https://media.tenor.com/TG7743qRQBkAAAAC/falcon-space-x.gif

A couple days of Green is all it takes for sentiment to flip.

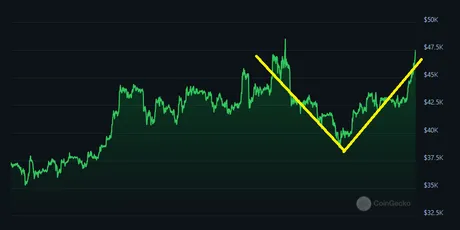

Bitcoin is up 10% in three days and everyone has gone from, "Oh no the ETF was sell-the-news," to, "omg send it," in record time. We are now back into the local highs range after a V-shaped recovered occurred. This move was expected by both me and everyone else that saw that Grayscale's bleeding into the market could only continue for so long.

The ETF inflows are a thing of legend at this point. This "fundamental gain" is outperforming every fundamental gain before it by exponential bounds. Normally hype like this is a total bust and never delivers, but this one is actually doing what it was supposed to do. Now 5k-10k BTC are being gobbled up every day by these Goliaths. Taking gains is not really an option until we hit something like $100k and the laser-eyed maxis come out of the woodwork to celebrate and sell the victory. Do not sell your assets to Blackrock; we need to get to 2025 first.

We can see pretty clearly that the V-shaped recovery only went as low as the MA(100) (100 day moving average). Got an auto-bounce off that line and continuing on with the golden cross fanning. The MA(200) sits at $35k, and support at that level looks uncrackable at this point for a couple of other reasons.

Chinese New Years

The new year in the East starts tomorrow, and they don't mess around. Traditionally this time of year is an insane wildcard for crypto. Either the price moons or it dumps hard. Because we are at a relatively low point in terms of gains over time it looks like we are going up.

Halving FOMO & Retrograde

The timelines on this run are lining up absolutely perfectly. It's always been my theory that the next halving is being massively overhyped. If we were going to start rallying and peaking a month before the halving event that would start right about now, which it appears to be doing.

A month before halving is going to be around the Ides of March (how ominous). The new moon is on March 10th. On top of that Mercury will be in retrograde from April 1, 2024, to April 24, 2024, just in time to slap the halving event.

Of course astrology is silly but I like to use it for confirmation bias. I already believed that Bitcoin was going to peak before halving so I look for evidence to build that narrative. Then if I'm right I get to point back to this post and reference how smart I was. Very cool.

And what of the trendline?

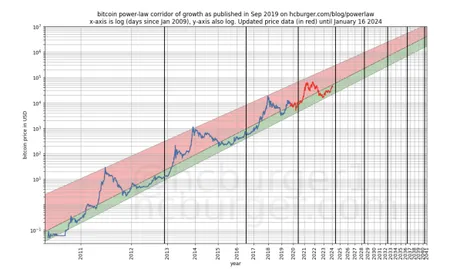

In order to calculate the doubling curve trendline we take the current year minus 2014 (which is 10), then we add how many months it's been in the current year (like 0.1 years), then take 2 to the power of that number. Then multiply that number by a $100 baseline.

2^10.1 * 100 ~ $110k

So the trendline is telling us Bitcoin is worth around $110k right now. Is this analysis still relevant after the last bear market? I believe it is, and it would take more than a fraction of 1 cycle to disprove.

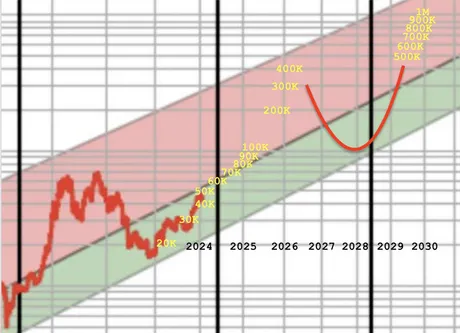

Another tidbit of analysis I saw on Twitter I also found very valuable. This one is still based on exponential growth on the logarithmic Y-axis, but is a little bit more conservative than doubling every year. The point is that $400k comes up as a point of interest in both models. This model says $400k will be the peak, and the doubling curve says $400k will be the average price near the end of 2025 (say October). Either way I'll have to take gains in Q3 and Q4 of 2025, and perhaps even before that if I want to gamble gamble.

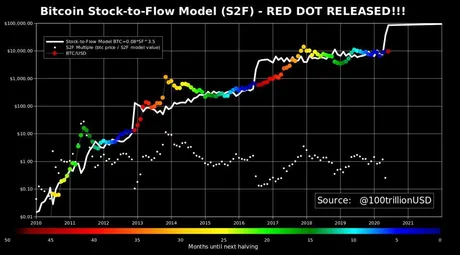

Stock to flow

PlanB's BTC model also tells an interesting story. It's saying once again the market is overdue for a run up to $100k.

Significant points of interest

- $100k

- $400k

- $1M

Conclusion

Number is going up, but we have a long way to go before we can take gains. Selling our crypto to greedy vultures is not an option. Selling them to boomers who would have never otherwise bought BTC is also not an option. We have to wait unless we get a huge mega-pump within the next 5 weeks. If so we can gamble it up and hope price goes down into the halving event. Of course we should only be gambling with small amounts at this point because 2025 is going to be the real year for taking real gains. Don't pull the trigger too early, frens. Wen moon? Soon.

My expectation is that there will be only 3 weeks of real rallying in an upward direction, so we should plan for the next 2 weeks of being a struggle-bus that attempts to crack resistance around $50k unit bias. No matter what happens I will probably DCA sell a little bit a month before halving (mid March) because I'm almost positive this will turn into a very disappointing bull-trap as we head into April.

Bitcoin is worth $100k; the market just doesn't know it yet.

Return from Time to revisit the log trendline. to edicted's Web3 Blog