought impossible just one year ago.

That's the thing with crypto: It's highly volatile. We need to be selling off during the good times so we can pay for things and buy the dip when everyone else is in panic mode. This is one of the best ways to support these networks. Buy low; sell high; provide stability to the network in doing so and get paid by the market itself.

Unfortunately, it is the tendency of everyone in a capitalist system to maximize their gains and output. Rather than DCA and playing it safe, we tend to make big moves all at once after we've decided to turn bearish or bullish. This is not a healthy or safe way to protect wealth. It's pure gambling and we should try to avoid it if possible.

That being said I've held on for too long to chicken out now. The plan was always to get to Q4 2021 and refactor then. Judging by what I've been seeing recently, I highly doubt I'm going to be disappointed by the plan I forged 4 years ago.

2018 was a brutal year. ICOs were a brutal disappointment. The DEFI farms of 2021 will be just like ICOs, except even worse. When the killer dapp is liquidity itself, we are going to see bubbles like no one would ever believe. Steel yourselves.

Speaking of AMM...

This is a superior technology that just continues to prove itself time and time again. Ten years down the line all liquidity pools will be AMM. That's just the best way to provide liquidity and yield for everyone involved.

Another random thing I was considering is that buyers and sellers share the burden of slippage when it comes to Automated Market Making technology. When someone buys/sells a coin using AMM, they take a slippage loss, but the liquidity providers also take a loss in terms of "impermanent losses" at the same time. It almost seems like a lose/lose situation until we consider that LPs get access to exponential yield and the traders get access to exponential liquidity, so in reality it's a win/win for all parties concerned.

Conclusion

Exponential growth is not a natural occurrence unless enough resources exist to support it. With the advent of decentralization taking over and disrupting a 40-year old centralized environment, it has never been more possible to create exponential growth injected directly into the backbone of the economy itself: currency. Expect these numbers and growth metrics to continue not making sense. We are on the brink of a worldwide evolution, and nothing can stop it from happening, short of turning off the Internet and ushering in a new Dark Age (which obviously benefits no one).

Posted Using LeoFinance Beta

Return from These numbers are absurd. to edicted's Web3 Blog