It's funny that everyone says DeFi is in a bubble (including myself) without actually knowing anything about it.

In my last post I made it pretty clear that the price of LEO is obviously going down because 300k tokens will be injected into the economy. Did any of you think maybe I'm just bullshitting you to try to drive down the price and buy more tokens? I wouldn't put it past me!

Certainly that's not what's happening as everyone can see on-chain that I am indeed selling off stake, but you should never just take someone's word around here at face value if you can avoid it.

After writing that post I had a very interesting conversation with @khaleelkazi on Discord. Even though I've been selling off all my LEO stake I wanted to provide liquidity to the wLEO pool via my Ethereum stake. This got me thinking about how the system could be gamed.

Couldn't I just provide super deep liquidity with ETH and farm the pool without worrying about my stake getting bought out? What happens if my ETH stake gets bought? Do I have to repost my wLEO to the pool to keep farming rewards? Wouldn't this be prohibitively expensive with high fees?

Turns out I didn't have any idea what I was talking about!

Seriously! Like, at all! The way liquidity works on Uniswap is COMPLETELY DIFFERENT than every other exchange. These mechanics are what make it so popular and unique in the first place.

https://docs.ethhub.io/guides/graphical-guide-for-understanding-uniswap/

Uniswap is unique in that it doesn’t use an order book to derive the price of an asset. In a centralized exchange, such as Coinbase Pro, the price of an asset listed on the exchange is determined by where the highest price someone is willing to pay and the lowest price someone is willing to sell meet.

That's right!

When you provide liquidity to Uniswap everything just gets dumped into the same pool.

You do not set any kind of price.

The algorithm sets its own price.

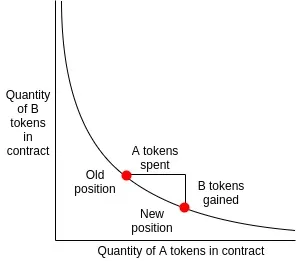

Instead Uniswap uses the Exchange contracts to pool both Ether and a specific ERC20. When trading Ether for a token, Ether is sent to the contract’s pool and the token is given back to the user. As a result, the user doesn’t need to wait for a counterparty in order to exchange or worry about specifying a price. Since anyone can list a token and users don't need to worry about matching with someone else, it is very easy to avoid any bootstrapping issue when first launching a token.

So if you wanted to buy wLEO on Uniswap, you'd dump ETH into the pool and it would give you wLEO in return. This changes the ratio of ETH:wLEO in the pool and thus creates a new price point.

For example, if ETH was worth $100 and there were 10 ETH in the pool, and there were also 10000 wLEO in the pool, Uniswap would know that wLEO was worth 10 cents a coin because each side gets balanced at a $1000 market cap. Not sure what kind of Oracle Uniswap uses to peg ETH to dollars, but I also don't really care.

Uniswap is what I would call a derivative exchange.

And not because it exchanges derivatives, but because its own liquidity is derived from the existing free-market.

third party arbitrages play a large role in maintaining the correct ratio of token to Ether in Uniswap pools.

Essentially Uniswap could not exist if users could not peg these tokens using the liquidity and order books on other exchanges. The way it piggybacks off the resources of other exchanges is straight up genius.

Uniswap incentives users to add liquidity to pools by rewarding providers with fees that are collected by the protocol. A 0.3% fee is taken for swapping between Ether and a token and roughly a 0.6% is taken for token to tokens swaps.

Therefore on top of the 300k wLEO bounty being dumped into the protocol, this 0.3% fee will be collected as well by yield-farmers. Whenever someone cashes out their liquidity tokens they get their coins back plus their fair share of fees and bounties. It's a pretty incredible system, dare I say innovative and disruptive, as cliche as those terms have become.

This is exactly how Uniswap has been able to dwarf centralized exchange volume given recent history.

It's unlike anything the world has ever seen, and most people don't know or care how it works because they are just using the super simple interface to buy tokens without providing liquidity (guilty). That's all part of the genius of it. It's essentially the decentralized Google of exchanges.

Sellers remorse?

When liquidity providers are adding to an established pool, they should add a proportional amount of token and Ether to the pool. If they don’t, the liquidity they added is at risk of being arbitraged as well.

So now I'm realizing that if I want to provide liquidity to the wLEO pool I had better make sure I don't push one side off balance or I would basically just be throwing away free money to anyone looking for an arbitrage opportunity. To be 100% safe you must add an equal amount of market cap ratio to both sides of the pool.

Bullish case for LEO

Yeah, we've gone x4, but does that mean x10 is off the table? Not really. People on Ethereum love to gamble, and if we lure in even 10 people with some stake to back up the pool that could send the price of a token flying because they'd have to push the ETH ratio in wLEO's favor, or buy tokens off the open market. With such an aggressive bounty to post liquidity (300k coins) this could easily be enough to lure some randoms into our network to yield farm; a concept I did not understand until just now.

Conclusion

I've always said that Bitcoin is a unicorn asset. Nothing else in the history of mankind has consistently doubled in value every year for over a decade. It's insane.

However, it seems like we are approaching another crypto bubble that is once again defined, not by Bitcoin, but by Ethereum. First it was ICOs and now DeFi. I've always said Ethereum's niche was DeFi even in the middle of the ICO craze. The more research I do the more I'm convinced of that 'fact'.

@khaleelkazi is EXTREMELY motivated to make LEO a success. Let me tell you, this guy is busy busy busy trying to make this network (one who's stake was airdropped for free onto the community) the best it can be.

That's the magic of crypto. Many of you LEO holders out their will enjoy all the free value being generated here without having to slave away to make this network a better place. The network effect is powerful indeed.

Bitcoin may be a unicorn asset, but Uniswap is a unicorn exchange.

Leo may be jumping on this train at EXACTLY the right time. This bull run hasn't even started yet.

Return from Uniswap Pools Explained to edicted's Web3 Blog