The other day @onealfa was listing off some rules for crypto in the LEO Discord. Apparently rule #2 was HODL. So of course I decided I would troll this process and just start making up random rules like "Rule #1 is don't talk about Rule #2" like it's Fight Club and whatnot.

But in the end I was able to take it seriously and actually flush out a top ten set of what I would consider some key advice for users entering the space.

Rule #1: Community is key.

People get mad when coins like Litecoin and Doge spike. Hell look at Doge today. Up to 25 cents when the normal price was well under a penny a few months ago. Why do they get mad? Because those projects, "Don't have fundamentals." But for the most part lets be honest: it's just because their token isn't mooning and they are jealous tribalist whiners.

Spoiler alert: currencies don't need fundamentals; they need users. That is all. We assume that networks with good fundamentals will get all the users. That is false. That is like saying no one likes the Raiders because they never win the Super Bowl. Raiders fans are some of the most diehard fanatics out there. Wen Raiders token? They'd pump it to the moon.

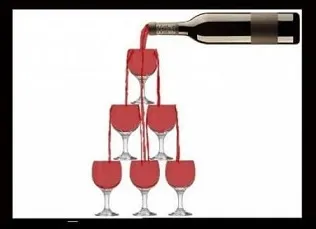

Rule #2: HODL!

90% of gamblers lose money on average. The easiest way to make money in crypto is to pick solid projects and simply hold the tokens without trying to trade them back and forth. It's not about timing the market; it's about time in the market.

Not only is this a better & safer strategy for 90% of all users, it's also a less stressful solution. Rather than having to constantly worry about buying and selling you don't even have to look at the price. Just come back to it later and hope for the best, as this strategy usually works out.

Rule #3: Trust No One!

The entire point of crypto is to be your own bank and maintain responsibility of your own assets personally. Not your keys, not your crypto. Leaving significant amounts of capital on centralized exchanges is just asking for trouble.

That being said hot-wallets, hardware-wallets, and even cold-wallets have their pitfalls. Employ decentralization and have a good spread of assets in a lot of different places so if one form of security fails you won't lose it all. Decentralization is key.

Rule #4: Test, Verify, and Backup.

The worst thing you could possibly do in crypto is have such good security that even you are locked out of your own vault. Crypto is complex and if you mess up your money can just vanish forever. Lose your keys? Gone forever. Send money to the wrong address? Gone forever. Get hacked? Bye Bye.

New users should always send test transactions to make sure what they are doing is actually going to work. Unfortunately this becomes prohibitively expensive on the biggest networks that have the highest fees like BTC and ETH.

Whenever making a new wallet don't simply trust that you've done everything right. Not only do you have to send money to a new wallet, but you also have to ensure you actually control the wallet you created. Once everything is verified, creating at least one extra backup of the private keys is absolutely essential to maintain proper security. Ask yourself: if my house burns down... how much crypto do I lose?

Rule #5: DCA

Perhaps your crypto has mooned and you'd like to take some profits. What do you do? I'll tell you what you don't do: sell everything all at once and hope you perfectly timed the top.

Similar to HODL strategy, Dollar Cost Averaging is the superior strategy used to limit volatility and risk resulting from unknown external forces. If you think you want to sell some of your stack: sell 5% and wait a few days or even a week before making another decision on the matter.

If you ignore these warnings you're almost sure to fall into the trap of constantly second guessing yourself. You move all out and your coin goes up even 5% and you could panic and move all back in again. Before you know it the market has crashed and you've made a dozen foolish moves that were easily avoidable. This market knows how to get inside your head and fleece the newbies: don't be one of them.

Rule #6: There is no silver bullet.

There is no Bitcoin killer; there is no Ethereum killer. These are the stories antiquated venture capitalists tell their children. You can't patent open source code. You can't buy communities. You can't solve all the problems with a single network. Get over it Maximalists: Bitcoin is extremely niche (secure & stable, but also slow & expensive).

There isn't going to be one blockchain to rule them all, so you might as well branch out and get involved with projects you're personally excited about and actually use. If you don't know what to pick or if a newbie asks you for help: The Answer Is Bitcoin. Every time. Don't send a newbie down some rabbit hole farming some new experimental DeFi token: that's just mean, and highly likely to blow up in their face and cause salty feelings. Bitcoin is the anchor. Start there first and branch out after.

Rule #7: You get what you pay for.

There's a reason why Bitcoin and Ethereum transactions are so expensive. These are the most decentralized networks in the world with the most inefficient and expensive redundancies. When it comes to security: you get what you pay for. Sure, thousands of users will migrate to Binance Smart Chain because fees are so much cheaper: that doesn't mean they aren't going to get wrecked.

Or maybe they won't! Even CUB is on BSC. We hope for the best but prepare for the worst. This is one of the reasons I'm so bullish on Hive. We have fairly good security for a chain with "free" transaction costs. Our security is better than BSC: I guarantee it. Also we aren't full of rugpull Defi scam coins (yet). Again, every network has tradeoffs, and no network can do everything.

Rule #8: If its too good to be true...

You're either a genius or a sucker. Truth be told it has nothing to do with being smart. Lucky people get called geniuses all the time after the fact. This is gambling. These lifeboats are rickety.

The problem with projects that are too good to be true is that the dev teams make it sound like the product will be easy to program and they theorycraft it all out, only for nothing to get done or no one to adopt the platform. That and the endless exit-scam culture we've been witnessing lately: dear god.

When it really comes down to it: investing in the top ten by market cap (especially Bitcoin) is going to be the best bet 90% of the time. "Only" making x2 per year with BTC might be "boring", but let's be honest: you're probably just being overly greedy.

I never speculate on networks that I don't use anymore. Also, when I feel like the bear market has started, I will heavily retreat back into BTC with the rest of the rest of the trading bots. In general, alts can only vastly outperform Bitcoin for a few months every four years.

Rule #9: Learn the tech.

Crypto is complicated, but it's worth it. We are entering into a very strange time period in human history. This is a digital age. Knowledge is power. Data is coveted and monetized.

We should never stop learning. A shark that stops moving forward: dies. In this same vein, we should remember how far we've come and how alien this all is to "the normies". Teaching others is a great way to retain information for ourselves permanently while adding value to the cryptoverse.

Rule #10: A journey: not a destination.

Evolution does not end. Life goes on indefinitely, regardless of the individual. The environment undergoes constant change and we must adapt to our rapidly changing conditions.

Life is a game, and money is the scoreboard. However, with crypto your money is also your reputation: Ney, your very lifeforce. In decentralized systems such as these, there is no end-game. No matter how much money you have, building more value for yourself gifts additional value to everyone else in the network and furthers our own reputation. This is nothing like the legacy economy where billionaires simply try to scoop up every last bit of value for themselves. No matter how much they earn we gain none of the benefit. With crypto the entire script gets flipped.

We're transitioning from zero-sum game theory and cutthroat capitalism to synergistic cooperative systems without limits. A star is being forged: and at the heart of that star will pour fourth seemingly infinite power. You and I will have front row seats to watch as we hit critical mass.

Some other rules that didn't make the cut:

- Stop asking wen

- Hedge your bets

- Make connections

- Stop speculating and lay down roots.

- Shiny new things tarnish quickly.

- Don't invest more than you can afford.

- Not not financial advice.

Posted Using LeoFinance Beta

Return from Top Ten Rules of Crypto to edicted's Web3 Blog