This morning some big players pulled the trigger and sucked down hundreds of millions of dollars in Bitcoin liquidity to break previous all time highs. Gee I wonder who it could have been...

Bitcoin has been consolidating under all time highs for an entire month now. That consolidation has come to an end today.

This new rally is all but guaranteed to be the beginning of a huge wave of FOMO. Volume has been high for an entire month. For an entire month, Bitcoin holders have been popping out of the woodwork to sell at "all time highs". I repeat: this has been happening for an ENTIRE MONTH. 4 years ago we hit all time highs only for a single day. This rally is supported by a wave of institutionally dominating hands.

Retail, prepare to get fleeced.

Now that we've broken above $20k, the insane unit-bias level, guess what all those people are going to do that sold below $20k knowing for a 'fact' it was going to crash? They are obviously going to freak out, because again, their hands were pathetically weak.

So now, as predicted like a dozen times, a huge percent of the people who sold over the last month are going to log in and start doubting themselves. Many of them will FOMO back into the market at a loss, transferring that value to the institutions that have been buying so heavy-handedly. The start of the parabolic run likely started just now. As is self-described by the title of this post, we are about 2 weeks away from a local peak that also happens to be an all time high.

There are patterns to Bitcoin trading. Sure, buying the lows and selling the highs are tough. But honestly, Bitcoin is easier than most assets to run analysis. This is because it is literally doubling in value every year. Even if you mess up you're still going to make money.

Scrying the tealeaves

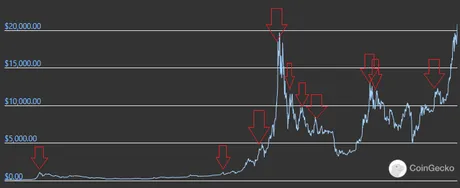

There have been many many examples in the past of the Bitcoin market bubbling up over two weeks and creating a blow-off top volcano pattern. This is what I've been predicting for a while now, and we could easily be very close to that moment now that unit-bias consolidation has been busted.

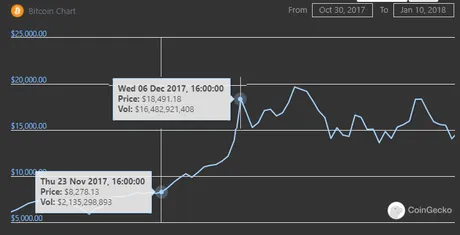

The most obvious example is the last epic bull run to all time highs in 2017. The market plateau ended on November 23rd and the market kept ascending, much to everyone's surprise. It took two weeks for the top to blow-off on Dec 6. Even though the market rallied a tiny bit higher in Jan this was obviously a great spot to sell.

The example I always use is the Bakkt bull run of Summer 2019. The market started going up on June 12th, and two weeks later it is peaking at $13.8k

There are many many examples of this. Don't take my word for it... just see for yourself. The timelines are pretty consistent. Sometimes it takes around 3 weeks on a dead-cat-bounce, but usually on a fresh run you get the FOMO and the unstable bubbling in less time.

There's also the question of: when do we start the timer? Do we start the timer a week ago when Bitcoin was bottomed at $17.6k, or do we start it now that we've finally crushed $20k? Personally, I think it will end up being 2 weeks from now, which is 3 weeks from the last bottom... all the timelines seem to be adding up when looking at the history of Bitcoin.

Amazon

I'd also like to note that volume has really picked up at work as we approach all those last minute Christmas gifts. Again, with lockdowns being reinstated and everyone being absurdly broke and in debt, this whole thing could be derailed in as little as a week.

Evictions have been pushed back to January, this is an event that's going to fucking rock the economy to the core. None of this rent debt has been (or ever will be) forgiven. It will be up to the establishment as to when this shit hits the fan.

If evictions are allowed to begin happening in Jan and doesn't get pushed back again, that means everyone who is months and months behind on rent is going to get kicked to the curb in March/April. It takes around 3 months to legally kick someone out of a house.

This is the perfect time to let it happen, because March/April is already a not great time for the economy according to the history of cycles. This will allow those who have resources to scoop up cheap assets like they always do.

Tanking the economy on purpose is a valid strategy. You can make just as much money in a bear market as a bull market. By combining the two gains become exponentially sustainable if you know when they are coming. I continue to watch how this controlled demolition is going to play out.

I'm also curious to see if Bitcoin drops on Christmas day, which would signal that it was given as a gift and sold immediately. I doubt it but you never know... last year I mentioned it and it didn't happen but this year might be different considering the climate.

Conclusion

We'll have to revisit this in a week and see if the market looks unstable or if we are still moving up at a good rate. Traditionally, the most gains are made on the last day, with a FOMO crescendo that ends with an epic crash into the mountain, followed by legendary opportunities to day trade.

That puts the next peak at like $50k on the 30th of December. Personally I hope it takes a little longer than that, because I might wait for Jan 1st to sell in order to delay the tax nightmare that is crypto. More updates to follow in a week.

Until then... HODL!

Posted Using LeoFinance Beta

Return from Two Weeks To Peak to edicted's Web3 Blog