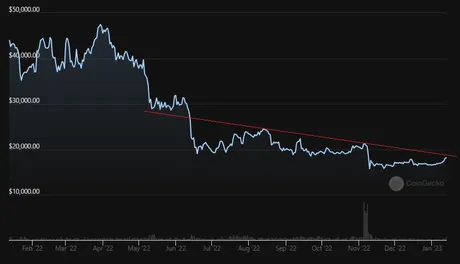

As soon as FTX collapsed I realized that the initial price discovery showed that we really needed to hold a price point above $18k to really avoid the bullshit. Obviously that didn't happen, but surprisingly we are flirting with that level right now, so that's fun.

Checking the aggregate data over the last 12 months we can see that we are either at or approaching resistance right now, so the chance that we can actually hold this level seems slim, but you never know. History shows that we often have to wait for February or March before the market is truly ready to move up for real into May. May is usually a very solid month in situations like this, and if we're lucky the actual peak of a bull trap would lag into June for a true summer run.

Of course the legacy economy is looking dire as ever, and there is zero indication of the ultimate blowup that would signal the bottom of the stock market. Perhaps that day won't ever come, but let's be honest that would be a pretty weird outcome. Perhaps the best we can realistically hope for is that such an implosion comes late (after June) and we have time to run up and take gains before getting hammered by the granddaddy market.

By the end of this year my doubling curve metric will be sitting at $100k, so even in the event that Bitcoin explodes to $100k over the course of 12 months (x5.5), I'll still make the claim that we are not in a real bull market. It's just a return to the standard. Kind of a weird thought that we could go more than x5 and I'd be sitting here thinking we were still in a bear market even at all time highs.

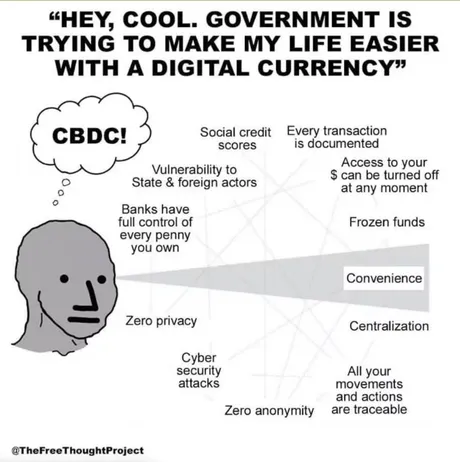

And how is USD different?

It's funny how much bellyaching people do over CBDC while at the same time having zero clue just how much it helps Bitcoin. A CBDC validates crypto in a way that governments and banks have thus far refused to capitulate. More importantly, a CBDC ironically forces the issuers of the token to create strong liquidity pairs... and guess where the strongest liquidity is?

If you guess BTC you'd be right. A CBDC essentially forces the issuer to tap into the cryptosphere. Siphoning value from the legitimate network is a top priority, but in order to tap into that value and create a CBDC/BTC pair... you have to have the BTC to back it up. It's not like this trade is going to magically be a decentralized solution. It will be heavily regulated.

And so the coffers of the CBDC would have to be lined with a metric shitton of BTC. Could a CBDC exchange do what other bogus exchanges do and print fake Bitcoin that aren't actually in the reserves? Sure, but that's also the last place people like you and I would be storing BTC... and if the entire thing blows up and turns into a failed experiment fractional reserve... then good? Right? No more CBDC and everyone realizes it has to be decentralized to work correctly. That's just more volatility within an ecosystem that can obviously handle volatility.

Of course, much like mining Bitcoin directly, there is really very little incentive to cheat these things. Look at every single entity that prints fake Bitcoin and then gets caught with their pants down. They go from being billionaires to completely broke. So why cheat the system when you can just play by the rules and make billions for free?

The idea that the government can force people to use CBDC is pretty comical. Look at how difficult it is to onboard people to Hive. A lot of those people already have crypto experience by way of Bitcoin and Metamask, and they still find it difficult to navigate the learning curve.

So the idea here is that the government... the government... is going to create some sleek solution with an extremely low learning curve that's easier than traditional banking? And they are going to incorporate it into everything and even legally mandate it across the board within a couple years?

What fantasy land are these people living in where government has ever done something like that in the history of ever? Gov is incompetent and slow and drowning in red-tape: always. There is no evidence to suggest any of this is remotely possible. Grandma still has trouble using email but you're going to try to force her to use a CBDC? Please. Stop joking, this is serious.

I've overtalked the CBDC thing.

Bears are feeling the sting right now of the stepladder of the market climbing up and up. However I've seen this pattern enough times before to know that we can lose an entire month of gains in a single dump after topping out. This is pretty much what I'm expecting to happen. Need more time to consolidate before the real floor is forged.

Of course like I've mentioned before if we can hold above $20k all the retail bears are going to be losing their minds. All those calls for $10k vanished just like always happens at the bottom. No matter how low the market goes, bears will predict another 50% decrease thinking they can still make a big score. Personally I still think the ultimate bottom to lookout for is $14k, and that assumes a complete meltdown of the stock market.

Oh... lol

While I was writing this Bitcoin spiked to $19k. lol. Okay then. Alright well this is getting serious. Perhaps the market is done playing games and the floor has already been set. Who knows? Every day that goes by that people realize the FTX contagion is over is a good time to acquire more.

It's also funny how these tiny pumps feel big at these depressed levels, but they are really quite small. BTC is on extreme discount all the way up to $25k imo. I'm sure it would feel dumb to buy at $25k when it was just $16k weeks prior, but at the same time it doesn't really matter considering where we want to be in a year or two.

When it doubt, zoom out.

Riding the roller coaster is fun, but making financial decisions based on day to day micro movements is a recipe for disaster. At the end of the day you either have a balanced portfolio and your fine or you don't and you're at risk. Of course we see these professional 'hedge' funds that are also down bad and it is literally their job to make sure that the money is safe. Remember that the next time you regret any financial decisions you made is 2022. Legit everyone did a terrible job.

What we can be fairly sure of is that Bitcoin and crypto at large are still moving upward exponentially. The explosions of growth are accompanied by huge downswings, but that's to be expected. Play it cool, hot shot. You'll be fine.

Posted Using LeoFinance Beta

Return from $18000 Critical Level to edicted's Web3 Blog