Koin remains extremely volatile and high volume.

Looks like we've found a lot of support at the 3.0 cent level. We dipped to 2 cents for a second but that was a dump from the #1 miner so that's to be expected. Anything under 3 cents is probably a good deal at this point.

I've increased my exposure to this market by x3.

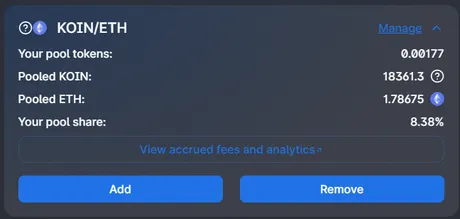

Still, this is "only" 1.8 ETH. I'm playing the speculation game only here. I see a pool with a lot of volume compared to total liquidity and I want to farm it.

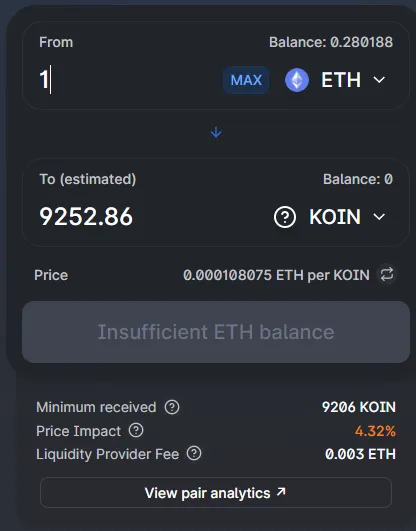

The mechanics of this completely organic and unsolicited market are very interesting. The Uniswap pool is very volatile because it is so small. This volatility creates a farming opportunity. However, the only way to farm the pool is to mine it (competing with server farms) or buy it on Uniswap. It costs around 1 ETH for 10k coins at the moment. This is how much you'd need to be an Orca (own 1/10000th of the platform due to 100M total coins). Only 3% of these coins have been mined thus far, and competition is getting steep.

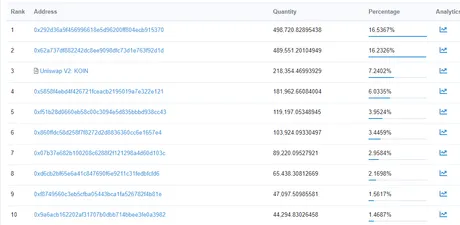

https://etherscan.io/token/0x66d28cb58487a7609877550E1a34691810A6b9FC

We see Uniswap make it to the #3 spot on the richlist, soon to be #1 shortly. It's simply too profitable with all the miners selling and people buying. More coins will enter the pool when 24 hour volume is higher than total volume. Count on it.

Why buy Koin?

Well, first of all, the pool is volatile and high yield. Because there is competition to mine from server farms this means buying the Koin directly will be cheaper for many users. This is essentially the only route to mine the Uniswap pool, which isn't even the most popular speculation of all this.

Artificial Scarcity.

The mining cost of Koin is significant. The ETH gas cost is even moreso. Both of these factors give Koin a higher value just due to the cost of acquiring them. No one is going to sell Koin for a loss at the base level. The system is reaching equilibrium. Remembers what happens to Bitcoin when it equalizes? It moons. Not financial advice.

Assuming a Koin price low of 2 cents and a gas cost of $2, we can see that the overhead cost of minting Koin would be 100 Koin. As many miners are mining rewards LESS than 100 Koin at a time, we see that 2 cents is not a sustainable number for this system to work. Either hash-power would have to go down (not likely), difficulty to mine (frequency) would go up (likely), or Koin token price would have to go up (also likely).

So...

We can see that even just buying 1 ETH worth of Koin has a slippage cost of 4.32%. That means the actual price moves twice as much as that (8.64%) because the algorithm buys all the way up for you, from current price to peak, and your slippage is the average median.

One ETH raises price 8%+

And this is the only way for a lot of people to participate.

Conclusion

I own 8% of this micro-pool, and it's been pretty good to me so far. I expect it will perform even better down the line. Koin is hitting an artificial scarcity support line at around 3 cents a Koin. This is a great price, but 2 cents can happen at any time if one of those server-mining stations decides to plunder the pool of ETH.

Trade wisely, or better yet bet against the traders and charge them a fee by providing liquidity here. The market demands it. 24 hour volume still higher than total volume. Mind blowing. Fully organic unsolicited market that popped out of nowhere.

Return from Tripledown to edicted's Web3 Blog