At this point the market knows for a fact that the FED is not going to pivot. 75 point rate hike early November. I'm a little surprised that Bitcoin spot price has still continued to hold at this support, but then again their seems to be infinite buying power in this range. Every time we see $18k some billionaire pulls the trigger and buys it all back up. Strange times indeed.

The wedge that we've been trapped in for 4 months is drawing to a close. Many technical analysts are comparing this to the 2018 crash from $6k stable support back to the doubling curve at $3200. I think that's a bit ridiculous, as nothing about this setup reminds me of 2018. The only similarity is that we are in a perceived bear market (which will stop being perceived as such if we don't make a lower low), and we are approaching a very important macro resistance. That is all, that is where the similarities end.

The testing of this support line has been a thing of legend. By all accounts, we should not have been able to hold this level. On 3 or four occasions, volume was spun up to maximum and enough Bitcoin was being dumped onto the market to drop the price 20%-30%. And yet the market has been SHOCKINGLY calm.

Technical analysists see that calmness and proclaim:

See, it's just like 2018!

What? No... this is nothing like 2018. 2018 never had multiple bouts of insane volume. Do these people not remember what it was like back then? The market was completely dead. There was never any volume. Ever. Just traded flat on zero volume for weeks and weeks until it finally fizzled out back down to the doubling curve.

Speaking of the curve.

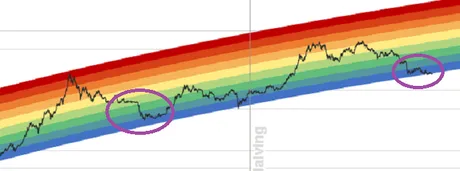

https://www.blockchaincenter.net/en/bitcoin-rainbow-chart/

The rainbow chart shows us that, once again on the logarithmic scale, we are trading at the lowest level right now. In 2018 the dump from $6k to $3k knocked us from the bottom of the 4th tier down to the top of the bottom tier. We are already at the bottom of the bottom tier in 2022... Right now. If the rainbow chart is to be believed (and I think it is), a flash crash at this level is highly unlikely. This is where Bitcoin can decouple from the stock market should the stock market keep tumbling.

Why else?

Again, this is nothing like 2018 for so many reasons. First of all... exponential adoption. Can we say that about 2018? Of course not. 2018 was so boring. Nothing cool was going on. The 2019 summer bull run was sparked by BAKKT institutional investment, which ended up being a huge nothing-burger that immediately dumped. Now we see the biggest banks and corporations jumping in. Everyone knows what Bitcoin is. Many understand the importance now that we are in the bear market and fiat is struggling worldwide.

Did you say bear market?

YEP, this is another huge factor that makes now much different than 2018. Many would claim that this makes 2022 even worse than 2018. Hm, yeah... does it though? It sounds right. The common sense is solid. Doesn't mean that's the actual reality of the situation.

The entire value proposition of Bitcoin is that we can't trust the legacy economy. Does it really make sense that spot price should crash into the dirt given the systemic failure of the economy Bitcoin is meant to disrupt? These are conflicting ideas. At a certain point Bitcoin will decouple and it does matter what the legacy economy does. Are we close to that point? Who knows, but I'd like to think we are.

Also, look at the damn rainbow chart.

Once again to compare 2017 to 2021... absurd! We already tried that. It was a huge fail. Remember how I was constantly harping on $200k BTC? Yeah, never happened. Look at the rainbow chart. 2017 bull market brought us to the tippity tip top. 2021 was basically just middle of the road. Totally normal bull market. No mega-bull run for us, and that's fine.

So what does this imply? It implies that volatility creates volatility. The higher the price goes, the lower it goes. Momentum. What goes up must come down. We didn't go up very high, and we are already scraping the bottom right now in this moment. To just assume we are going to keep spiraling down like 2018 is not really a very valid perception. My guess is $16k BTC should the stock market get back to Feb 2020 levels. At worst. And if we get to that point? BTC will completely decouple from the market.

How much Bitcoin is for sale at any given moment?

5% of the supply? Less? I think it's less actually. Think about that for a minute. If you believe that Bitcoin can drop another 50% from here, think about what that means. The market cap is $375B right now. So a 50% drop takes it to $187.5B. Less than 5% of that is actually for sale. So... $9B worth of Bitcoin for actual sale on a sliding scale. That sliding scale? Well, that cuts it down another 90%.

So it takes less than a billion dollars at that point to actually prop up the price. Less than $2B to prop up the current price. There are multiple billionaires buying BTC right now. And there aren't a lot of bulls that are going to flip bearish if it dips more. We saw the bulk of that transfer happen from the $30k to $18k dip. However, there are plenty of bears that will flip bullish given the right conditions. Think about how many will flip back from the Dark Side once we get back up to $30k.

Hopium?

To be clear, I do not NEED the support line to hold. I just think it will after everything I've seen. The legacy economy being in shambles isn't going to matter when Bitcoin decouples, and we already see signs of that decoupling happening right now. The craziest thing I've seen recently was a chart showing up BTC was less volatile than the DOW JONES in Q3. LOL, what? That absolutely should not happen when considering the most risk-on asset in the world. Conclusion? Bitcoin is no longer a risk-on asset. These are the things we learn during the legacy bear market.

Let's not forget that Bitcoin has NEVER been inside a legacy bear market. This is what Bitcoin was built for, and everyone is freaking out. Personally I'm excited. I know we are going to learn new things about Bitcoin and new things about crypto. This bear market is going to last what? 18 months? Two years? Three? I mean we can all see how bad it looks. It could easily last 3 years. Do you really think crypto doesn't get a bull market in 3 years? Of course it will, and when it does... everyone's gonna be like... "What? Crypto is going up and stocks are going down?!" That's bullshit: Time to buy crypto. The flipping happens quickly.

The stock market has been making lower lows, and Bitcoin has been making higher lows. It's a very good sign of the macro decoupling that is taking place. We all know that this upcoming recession was overdue and is all but guaranteed to last at least another year. It's going to be very interesting seeing how this all plays out. Again, this is completely uncharted territory. We've never seen what crypto actually does when the system it was meant to replace shows signs of failing. Everyone just automatically assumes it's going to be terrible, which is not a very good assumption to have. We should assume nothing and just go into this blind. Wipe the slate clean and keep your mind open. We might be able to navigate the environment better that way.

Conclusion

The damn wedge we've been trapped in is finally coming to a point. Already we see the price wicking above the line. However, we'll likely have to hold above $20k for a day or three before some of the bears decide it's safe to enter. Luckily it looks like we don't have to worry about that 75 point rate hike, as it is already priced in at a 96% chance of happening. I wonder which piece of the world economy will break first. Stay tuned to find out.

Posted Using LeoFinance Beta

Return from Wedge Wedge Go Away! to edicted's Web3 Blog