We've all been told that the scarcity of 21 million Bitcoin is what gives it value. This is a lie and a form of unit bias. 21 million Bitcoin is not scarce. 21 million is an arbitrary number picked out of nowhere and has nothing to do with Bitcoin value.

Unit Bias

The most common form of unit bias fallacy in the cryptosphere is believing that it's smarter to buy cheap coins. Believing that Cardano is a better buy than Monero because ADA costs $0.08 per coin and Monero costs $110 per coin is a good example of this situation. I chose these two coins because they have a similar market cap (the number that actually matters).

Potential investors see that $0.08 and they think,

Wow, if ADA was worth as much as Bitcoin I'd make x75,000!!!

Well... that's never going to happen because there over 1000 times more ADA in circulation than Bitcoin. The proper way of doing this math is looking at market cap. ADA is at 1.9 billion and Bitcoin at 108 billion, so if ADA was worth as much as Bitcoin it would go x57, not x75000. This is a much more reasonable number.

The human brain is easily hackable. We receive a hit of dopamine in our brains when we complete a task. Our brain doesn't like that we would have to deposit $600 into Coinbase ten times in order to acquire a single Bitcoin. Our brain wants us to buy something cheaper and complete those full coins faster. This is unit bias.

Even when you know about unit bias, it can still overtake rational thought. I am no exception. I am a computer programmer. I'm a pretty smart guy, but still I find myself force-finishing meals that I should have saved or thrown away. I am often compelled to finish what I've started (this might even be a reason for NOT starting something). When I first came onto the crypto scene, I was much more likely to research a cheap coin than one that cost over $100. No matter how smart you are (or think you are) we all get brainwashed on a daily basis. How many stupid advertising jingles do you have memorized?

Bitcoins are not scarce at all. A Bitcoin is an arbitrary 100,000,000 Satoshi. This is the real unit of value that matters: the smallest unit. If Bitcoin is capped at 21 million coins, then Satoshis are capped at:

100,000,000 Satoshi/Bitcoin * 21,000,000 Bitcoin = 2.1 quadrillion Satoshi

Doesn't sound so "scarce" anymore does it? If a Satoshi was worth just one penny, the market cap for Bitcoin would be 21 trillion USD. This is a real possibility, putting the value of a single Bitcoin at $1,000,000. This is probably why John McAfee throws around this outlandish number. Ironically enough, this scenario was derived from unit bias. Our brain wanted to complete the round number as we asked ourselves, "What if a Satoshi was worth a full penny?"

When we compare Bitcoin to Steem, we see that Steem is actually more scarce than Bitcoin. While one Bitcoin can be divided by 100,000,000, a Steem coin can only be divided by 1000. This means Steem only has 277,607,639,000 milliSteem. That's a factor of 7564 times less than Bitcoin. You heard me right, Steem coins (milliSteem) are 7564 times more rare than Bitcoin (Satoshi). Mind blown?

If tomorrow the Bitcoin community came out and said a Bitcoin is no longer 100,000,000 Satoshis. Instead, a Bitcoin is now 2.1 quadrillion Satoshis; there will only ever be a total of one Bitcoin in existence. This would have absolutely no effect on the fundamental value of Bitcoin. As I've said, the number of Satoshis in a Bitcoin is completely arbitrary and irrelevant to the value of the blockchain. The only measurement that matters is the smallest unit. This is the only way to calculate scarcity and precision. The arbitrary bigger coin we make up after the fact is simply an illusion so our brains can make more sense of it from a real-world perspective.

So, what gives the Blockchain value?

I'd be lying to you if I told you what gives the blockchain value. There are so so many variables. I often point to these categories:

| Application | Decentralization | Inflation | Speed | Community |

|---|

As you can see, the topic that we are discussing is simply a fraction of the Inflation/Distribution category. When people say that Bitcoin is scarce because there are only 21 million coins, what they really mean to say is that Bitcoin is scarce because the community has come to consensus that it should be scarce. The number have coins has nothing to do with it. All that matters is how inflation is created, how much, and who gets it.

I'm going to write an ELI5 post about how proof-of-work operates. I'll link that here For now, this link is broken.

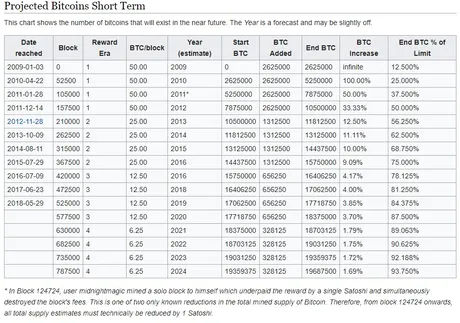

Each block on the Bitcoin blockchain provides a reward for whoever posts that block. Right now the reward is 12.50 Bitcoins per block.

https://en.bitcoin.it/wiki/Controlled_supply

As you can see the block rewards were as high as 50 BTC per block. On November 28, 2012 the reward was cut in half from 50 to 25. On July 9, 2016 the reward was cut in half by 25 to 12.5. Is it an accident that Bitcoin found insane gains in 2013 and 2017? These bull runs could have easily been catalyzed by a lack of coin supply entering the economy. Obviously, I'm not the first one to come to this conclusion.

The next block halving is set to block 630000.

This website predicts we are 620 days away from that moment in history.

The Bitcoin block mining reward halves every 210,000 blocks, the coin reward will decrease from 12.5 to 6.25 coins.

Should we expect another bull run about year after that? History does often repeat itself. At the same time, a bull run doesn't have to come from Bitcoin. This entire sphere is linked together and development is increasing at an exponential pace.

Brainstorming Sources:

| Title | Author |

|---|---|

| The Future Of Bitcoin | -- @taskmaster4450 |

| 21 Million Bitcoin Cap Is Infinite Because Magic | -- @tim-johnston |

| The Small Number of Decimal Digits in Steem | -- @krnel |

These three blog posts sparked this one. I got to thinking about how unit bias really affects the best of us. This tech is so complicated and very few understand even 10% of it. The Future Of Bitcoin shows how Bitcoin was basically designed for the elite to take over. I made the claim in my last post that this could have been a purposeful Trojan Horse attack from Satoshi Nakamoto herself.

The idea that Bitcoins are divisible, and therefore near infinite, is obviously a fallacy, but it made me realize that Bitcoins are arbitrary and Satoshis are the real hero of the blockchain. @krnel's post made me realize that Steem coins are much more rare than Bitcoin, which really surprised me the more I thought about it.

Not that it matters. Market cap is a much more accurate measurement of value. However, I've described in detail many times before how this is also a very flawed measurement.

Don't be a victim of unit bias. Ask yourself if you are approaching the situation from a logical perspective. Eating the last few bites of that massive burrito might not be the best idea, no matter how much of a completionist you are.

Return from Unit Bias Fallacy: 21 Million Bitcoins is Not Scarce to edicted's Web3 Blog