Crypto Twitter was very excited over the "pump" yesterday.

Of course by pump I mean a 3.2% gain, which used to be a completely nothing amount, but now that Bitcoin has very low volatility and people are bored everyone scrutinizes every move and blows it way out of proportion. I saw Tweets asking if anyone knew the narrative for the "pump" yesterday. Why does a 3.2% move require a narrative? Especially with Blackrock and Fidelity spot ETFs on the horizon. It's just the market doing market things. A year ago it used to be weird if BTC DIDN'T move 3.2% or more on a day to day basis. Now it's an outlier, and that's actually pretty significant.

Unfortunately waiting for an entry point has unsurprisingly failed me. Now I have to continue to DCA into BTC at a higher price, which is slightly annoying but whatever. I'm not day-trading here; this is a 2-4 month play. Swing trades only. I'm also starting to get the hang of leverage trading on MEXC. It's completely different from the last time I did it.

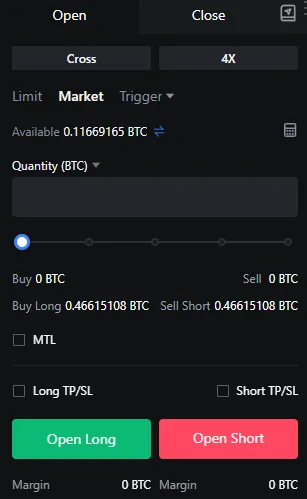

A year ago the way it worked is that you would manually borrow USDT and dump that loan for BTC if you wanted to go long. Now it seems there are a lot more advanced options (and also less tokens to choose from with significantly lower APR rates to borrow). First, you decide whether you want cross margin or isolated.

Cross Margin means your entire margin account is the collateral being used and you can lose everything that exists within the futures tab. Isolated margin means you get to pick exactly how much collateral you use for each trade. Isolated margin seems like a pretty advanced move used by either professionals or outright degens so I'm just using cross at the moment. Doesn't really matter because I only have one position anyway. I'm keeping my liquidation under $16k so I don't feel like the position is in very much danger at all, although I am considering setting up a stop-loss if I decide to get more aggressive with the gamble. Probably won't do either though. Baby steps.

So instead of borrowing USDT outright the MEXC platform does that part automatically for you now. If you want to go long on Bitcoin you just type in how much BTC you want to buy and click "Open Long". The USD loan is made automatically and used to buy BTC. The actual trading pair says "BTC USD Perpetual" so I'm not even quite sure what asset I'm borrowing here to go long. It might not be USDT. Unclear.

My bet is up like $50 at the moment.

Obviously nothing to brag about as the position I set up a couple days ago was just a small test amount to make sure I was doing it correctly. Still it's nice to see green. Notice that technically my position is "x4" margin but I'm nowhere close to max-betting on it. This number simply sets a self-imposed cap on how much I'm allowed to borrow so I don't trade at x125 on accident.

Looks like the platform says I could borrow another 0.466 BTC if I wanted to max bet... which is over $13k. The more I interact with the platform the more I realize why people get so absolutely wrecked playing the trading game. It's a gambling addict's paradise up in here. Looks like if I increase margin to x125 I can borrow over 14 BTC. LOL wut? No thanks. But also could you imagine BTC going x2 and getting 14 BTC for 'free'? NO! Stop thinking about it! Bad degen bad.

Chart tells a pretty weird story.

Even though yesterday's pump was quite smol and seemingly insignificant, it puts the current spot price hovering very close to and even above all the moving averages. The MA(100) and MA(200) are almost parallel, a thing that hasn't happened in years, and all 4 moving averages are within 6.4% of each other, which is actually kind of insane. The chart very much points to a volatile market that has pretty much flipped hard into a stable state.

If there's one thing I know about crypto it's that it doesn't stay stable like this for very long. I was hoping the golden cross on the MA(25) and MA(50) would lead to that psychout poop-and-scoop situation and give me a solid entry point, but instead it just did the standard golden-cross pump move, so that's annoying but whatever. My gut feeling is wrong 95% of the time anyway so I constantly have to ignore it or even counter-trade my own assessments, which is odd to say the least.

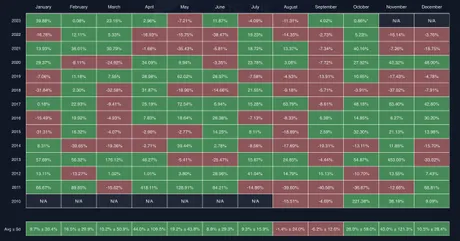

I think a lot of active traders have also correctly assessed that September being in the green is actually pretty significant. We've legit had six red Septembers in a row. The last green one was 2017 and then 2016 & 2012; all very good years for BTC and crypto. Either way October should be a pretty casual month, lightly green or red in whatever direction. A 10% to 20% gain month over month puts the spot price at $30800-$33600 by November. That's pretty healthy positioning going into Q4. The stage is being set.

Current events

If I'm going to make a post whose content is going to expire in a month I might as well bring up a few topics that I've been meaning to bring up but none seem to be worth their own post.

For starters we have Peakd and LEO making some developments. Peakd.com made some kind of big upgrade that very noticeably increases the speed of the frontend. It seems that they've made a switch (much like LEO) that assumes that the current action being performed is going to succeed and displays immediate result. This is a very good change for overall user experience and removing annoying delays that result from Hive's 3-second block infrastructure. Good stuff.

And then on the LEO side Threads is actually becoming a platform that is worth using. The ability to "Threadcast" has created the ability to chat during various Hive-based podcasts. The most basic and fundamental change was to reverse the chronological order to put them from newest to oldest like a chatroom would. Such a basic change that makes a massive difference in terms of UX.

I've been meaning to report on this for a while now (weeks?) and the longer I wait the faster and more streamlined this feature seems to get. It's nice to see a product like this get created without the advent of some new token, and the only requirement to use Threads is access to Hive Power and/or resource credits, so it's not even a tech-stack that requires the purchase of the underlying LEO token, which certainly is a nice thing in an environment that is supposed to be open source but littered with cash-grabs and outright scams. Crypto do be like that sometimes.

Chase UK Bitcoin Ban

Chase bank has also banned transfers to centralized exchanges and other entities affiliated with crypto within the UK apparently. Quite a few people are making a fuss over this and a some are even making some good arguments as this move being potentially illegal and certainly against the spirit of several key points politicians over there have been making recently.

Of course it's not very difficult for motivated individuals to circumvent such restrictions, but certainly some percentage of users that wanted to buy crypto simply won't when the transaction from their bank is denied. This is a numbers game. It also reminds us that while regulators have been ridiculous with their overreach into our territory: things can still get much much worse from here. Am I worried about further escalation? Not really, but that doesn't mean the possibility should be discounted as a non-issue.

Bitboy LOL

I don't know how familiar you guys are with Bitboy and the current drama... but apparently he livestreamed himself in an armed robbery trying to steal "his Lambo" back from a former business partner? I don't know it's all insane I've mostly been ignoring it but crypto Twitter was absolutely obsessed for a couple days.

yikes

Conclusion

Lots of crazy stuff going on in Crypto Land. Here's to hoping Optober continues. Friendly reminder that pretty much all my crypto predictions are wrong except when they are based on the exponential trendline, and the exponential trendline is telling us BTC is more oversold now than it ever has been (same as a year ago during FTX collapse). All we've been doing is mirroring the curve for a year straight. Price is at rock-bottom as we head into Q4, which is a very good place to be.

Despite all of this: development continues. Obviously fundamental infrastructure and grinding out utility is much more important in the long run rather than day to day price action. Still, everyone loves number go up, so it's hard to ignore times like these after such a brutal bear market.

Return from Uptober Bruv to edicted's Web3 Blog