Selling the bottom to buy the bottom.

So the APY on staking CUB has dropped to a measly 2.3%. I had a million CUB sitting in that contract (flex) and the only way to make it higher is to timelock it. Unfortunately the best yield on a timelock is 12 months (26%), with the lower periods escalating their way to the maximum on a spectrum.

Doing the napkin math on this I came to realize quite quickly that 26% is more than x10 higher than 2.3%, which means I could just lock 100k CUB for a year (10% of my stack) and that would generate more yield than the million CUB I had in there. It's a tempting proposition, so I decided to throw 200k in there for a year, currently valued around $3800. I'm so overextended on this token it's pretty funny honestly.

So then I had 800k to play around with, and I really had a hard time parting with any of it because of the whole 1M CUB unit bias that was feeding the dopamine in my brain. After weeks of flirting with an under the table buyer I finally decided it was time to get back into the LPs.

I've always wanted to have a CUB/HIVE position and decided now was a good time. It's an interesting moon-bag LP. No stable coins here. My go-to LP used to be CUB/BNB, but honestly I'm kind of over BNB right now with all the crazy stuff going down. Supporting Hive it is.

There's an added benefit for CUB within the context of pairing the token to HBD or Hive, and that stems from the wrapping fee. All wrapping fees go into buying and burning CUB, so simply providing liquidity to one of 4 out of 7 of the LPs generates free revenue for the network (anything paired to Hive/HBD). Whenever the difference in price of Hive & bHive is greater than the wrap fee (half a percent) we get forced arbitrage and CUB makes free money. This seems like the way to go at this point. Volatility harvesting is an interesting model.

I emptied my Hive wallet but it wasn't nearly enough. Had less than $2000 liquid. Still considering selling some Bitcoin to get some more Hive this way... but honestly that's a tough sell, as liquidating Bitcoin at this juncture is a huge risk that I know I shouldn't take. Yolo?

So I took the deal.

I didn't want to sell any CUB on the market, but my over-the-counter buyer was still motivated. Sent me 7000 bHive. That's a new personal record for me, and somewhat the point of this entire post. I've never just had someone send me $2000 worth of naked crypto before and just trust me to pay them back. I did this quite a few times with value transfers of Steem to Hive during the hostile takeover, but it was for much smaller amounts ($100-$200).

This just goes to show you that the connections and communities we are building here are strong. Ideally crypto is building a foundation that exists within a trustless environment. We aren't supposed to need to trust anyone to uphold their end of the bargain, but as it turns out, decentralization is hard, and at these early stages of the game there are plenty of opportunities and shortcuts presented to us that absolutely do rely on trust.

In fact, no matter how decentralized and "trustless" crypto gets, the foundation will always be one of trust. We are simply outsourcing that trust from an individual we are doing business with to the network itself. Theoretically the network can be untrustworthy, but this is exponentially less likely.

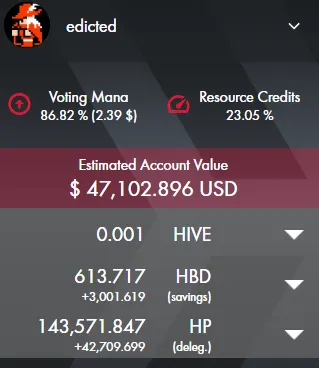

Even if I wanted to steal $2000 that someone had given me for a trade, it's actually quite impossible to do so profitably. I can't throw away my reputation on Hive for $2000, as my rep is worth much much more than that. At this point it's impossible to measure how much it is worth, but it's a lot. Who knows where Hive will be ten years from now? The reputation of my account could very well be worth more than the literal dollar value associated with my crypto holdings.

So I paired the 7000 bHive to 105,000 CUB in the LP, and sent 105,000 CUB to the trader for the 7000 bHive. Simple. Although now I have less than 800k CUB instead of 1M. Very sad. On top of that I still have half a million CUB just sitting around waiting to be thrown into an LP or locked for a year. It's quite likely I'll need to trade even more for Hive in order to get it into a place that actually generates yield and has a positive benefit to the network and myself.

Selling the bottom to buy the bottom.

So I've essentially sold CUB at the bottom, but at the same time I traded it into Hive sub 30 cents, which is just absurd considering how high we were flying during the bull market. I may use this stack to justify offsetting funds elsewhere. I still need to buy some Bitcoin back that I sold during the Binance FUD. Or maybe I don't. I guess it all depends if alts do okay during 2023, so who knows.

Conclusion

No one likes to sell the bottom, but what if you're selling the bottom to buy another bottom? Such is the state of things when trading one crypto for another within a connected market. It gets even weirder in this particular situation because selling an asset can ultimately lead to higher liquidity and a higher price over time. Quite odd indeed.

The world is in a crazy place right now, and trust is in short supply. Luckily, trust is the primary asset that crypto deals in. We can always trust the ledger because the ledger is being confirmed worldwide by many nodes worldwide, all operated by users who have an incentive to stay honest. In the event that we need to trust an individual that often works out too and we meet some amazing people along the way, just remember that it might not always work out in the end.

Within this context, we see how Hive is once again way ahead of the curve in terms of the apathy and malice we see on other networks. On a social level, communities like Bitcoin and Ethereum are completely fractured and the waters are full of hungry bloodthirsty sharks. Most do not even get warning of who the sharks are or what they are doing, and if they do it's on WEB2 social media. Hive is intrinsically more connected than that. Love to see it.

Posted Using LeoFinance Beta

Return from Trust in a Trustless Environment to edicted's Web3 Blog