A hard to understand topic

It's hard to understand something when our livelihood depends on us not understanding it. This logic is often extended to politics and rings quite true, but it also very much applies to the barbarian tribes we have forged within the crypto landscape. We all have our tokens and communities to support and will often do so completely irrationally if necessary.

What I mean by this is that any of the logical lines of thinking begin and end with: "Here's why you should buy the token that I bought." Unfortunately right off the bat this is a potentially disingenuous foundation riddled with conflict of interest. Because first and foremost the reason you should buy my tokens is to pump my bags so I can dump on you later. That's the quiet part that nobody says out loud when they're being serious about the topic at hand. Can devs do something? Let's make number go up. Came for the money stayed for the community, but give me money though.

It's very obvious that the problem gets exponentially worse when the token isn't performing well on absolute or relative scales. Take Hive for example: we are neither performing well on the absolute or the relative scale. The absolute scale of $0.30 USD is very close to the local low of 25 cents.... which is were we where when Bitcoin was x4 lower in price. Hive has bled on the market cap ranks to a comical number about to break into below top 400, which is just silly when we can see pointless memecoins that booted up yesterday making it to rank 50. Whether this is an opportunity or a slap in the face is based solely on individual perspective.

Events like this are automatically going to create irrational responses. I mean if the market is being irrational then why shouldn't we? So what does Hive have to offer that all these other networks don't? It is this exact line of thinking that is the problem. We don't need to justify our existence, just like a small community in Africa doesn't need to justify their existence. They just exist. Nobody is looking to wipe that small town in Africa off the map; that's delusions of persecution and grandeur at work. The small town will do whatever it does. We'll see.

Getting to the actual topic of discussion

One of Hive's big talking point is "free" transactions. Of course there is no such thing as free transactions because that results in immediate systemic failure, which is something I had front row seats to in real time when it happened to Blurt during the hostile takeover. Not only are free transactions not real, but we also wouldn't want them to be. Free basically means WEB2: which also isn't free because they shove ads down your throat, own your account, and monetize all your data. That is a high price within an emergent attention economy. It used to be a great deal, but now it isn't. The environment has changed; we are approaching critical mass.

So when users on Hive are like oh our transactions are free... and then new users come here and are like, "Why can't I post a transaction?" How do we respond? Oh yeah to get free transactions you gotta buy our token. LoL. Like... can we not? Can we stop marketing this feature as free and then immediately tell new users to go buy to get the "free" thing? It's embarrassing honestly.

Imagine if Hive had as much adoption in the future (5-10 years) as Bitcoin has today. So Hive is sitting at like a trillion dollar market cap. Anyone wanna venture a guess as to how much a Hive token costs if the market cap is a trillion? Hmmmmm... yeah the answer is at least $2000 per coin. Is that sounding very free to anyone? Let's assume it takes between 100-200 Hive per account to not run out of credits. That's $200k-$400k for a new user to get the "free" thing.

But nobody cares because the immediate lizard-brain response to that from everyone on this network is, "Well if Hive is $2000 per coin all my problems are solved so I don't care." Yeah, exactly. EXACTLY THE POINT. Because all the logic begins and ends with selfish intent; we all do it. Nobody cares about the network they only care about their bags. It's obvious.

So we have this situation where a lot of people are running around thinking that Bitcoin has a fee problem. And what's going to solve this fee problem? Oh, Hive is. Because surely Hive isn't going to have a fee problem when it's got a trillion dollar market cap, right? Bitcoin doesn't have a fee problem: it's got an adoption problem. The success of Bitcoin is the problem. The fact that people are using it and willing to pay $50 for a transaction is the reason why transactions are $50. That doesn't go away on a network with yield-farmed operations like Hive.

Did people complain about BTC fees when Bitcoin had a market cap of $130M? No because the token price for BTC back then was $7 a coin and transactions rounded down to zero making them free, just like they round down to zero on Hive right now. Same exact thing. The weird part is that the actual token price going up has nothing to do with fees going up, but rather the demand to use the on-chain network.

Fees are measured in dollars.

It might look like fees are paid with the underlying cryptocurrency on-chain, but they are not. Fees are a psychological free-market. The psychology of paying for things is measured with unit-of-account, which no cryptocurrency has yet achieved. Thus, we are measuring everything in USD. This is why Bitcoin fees haven't gone up at all over the last 7 years running. There's a breaking point right around $50 in which users simply refuse to pay more than that. That psychology isn't going to change; that is the consensus. BTC fees are not going to be higher than $50 for any extended period of time. Ever.

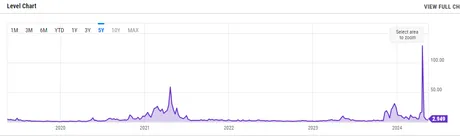

Here are the fees for Bitcoin over the last 5 years.

Notice anything? The number is not going up like we would expect it to. In order for there to be a problem the trend has to go up. It's forever crabbing sideways with random spikes of FOMO in between. The cost to put an operation on chain right now today at a token price point of $65k is the same as it was in summer 2019 when the price was $10k. How is that even possible? It's possible because the fee has absolutely nothing to do with the token price and everything to do with how much people are willing to spend to get their data on-chain... which is always going to be measured in USD until a new unit-of-account rolls around.

The fact that Bitcoin has gained massive adoption and token price over the last 5 years should tell us that the way we've been interpreting this situation is completely incorrect. Again, BTC is x7 the price and now we have Ordinals, Inscriptions, Runes, and BRC-20 shitcoins flooding the chain and the fee is still crabwalking sideways with random FOMO pump/dumps.

There is no problem here, and as soon as there is an actual problem the Bitcoin network will likely just come to consensus to increase the blocksize a little bit to make up for it. Many think it's impossible at this point for BTC to increase their blocksize. It's as simple as changing half a line of code written 15 years ago. Even Satoshi Nakamoto is on-record as saying this absolutely needs to happen.

They'll do it when they need to do it; they won't do it when they don't need to do it. If they increased the blocksize right now it would just get spammed with more bullshit and the fee would stay exactly the same while the cost to operate nodes would go up. If there was actual demand for bigger blocks then people would use the Bitcoin Cash BCH fork. This vaporous demand for bigger blocks does not exist; it's a fantasy. But even after testing it in the field and getting actual results that prove the hypothesis incorrect do we just sit here and act like fees are a problem. The fee chart alone crabbing sideways for over half a decade is already proof enough.

And now that we have these massive ETFs out here: the demand to use the BTC chain is actually going down further. A lot of these people are just going to trust Blackrock/Fidelity/Coinbase to handle business and perform all of these transfers of value off-chain which reduces the load on-chain. Is this the "optimal" solution? Nothing about crypto or solving the Byzantine Fault Tolerance problem was ever supposed to be "optimal". It only needs to be good enough to actually work. That has always been the goal.

"Good enough".

No one can fight the tidal wave that is the free market. If the free market wants a thing they get the thing, especially when it's connected to a protocol that can't be censored at the base level. If our collective response is: "Oh well normies shouldn't want to bank with Blackrock." I mean guess what too bad. They do. You lose. Automatic crippling loss. We don't just get to say how things "should" be and expect that to be valuable insight. That's just mid-curve showboating and virtue signaling with no bearing in the real world.

Actual difference between Hive and Bitcoin

You know it's funny to say but Hive probably has more expensive fees than Bitcoin and we don't even realize it yet. How is this possible? Because yield farming bandwidth creates a situation that allows for ossification and stagnation. The idea behind this being that early adopters (literally everyone here now and years into the future) will get to post whatever they want to the chain without incurring a cost that matters to them. That means every single one of us can spam the chain with whatever we want for no penalty. This intrinsically creates a scenario in which new users have to pay extra to make up for all that bloat. But see who cares because you aren't a new user so who cares?

Anyone who builds an app on Hive today will be grandfathered in forever as long as they hodl their stake and have a constant flow of resource credits. It doesn't matter if that app sucks; it doesn't matter if new devs could make something better. The old app wins because the old app has the stake backing it. That can't happen in the jungle of Bitcoin and Ethereum where fees are paid up-front with the token in real time. Resource credits are not a superior solution; just an interesting one worth exploring.

Bitcoin and Ethereum are on an even playing field. If someone creates a superior product then they win. That's not necessarily true on Hive where an old shitty app could operate as long as it had the stake to back it up. This is the dark underbelly of Hive that I've never seen anyone but myself talk about. To be fair this situation doesn't exist yet and it's still speculation, but the logic is sound (for now).

So how does Hive avoid this fate?

The thing that Hive actually does better than Bitcoin and ETH is pay for infrastructure. That is the key to scaling. Bitcoin doesn't want to increase the blocksize because nodes would be more expensive to operate... and those nodes get paid zero to operate so this is a large burden. Hive doesn't care about this problem because Hive node operators actually get paid. If the Hive token goes x100 in price and we need to increase the blocksize to accommodate demand we can do it no problem because all the nodes are already earning x100 more block rewards (because again everything is measured in USD).

The problem with this "solution" is that it basically creates a situation where at a certain point it will no longer be possible for anyone to run a Hive node unless they've been voted into the top 100 witnesses and are earning rewards. Like if it costs $5000 a month to run a Hive node obviously nobody gonna do that unless they're making over $5000 for their troubles. Do I think this is a good tradeoff? Actually yeah I do. Hive doesn't need more than 100 independent nodes in operation at any given time.

Anyone who thinks $5000/m is totally out of the realm of possibility is forgetting that Steemit Incorporated was paying more than that for their full node implementation of Condenser. It's actually kind of funny to see people be like, "Yeah we're gonna be the next crypto Facebook." I mean how much do we think Facebook pays a month to run their service worldwide... let me check.

First, Facebook spent $860 million, or about $1 per active monthly user, to deliver and distribute its products last year. The bulk of that money was related to data center equipment, staff, and operating costs. That is up from about 80 cents and 60 cents per user in the two previous years.

Yeehaw, almost a billion per year.

Now imagine that cost being multiplied by every witness. Fun times. Luckily Hive users are worth more than $1 a year. It is known.

Conclusion

The cost to use a network is solely dependent on how much the users of that network are willing to pay. The cost to use Bitcoin crabs between $1 and $50 because that is the price Bitcoin users are willing to pay. The cost to use Hive is $0 because that is the price users are willing to pay. To assume the cost to use Hive isn't going to increase is a blatant assumption that often goes completely ignored and instead gets accepted as irrefutable truth. This doesn't get to be decided by anyone; it's decided by the free-market on aggregate. Deals with it.

Token price has no affect on fee price.

Fees are measured in USD and solely dependent on the demand to use the service vs the supply in bandwidth currently being offered. Hive currently offers 22KB/sec max block size. That's not a lot. That's the speed of a 56k modem from 1998. Can we increase this limit? Sure. Can we increase it without incurring a cost or stress-testing bottlenecks? No. There's a lot of nuance to this topic and everyone dumbs it down to: "HIVE OPS FREE FOREVER BRO TRUST ME BRO PLZ BRO PLZ".

Extrapolating Bitcoin fees with token price increase to "prove" that the BTC network has scaling issues is a direct result of "buy my shitcoin; pump my bags" antics. This is not a competition. We do not need to justify our existence. This is a collaboration. Bitcoin benefits Hive and Hive benefits Bitcoin. In fact it's quite obvious that Bitcoin benefits Hive a lot more than the other way around, so the lack of respect is honestly quite disturbing, but also makes sense because Bitcoiners are their own breed of toxic trashpile on a completely different level. But that's another story altogether.

Return from Token Price Doesn't Affect Fee Price to edicted's Web3 Blog