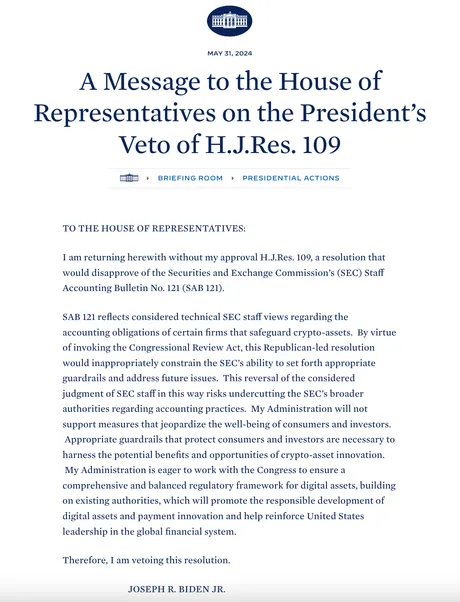

How to lose all the crypto voters in a single move 101.

You know it's Clown World at its finest when the smartest and most decentralized option is to allow banks to custody crypto... and then the acting administration vetoes the ability to make that happen. You know what would be way better than all that? Is if Coinbase just continued the stack up the biggest honeypot in the history of ever. Yes, let's pursue that obviously terrible option. What could possibly go wrong?

Cute

Republican-led resolution

This issue has absolutely nothing to do with left vs right politics but of course make sure to call it "Republican-led" so that automatically all the brainless followers will support the current thing and oppose whatever those "dirty Republicans" are up to. Nice work.

Appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation.

Wow what word-salad full of nonsense-talk.

This is just a flat out lie. We know this because they've had plenty of time to regulate the industry, and simply refuse to do it; instead opting to just make up the rules as they go and sue indiscriminately all the most trusted names in the space who are doing everything in their power to comply.

My Administration is eager to work with the Congress to ensure a comprehensive and balanced regulatory framework...

Hm how about I stop you right there and just call you a liar. Because that's what you are.

Therefore, I am vetoing this resolution.

Leader of the free world can barely string a full sentence together and I'm supposed to believe he had anything to do with any of this decision? Again, very cute story. Tell it walking, please.

None of this is surprising.

It's not even disappointing honestly. All of this was perfectly expected. In fact many have already pointed out that there is a very real financial incentive for institutions like Blackrock and Fidelity to burn the bridge behind them and make sure that others aren't allowed to cross it. Imagine every retail bank having the ability to custody Bitcoin and allowing their clients to buy Bitcoin directly from them and hold it within their account. A lot of value would bleed from the ETFs into the retail banking sector and hurt the profit margins of the ETF (assuming the price of Bitcoin doesn't moon in which case everyone wins).

So what's up with this law anyway?

SAB 121 is a SEC rule that prevents the banks from holding crypto as collateral. This law simply sought to repeal that nonsense. There's been an attack on retail banking for a while now. It wasn't that long ago that the DTCC clearing house declared that Bitcoin derivatives like ETFs have a 0% collateral value within the financial system.

They really seem opposed to giving the banks the opportunity capitalize on this magic asset class. On the other side of the coin it makes sense because crypto is insanely volatile and banks have proven themselves to be not that great at hedging against that type of risk. Too much dependence on crypto within legacy finance would inevitably lead to the mother of all financial collapses because everything is built on a vaporous house of cards.

That being said I do 100% believe that crypto will be the reason a lot of these banks are able to stay afloat. This is pretty ironic in retrospect when we used to all believe that crypto would be the death of the banks. Now it's much more clear that crypto as pristine collateral is exactly what the debt-market needs to stop itself from imploding from a cascade of bad-debt defaults. The future is weird like that. Sometimes disruption and adoption are the exact same thing.

Conclusion

The Biden administration is completely cooked. They will not win reelection. This was clear to me within 6 months of them being in power. They can't even win if they cheat at this point. That's how bad of a job they've done. It's impressive really. Not to imply that someone else is going to do any better. It's all political theater for the rabble.

I will say that it's interesting that crypto seems to actually matter now when it comes to the political arena. Imagine what it will be like when these market caps are x10 or even x100 higher than they are today. At a certain point opposing crypto is going to equate to full-on luddite political suicide. We've come a long way since our humble grassroots beginnings. For better or worse.

Return from VETO! to edicted's Web3 Blog