Recently the SEC forced Coinbase to make a statement.

What did Coinbase have to say?

Hilariously enough:

Not your keys, not your crypto.

Yes, the SEC basically demanded that Coinbase announce that if they go bankrupt, all the crypto that belongs to Coinbase users, well, it actually legally belongs to Coinbase and will be counted as part of their assets.

The thing about bankruptcy is...

You're not allowed to declare it if you have assets that could be used to pay back the debt. That's how it works. If you have money you can't just be like "I'm broke" then take the money and run. Well, actually, people can't... corporations can, because corporations have more rights than people do. I'll get to that later.

So Coinbase declares bankruptcy.

What's next?

All of Coinbase's assets are declared and added up, then compared to the debt that is owed. Then, all of Coinbase's assets are liquidated and divided out to the entities they owe the debt to. Whatever is leftover and can't be paid back is zeroed out.

However, the brand and the business itself are also assets, which are now owned by the people that Coinbase owed money to. Will they pick up the pieces and keep Coinbase operational? Probably not. Say they owed a bunch of money on a traditional bank loan. Are legacy bankers really savvy enough to turn around a failed business that they now own? Probably not, and they are smart enough to know it. Not worth it. So they let the thing die a swift death. Easy.

Overhead costs of running a business are massive and profit is a thin trickle .

How does this play into not your keys not your crypto?

It's just funny how even legally, this is true. Most people out there would assume that not your keys not your crypto means that someone is going to illegally steal your crypto. Rather, we see that no, the crypto is stolen perfectly legally during the process of bankruptcy.

You'd think that people would have rights and people would own the money that they deposit in a bank. This is simply not true. Centralized lawmaking is centralized. The institutions own everything. If they make a bad decision? Too bad, so sad. Poof, gone.

Thought experiment: Coinbase knows they will go bankrupt.

Here's the really messed up thing. Imagine you are an executive at Coinbase, and you know there is a 99% chance you're going to go bankrupt. But hey, fuck it! Let's go for that 1% Hail Mary play!

So you go to the bank and you get a loan.

It's a huge loan. The bank thinks Coinbase is doing great and the executives haven't been honest with the struggle. So what happens? Well, first of all, maybe the Coinbase executives just give up and give themselves huge bonuses with the bank loan. Pocket the money and declare bankruptcy. Then when the bank goes to collect their debt guess who pays for it? Yep... all the people who deposited money into Coinbase. Isn't that fun?

They could also dump their stock knowing the company will go under, but that actually is illegal and would be insider trading. Doesn't mean it doesn't happen, but there is a stark difference between legal and not so it's noteworthy.

It is in this way that we can see that it is not legal to steal customer funds directly, but stealing indirectly via bankruptcy is perfectly legal. People often talk shit about Donald Trump and how bad of a businessman he is for having so many failed businesses that went bankrupt. Yeah, those people don't know how it works. Try again, you're bad at this. Corporation/Debt harvesting is a profitable business. Doesn't work out so well for the corporation in the end. Just like a cow at your local farm.

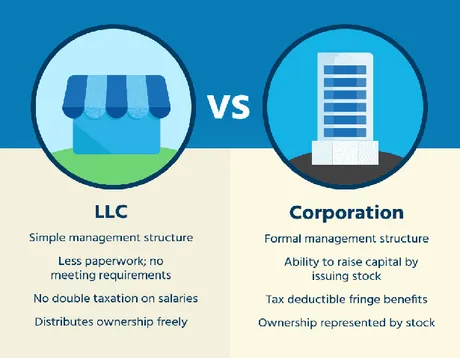

LLC: Limited Liability Corporation

This is where all the magic happens. Legally, this is how barriers are put into place that stop the court system from suing the owners of a company for debt personally. Anyone who sets up an LLC can't be sued for their house and other assets if their business goes under, because the business is a 'person' and this 'person' doesn't own the house in question.

It's a nice protection for entrepreneurs.

I'm sure many people would never start a company to begin with if these protections were not in place, so theoretically it's helpful to have these things around to expand the economy. However, just like any rules or regulations, those who know them the best know how to exploit the system for personal gain.

So yeah, it's possible to funnel debt through these systems and leave everyone else high and dry. A house bought with profit from an LLC can't be taken back by the bank after the fact (assuming the LLC isn't the owner of the house). Welcome to the wonderful world of corporations legally counting as their own person within the legal system. It would be like if the bank tried to sue you because your brother owed them money. Hm, yeah, nice try bank. Pass.

Bail-in

I've talked about bail ins like a dozen times over the years. During the next banking collapse, everyone is going to know what they are because they will be happening left and right. Essentially anyone who deposits money into a bank that fails will have the money haircut as described above. In exchange, they receive ownership over the business. However, what good is ownership over a business worth $0? Who will pick up the pieces when the debt is restructured? There are no guarantees.

Conclusion

Not your keys, not your crypto. Even the SEC knows it and forces crypto banks to declare it. Pretty wild honestly. It's safe to say that we should never hold more than 20% of our crypto assets on these centralized exchanges, and even then it should be spread out across multiple exchanges (the best ones) to ensure that if one goes under we don't lose it all.

What are the best crypto banks? Eh, Binance. And even then, they participated in the Steem hostile takeover in a big way and made no attempt to help us. We know where the loyalty lies when it comes to corporations. Can't trust them but also have to trust them. Perhaps one day the DAO will make them irrelevant, but that's at least a decade out.

I used to think Coinbase was a really solid place to hold money as well. However many issues have come to light that show otherwise. Regulations are choking American crypto exchanges (just the other day I was forced to answer a bunch of bullshit questions because my account was locked), and the bear market doesn't help either.

At the end of the day being our own bank and not relying on centralized custodians is the answer. We will see this theme play out over and over again. People trust the custodian because it's convenient, and then they get absolutely burned and are essentially forced to do it the right way. I expect a big hack or insolvency to roll around that really brings this issue to light (if the dozen random exchanges that have already gone bankrupt weren't enough).

Posted Using LeoFinance Beta

Return from Thought Experiment: Coinbase Goes Bankrupt to edicted's Web3 Blog