I've done a LOT of research on AMM.

On a technical level, it's actually surprisingly simple.

k = x * y

The most basic form of AMM is essentially the most simple equation one could possibly imagine. Again, it's important to point out that Automated Market Makers are not a new technology. The only thing new is crypto itself.

Yield is the crux of AMM.

AMM tech has been around forever, but what hasn't been around forever is a way to actually make it work. This is a matter of proper incentives (risk vs reward). When Uniswap launched and started taking a 0.3% fee (three times higher than competing exchanges like Binance), we saw that even then it was often worth it to not provide liquidity to volatile assets with extremely high slippage costs (called impermanent loss within this context of AMM LPs).

Only by allocating massive yields to the AMM pools was liquidity actually able to be incentivized. A 0.3% trading fee is simply not enough. Massive amounts of tokens must be "printed out of thin air" to incentivize the risk of being a provider of liquidity.

Many have tried to call this "unsustainable" because high inflation eventually leads to high supply and a devaluation of individual tokens... but that claim of unsustainability is based on mathematical delusion (not dilution).

If the token price declines 50%, but I have 4 times as many tokens as I did before, this is not only sustainable, but I just doubled my money. The false narrative that number has to go up to be sustainable is a foolish one.

At the end of the day the inflation that we print is either +EV or -EV (plus/minus estimated value). Either the inflation we print is a good idea or a bad idea, and there is very little wiggle room in between. This is the main thing we have to look at when considering if a DEFI tokens is sustainable or not. And in many cases, we have to guess, because calculating EV is not that simple because individual variables often can not be isolated (this is the purpose of control groups and Occam's Razor when doing science experiments; isolating variables and running experiments on them to draw valid conclusions).

Taking a look at Polycub LP:

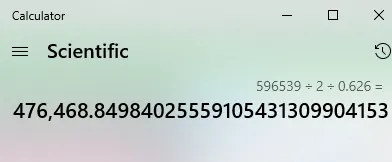

So, given this snapshot, we currently have $596,539 in entrance/exit liquidity. But what does that actually mean?

Let's find out how many Polycub tokens are in here by dividing by 2 and then dividing by the current price of Polycub in terms of USD.

So we see that there are 476,468 tokens inside the liquidity pools.

Again, what does this mean?

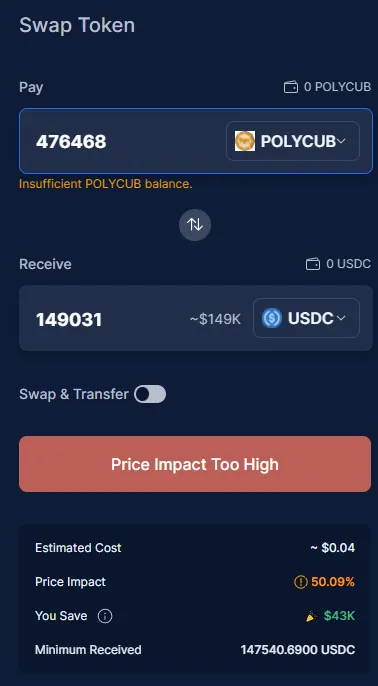

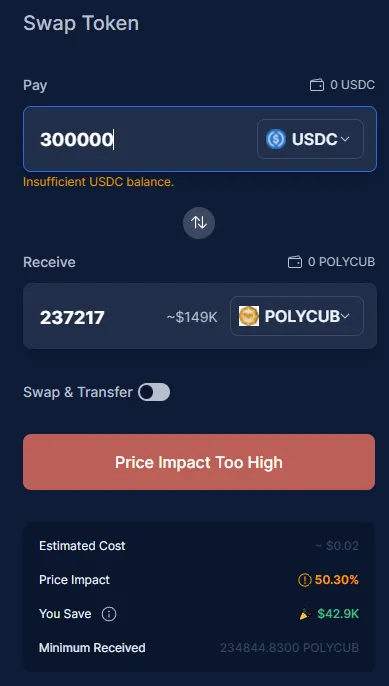

Well, for one it means if we dump 476,468 tokens into these pools, that should crash the price 75% (x4 loss), because if we double the number of pCUB tokens in the pools and extract half of all the exit liquidity, that will change the current ratio by 4 to 1. Conversely, if someone tried to buy that many tokens all at once, the price would spike x4 (in theory).

Checking our work:

We got the exact answer we were expecting.

If we double the USD values in these pools or double the Polycub, the price impact is 50%, but the total slippage is x4 instead of x2. This is because when someone dumps money into a liquidity pool, they are buying or selling all the way up and down the curve.

For example, if I pump a token from 50 cents to $1, I'm buying all the way up. Some of the tokens I bought cost 50 cents, and some cost 51 cents... 52, 53, 54, ... all the way up to 100. Therefore instead of having to pay $1 per token it was on a curve all the way up, which cuts the price impact in half compared to how far the final price actually moved.

Is this enough liquidity?

Sure, I think it would be... if the vast majority of tokens weren't sitting in xpolycub.

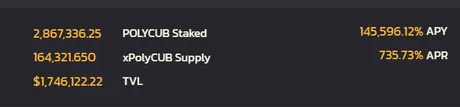

With 2.87M tokens essentially "trapped" inside of the single staking pool, that only leaves a pinhole funnel of liquidity to exit the system. Based on the math we've done, if even 16% of these tokens want to exit the system, that's going to crash the token price 75%. Oops.

And look at that APR: 735.7%.

So not only would dumping 16% of xpc crash the token price 75%, but also that number gets worse and worse every single day, because XPC is being allocated more yield than pretty much every other pool combined once we take the penalty into account.

Something I have learned during all of this is that tokens inside a single-staking pool has negative value to the network. We are allocating MASSIVE yields to a liability with negative estimated value (-EV). The only thing one can do with XPC tokens: is dump them or hodl them for more yield. At some point we must assume that people will stop farming and start dumping, and more than 75% of all coins in existence are sitting in XPC because everyone was heavily incentivized to be there due to the absolutely ridiculous yields.

A healthy percentage of tokens in the single staking pool is 5%-25%

Again, the only thing that a single-staking pool is good for, from the network's perspective, is to dump tokens and lower token price. Therefore, if we want number to go up, you actually don't want any coins in the single staking pool whatsoever. If everything is in the liquidity pools, outside money knows that there is no way for a single-staking pool to dump on them, and buying becomes much more attractive because the liquidity providers are sharing the burden of slippage with the new users buying in 50/50.

However, we actually want some coins in the single-staking pool so we can later lower yields and lower the price of the token. This is what literally no one understands yet (I haven't seen anyone come even close to articulating this). Why would we want to make the token price go down? Because the price is overblown and overbought, and we need to provide tokens to the market by lowering the yield on single-staking and incentivizing the network to dump tokens into the LPs.

This is called elasticity.

And it is one of the most important things about currency, stability, and unit-of-account. Everyone understands why we should be making the token price go up. Literally no one understands why we should be bringing the token price down. I suppose this knowledge puts myself in a pretty baller position to create my own DEFI token. Soon™ amirite?

Again, the only thing that a single-staking pool is good for, from the network's perspective, is to dump tokens and lower token price.

FROM THE NETWORK'S PERSPECTIVE

This is the key variable in that sentence. From the perspective of a LEO degen such as myself, the single staking pool is the awesome place to be. It is the moonbag pool that allows us to stack tokens without having them be up for sale. They will not suffer from impermanent losses when the price goes up (like the LPs would). Thus founders of DEFI tokens want to give the core group special privileges to the early adopters and over-allocate yield to the single-staking pools, and they never take that yield away, even when it is completely appropriate to do so.

The Catch-22 here is that by having 75% of all tokens in the single-staking pools, we are making a very blatant statement: Come buy some CUB or Polycub tokens with high slippage rates so we can dump on you at the higher price. Yeah, talk about the best way to completely disenfranchise new users from joining the system. This is not a good way to scale up or inspire confidence.

Sustainability.

The obvious key to DEFI sustainability is creating a stable asset with high yields. We never want the token to increase or decrease in price. If the token price goes up we lower yield to single staking to push the price down. This increases liquidity and makes the protocol even stronger. If the token price goes down below our reasonable price target we increase yield to single staking and cannibalize the liquidity pools in the process. This puts us on the backfoot and lowers liquidity, but it keeps the token price stable and incentivizes new users to feel confident in joining without feeling like they will get dumped on. Perhaps, in this way, Polycub is indeed exactly like Bitcoin and the maximalism that has resulted from that deflationary system.

Not about timing the market.

It's about time in the market. If token price stays relatively stable, but offers 50%-100% APR, imagine the power of offering 50%-100% APR on what is essentially an algorithmic stable coin that actually manipulates yields in a way that is superior to central banks and distributes that value to all participants? I'm not exaggerating when I say that the first DEFI token to actually figure this stuff out will make billions within a few years.

If the token price is stable and the yields are high, then it doesn't matter when users join the platform. Everyone gets an equal shot at earning. Compare that to a hyperdeflationary system like Polycub where 90% of the tokens are distributed to LEO degens and bots farming the kingdoms within the first month. Like... we can do better than this. The next CUB-clone launch on the next EVM chain should be completely different than both CUB and Polycub.

It would be foolish to assume that Polycub is totally sustainable and we can just clone it over and over again across the EVM networks. Look at how much market cap got sucked out of LEO and CUB to support this thing. I think a lot of that value has already bled out of the system entirely by not providing a fair launch and allocating massive yields to kingdoms that slashed the network with exponentially negative EV. However, there is a delayed reaction in play because degens are still rocking xpolycub hard and have no idea that they are trapped in a pool with millions of dollars of theoretical market cap that can't be realized.

The exponential yields we've allocated to the single-stake pool has hidden all the value that has bled out of the system because most users are still in HODL mode while yields remain ridiculously high. Again, look at the math above: Extracting $150k from the liquidity pools melts the token value by 75%. A $2,668,808 market cap on the homepage display does not reflect the actual liquidity of this system. This is especially egregious because 600k Polycub tokens that are yet to be airdropped are being counted in the market-cap.

Conclusion

Very important work is being done here. Theory and reality very rarely actually mesh up without making huge adjustments to the hypothesis and conclusions that result from actual in-the-field testing. CUB and Polycub are opposites in a lot of ways, and I think when we find the middle-ground and start allocating inflation to mostly +EV contracts while learning to pivot in real time we'll find that secret equation that creates billions in value for the entire LEO ecosystem. I'm here for it, and I hate to rain on the parade, but I have very legitimate concerns that will likely continue being ignored until they are proven to be true by trial and error. Just need to get these thoughts out there before it all goes down.

We will find out exactly how this plays out in the next 5 weeks. Emission rate has been reduced from 3 to 2 while I was writing this. It will then be cut in half (50%) a week from now, and in half again 4 weeks after that. That means yields will be 75% lower just from emission drops alone, and we have to add a little extra in there to account for more tokens in the ecosystem competing for yield. That means likely yields across the board will be slashed by at least 80% in 5 weeks.

That puts the yield of pCUB/ETH LP around 145%, which means none of the LPs will be financially worth taking the 50% penalty. Evidently, because xpolycub yields were more than 50% subsidized by the penalty, we can assume that xpolycub yield itself will drop 90% or more in the next five weeks, an x10 loss from 730% to 73%. Asking if Polycub is sustainable during the hyperinflationary phase is... ridiculous.

The post-long rant after the conclusion

I truly don't understand why this would be such a hot take.

Stability and sustainability are intrinsically connected. They are the opposite of volatility. To make the argument that Polycub is fully sustainable but we just need to get thought this hyper-volatile stage before we get there? No. That's not real.

At the end of the day we must admit that all of us wanted to create unsustainable hype on day one, create a system that would funnel money into the bags of LEO zealots, and give massive rewards to everyone that was willing to jump in head-first at the beginning with everything they had on blind-faith alone. I did it, and I made money. Hurray for me.

The problem with that model is that every whale and every bit of smart money is already all-in within the first hour of launch, and after the initial hype phase of 48-72 hours (which is incredibly common across the board in crypto) all the token can do is bleed out until is scrapes rock-bottom support, because there is literally no money left to buy the dip; we already spent all our money within the first hour. It is not an offensive stance to claim that this is a terrible UX and that we should have opted for a boring launch with reasonable sustainable yields right from the beginning instead of going totally apeshit just like we did the first time with CUB itself.

If this post feels like a total hatchet-job to you, I assure you I am holding back quite a bit. There's so much more to be said about the rushed/unfair launch of the token, the marketing surrounding it, the prominent members of the community giving not not financial advice, the absurd yield allocations to kingdoms, the absurd yield allocations to xpolycub and the false narrative that it is fundamentally different than CUB kingdoms (it isn't, it's just a single-stake pool being allocated exponentially more yield than CUB kingdoms... for now), and this idea that it will all be fine if you just hodl through all the bullshit that never needed to exist in the first place.

And you know I guess the worst part about all of it is that I had to sacrifice my own integrity and keep my fucking mouth shut the entire time because I had over a hundred thousand dollars in play while I gambled my ass off in liquidity pools that were obviously being allocated way too much inflation as we all played this fun little game of trying to siphon each other's money into our own pockets.

If it can't be implied by my tone by now, I have liquidated all of my core Polycub positions and moved every last bit of that value back into Hive, LEO, and CUB. In fact, my bridge liquidity (bLEO/BNB + pLEO/MATIC) has increased from $16k to $45k. Not too shabby, eh? The number of LEO tokens I control total now is over 250k, which is batshit insanity if you ask me.

Do you know how long it took me to exit?

First from xpolycub into the pCUB/ETH pool took me like a week, and I actually had people in LEO Discord tracking my movements and calling me out publicly for selling. Spoiler alert: that's not a good sign. Then it took me another week to exit pCUB/ETH without completely crushing the market. This is why pCUB/ETH yield is so much higher than pCUB/USDC: my position was relatively massive and the pools haven't equalized yet.

So hopefully price can recover now that I've personally run out of gas, but at the same time my stack was small potatoes compared to some of these other LEO whales out there. Those guys basically can't exit. They have to wait for exit liquidity.

As far as I'm concerned it's not possible to make money on Polycub right now. Best one can hope for is to break even until we scrape rock bottom (same exact scenario as CUB). I'm targeting something like 10-20 cents before I'm willing to try and pick up the pieces and defend a real support line. But hey, since when have any of my predictions ever turned out the way I wanted them to anyway?

Ending on something positive.

Long term I'm wildly bullish on this ecosystem as a whole. Bonding is an interesting test and Vault loans have high intrinsic value (assuming the vault actually has the money to offer them). Also all the work being done on one EVM chain can easily be ported to another one with very little friction. This feeds into the whole Sliver Deck ideology where all this open source work creates massive overall synergy and abundance.

The success of Polycub feeds into the success of the entire network that Khal is building, so of course I hope to be wrong and that a lot more outside money is sidelined waiting to jump in at any second. My ultimate grievance with how everything went down is that all the financial incentives played out in a way that infer that there is no more money left to buy the dip and that we are floating on thin air with a single-staking pool (plus kingdoms) that act as a massive liability on top of paper-thin liquidity pools.

NO PAIN NO GAIN!

Honestly at the end of the day we just need to ride this out and keep an open mind as how to proceed. I've presented a lot of valid reasons to be bearish, and they needed to be said, but there are a lot of variables in play here and a lot of ways that this could actually go down.

I felt a strong need to play Devil's advocate here and warn people that this is not zero-risk sunshine and rainbow-unicorns situation, because that is exactly how it's being marketed. Crypto will always be painfully volatile and risky until we figure out the secret sauce to make it not. My ultimate goal is the find that recipe, and I assure you I'm learning all I can from my experiences here. Wen moon?

Don't push the publish button. Don't do it. Bad idea. Very very bad.

Posted Using LeoFinance Beta

Return from Welcome to my Hatchet-Job: Polycub Liquidity Pools & Sustainability Models to edicted's Web3 Blog