I'm now glad and somewhat vindicated that I exited Ethereum at $1000 before the run up to $4k+ even started back in January 2021. It was very obvious to me that the fees were simply not sustainable considering the apps that were being built on the network. The only way to get lower fees was to get a lower price and lower adoption rates, which certainly wasn't going to happen in the middle of a bull market, was it?

link

The "upgrade" to proof-of-stake is pretty much objectively not an upgrade at this point, no matter what the central banking mafia tries to put out there with derivative media sites that they control. No, Bitcoin does not "waste energy". It will not be the cause of unsustainability or the reason the Earth is so polluted. It is the very banks who fund infinite war via the military industrial complex who are responsible for a lot of these problems; the same people trying to tell us that crypto is the reason everything is broken... but I've been over this a dozen times already and risk spiraling off topic.

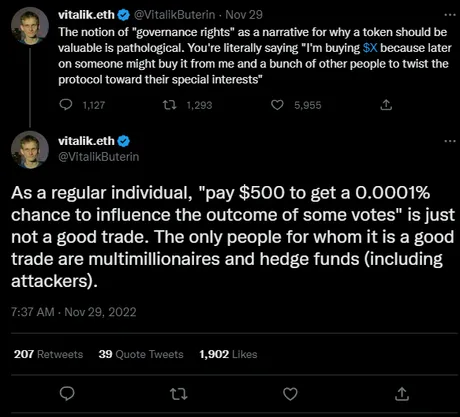

When the founder of a cryptocurrency comes out with all these bad takes on crypto governance, they are not talking about crypto as a whole, but rather their specific token. Vitalik is scrambling, and it shows. The bottom line is that he is basically telling us that Ethereum governance is broken and will basically be captured by both regulators and the super rich, assuming that it hasn't been captured already (which arguably it has).

I would not recommend having a huge Ethereum position. Maybe 10% of your portfolio max if you REALLY like Ethereum. This is not to say that the token price will decline, but politically it is sound advice to completely exit ETH if you believe in decentralization and communities who rule over themselves rather than being slaves to the empire.

Vitalik must be pretty jealous of Hive right now.

He knows all about the hostile takeover, and has Tweeted about it quite a few times. I bet he wish he could do the same for Ethereum as Hive did to Steem. But how could he? That would mean him losing all his stake, and all his friends losing all their stake, and the foundation losing all of its stake. lol, he literally can't opt for the nuclear option like we did. I mean he could, but that basically equates to political suicide.

So Vitalik is projecting his problem onto the entire space rather than point out that it is Ethereum that has the problem... and every single other network with a redonkulous premine. What is the biggest acceptable premine for a founder to have? I'm gonna go out on a limb here and say 1%. As difficult as it sounds, I think that every network should start out with a diverse group of people numbering about 100 (1% each). Could be founders. Could be venture capital. Could be retail. Could be a foundation. Could be anyone. Just don't let any one entity have more than 1%. I would consider that to be an excellent seed.

Which is hilarious because governments all around the world could make cryptos that were infinitely better than that. Anyone with access to KYC information knows about thousands (if not millions) of unique individuals. How many unique people does Coinbase have access to beyond reasonable doubt? Quite a bit. Google tells me the number is 73M people. Even if the number was 1M that would still be a better opening distribution than any crypto in the world has right now.

So why don't they do it? Why don't they airdrop millions of people with a new token with a perfectly fair and amazing distribution? Certainly there are a few reasons. One is the legal concern, but if you aren't selling tokens then the SEC can't claim it's a security because there was no centralized agent trading their shitcoin for USD. There may be other legal concerns that I don't know about... but honestly such a project doesn't even need to be associated with the entity that provides the KYC info on unique individuals. All that matters is that 1 person gets 1 airdrop.

The main reason why many would claim such an experiment would inevitably fail is that many people tend to dump their airdrop for whatever they can get for it. This is where I think a brand new template is required; one that suits the attention economy. This is also why I'm constantly harping on the idea that permanently locked/bonded stake has a lot of value. If millions of people are airdropped with tokens that they can't sell, then they are basically forced to interact with the network, possibly even on a daily basis.

DEFI has already shown us that permanently bonded tokens have value by the good graces of yield farming. Imagine if Coinbase created a social media similar to Twitter and seeded it with 73M airdrops to their users. The users can't dump the airdrop as it is permanently bonded, but upvoting content on the Twitter clone generates yield just like we do here on Hive. I have to admit if something like this gets created Hive is in quite a bit of trouble on the social media side of things... although I've always believed that gaming in Hive's true niche.

It's all a matter of distribution.

A token equally distributed to millions of people has IMMENSE value. It's a very communist idea, and has ultimately failed because no one created this template of permanently bonded stake. Rather most people sell out instantly and the distribution becomes instantly abysmal, with deep pockets buying a majority of the tokens from the resulting dump.

Vitalik knows this.

He knows distribution is everything, especially in terms of viable stake-based governance. He knows that Ethereum's distribution is absolutely abysmal, and his generic comments about governance only apply to networks with gross premines and terrible distributions. It should be clear right now that Hive is flying under the radar with one of the best distributions out there, if not the best. After all Bitcoin doesn't even count because it doesn't have staked based governance votes.

The importance of upvotes and the curation kickback

When Hive changed curation to 50/50 I was VERY skeptical. I thought it was a step into the wrong direction, especially with the 5 minute rule still in play and the ridiculous bot voting that exploited that mechanic. Now the 5 minute rule is gone (though the ghost of it remains as can be seen from bots voting at the 5 minute mark). We can now upvote anything we like within the first 24 hours and it's all good. No one gets an advantage for running a bot or voting first. It's all coming together.

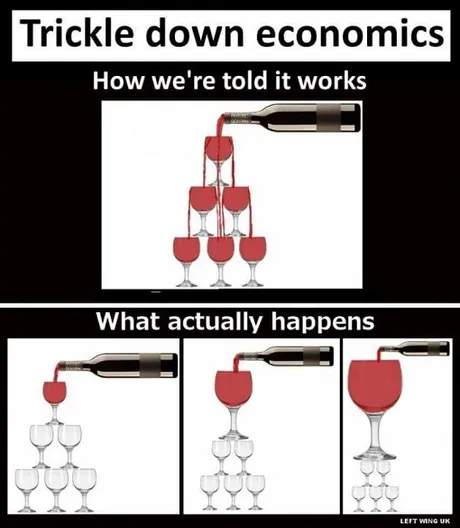

The ultimate point to be made here is that most upvotes on Hive create a better distribution for Hive. It's wild to see trickle-down theory fail so miserably though Reganomics while on crypto it seems to work out quite well.

This is the nature of decentralized systems.

In an actually decentralized ecosystem, the cup at the top literally can not scale to capture all the value. We saw this first hand during the last bull run when Ethereum fees spiked to $200+ and DOZENS of EVM clones popped into existence out of nowhere. Ethereum could not capture all the value, and thus more centralized and niche networks piled under it to capture the Ethereum overflow.

On Hive we have yet to see what happens when the system overflows. We've quite simply never gotten the adoption required to stress test this thing in the wild. One day. Soon™. Until then I find quite a bit of solace in the fact that every single upvote on Hive either increases decentralization or becomes a wash in the event of self upvoting or circle upvoting. Self-upvoting doesn't increase centralization, it simply maintains the status quo; self-upvotes are neutral in terms of distribution. I've already explained the math on this like a dozen times so I'll spare you this time.

Upvotes on Hive also incentivize content to be produced directly on the chain. Theoretically this will become a much more rare occurrence when Hive gains more adoption, but for now we can see our distribution getting better while other networks are largely stagnant or even getting more centralized as all the plebs sell the bottom. Look at the trending tab. Do the biggest stake holders scoop the highest rewards? They do not. The system is working.

https://peakd.com/hive-167922/@dalz/top-hive-earners-by-category-or-authors-curators-witnesses-dao-or-november-2022

--- @dalz

https://peakd.com/hive-167922/@dalz/top-hive-earners-by-category-or-authors-curators-witnesses-dao-or-november-2022

--- @dalz

Conclusion

In no uncertain terms Vitalik is telling us that Ethereum governance is totally screwed. I'm glad I no longer carry a bag there. 2023 is the year of Bitcoin, methinks. But also don't be fooled by his bleak sentiment, as his words do not apply to the Hive ecosystem. In fact DPOS in general is simply better for governance than non-delegated proof of stake. That's just how it was designed right from the beginning. However, the ultimate factor to consider here is the token distribution.

I find it comical that he would say, "As a regular individual, "pay $500 to get a 0.0001% chance to influence the outcome of some votes" is just not a good trade." Really? So voting for the president of the United States is actually x100 worse than the number he just presented to us. If our voice means little in terms of stake-based networks, then it means absolutely nothing in terms of legacy republic governance, but I guess people on Hive already know this.

At least with a governance token you can vote AND do everything else it's programmed to do. Hell, on Hive we are yield farming bandwidth with the governance token and letter people post to the chain using a derivative asset. So far ahead of Ethereum at this point it's not even funny. All we need are the devs to back up the tech and Hive will catapult forward. Go go gadget Hive Application Framework.

Hive is in such amazing positioning for 2023 regulatory overreach and the subsequent bull market that rockets out of this recession. We are flying under the radar, and there are thousands of low hanging fruit that the SEC will go after before even considering our network. Distribution is getting better, even within the bear market. Other networks are not so lucky. It's a slow grind, but it all adds up.

I hope Vitalik does it.

I hope he pulls a hat trick and miracles up a governance system for Ethereum that isn't complete garbage. That would be great for everyone in the cryptoverse. Will I bet on such an outcome? Absolutely not.

Posted Using LeoFinance Beta

Return from Vitalik: Ethereum is not in a good place. to edicted's Web3 Blog