I've been watching a good amount of documentaries with my girlfriend lately. She picks them, I watch um. Easy. Every single one of them is worth a post and I've been really slacking in that department. I'll get around to it eventually.

WeWork is a story I missed out on because I wasn't into financial matters back in the day when all this crazy stuff was going down (2010-2015). This is a super unique story about what is essentially a corporate cult that collapsed spectacularly, going from a $47B valuation to $3B... yikes!

This documentary, and in essence this entire concept, shows us just how badly disconnected the world is. There is a record-breaking demand for community and togetherness and happiness, and no one is delivering. The prospect of WeWork lured thousands upon thousands of Millennials into this cultish corporate experiment.

At the center of it all is this guy: Adam Neumann and his spiritually quirky wife Rebekah. The core of the entire business was surprisingly boring: subletting office space and creating a workplace for various companies & startups.

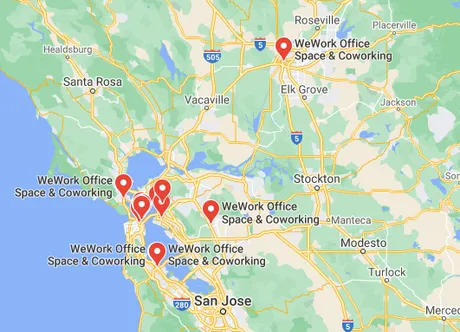

If you check out Google Maps these WeWork buildings are still all over the place in like every state even though it was an abysmal failure in terms of maintaining that all time high valuation. It started in New York but it looks like they have at least one building across every major city in the USA now. I could personally drive to one in under an hour. Crazy stuff.

This documentary is super interesting and relevant to crypto, because stuff like this is going to happen at x100 the frequency when crypto starts becoming mainstream. Adam Neumann created communities by renting/buying out huge skyscrapers and turning them into living and workspaces, attempting to CULTivate strong bonds between everyone within these buildings. Engagement was number one. Remind you of anyplace?

The crazy thing about these WeWork communities and living spaces is that outsiders were basically either not welcome or weirded out by what was going on here. Testimonials of WeWork employees bringing their friends in off the street ended in those friends never returning. Even leaving the building has an air of taboo to it, just like we would expect in an actual cult or exploitative situation.

It's pretty nutso because this really could have become huge if it was done correctly. Crypto would have made it a screaming success if it was done properly. However, as we all know, greed and incompetence often get in the way. Adam tried to scale up too quickly and relied on investments before the deals were even signed, this led to a chain reaction of layoffs and reduced valuations when it crashed into the mountain some years back.

He let the greed get the best of him, and without even breaking any laws he was able to get a $1.7B payout for stepping down as CEO while his company crashed into the mountain. It's funny how the politics played out like they did. He took a vacation to his homeland of Israel and smoked weed on the ride over. When this was discovered investors and public opinion decided to turn against him when combined with all the other shady things he was doing.

Not creepy at all.

At the heart of the WeWork culture was a more modern version of the Wolf of Wall street (if you guys watched that movie with Leonardo DiCaprio). Except instead of everyone working for the same company pushing penny-stocks on unsuspecting victims, it was much more like the employees themselves were the product rather than the clients.

Corporate vacations were mandatory and they partied pretty hard. The ability for Adam to mix a corporate culture with a party culture that appealed to Millennials who were just starting their careers was pretty legendary. Personally Adam kinda seems like a full of shit goofball to me. Who would follow this guy off a cliff? A lot of people did, including one of the richest people in China.

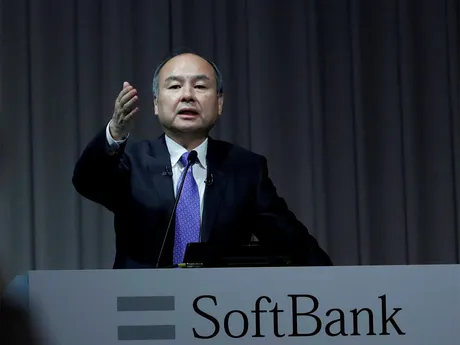

Masayoshi Son

This is the biggest VC basically in the entire world. He created a $100B fund which full on dwarfs all other funds. He wrote Adam a check for $4B, and that was pretty much the beginning of the end. This essentially created a domino effect of winners tilt decisions that ultimately tanked WeWork valuation.

WeWork was being valued like a tech company with extremely low overhead costs and a valuable product, when in reality it was just subletting real-estate, which has much more consistent returns and less volatile growth. WeWork kept fudging the numbers and creating false metrics to make it look like they were making money when they were really just ignoring various operation costs.

Masayoshi Son ultimately pulled funding from WeWork because his investors pressured him to cut his losses. His main focus is on the Singularity and AI essentially guiding humanity... so all around pretty creepy stuff. He's certainly worth some more research and a separate blog post.

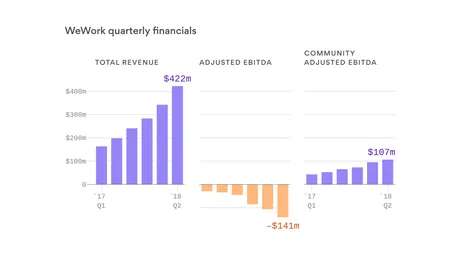

Community Adjusted EBITDA

Last night I was introduced to this (apparently very common) valuation metric called EBITDA.

It stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, and is a metric used to evaluate a company's operating performance. It can be seen as a proxy for cash flow from the entire company's operations.

WeWork created new metrics like "Community Adjusted EBITDA" that ignored certain operation costs to make them look profitable. It was in this way that they were able to deceive investors and clients alike without breaking the law. Simple but smart on a certain level.

Hey look at that the entire Hulu Documentary is on YouTube. God bless the internet. Hopefully this doesn't get taken down.

https://www.youtube.com/results?search_query=wework+documentary

If it does there is still tons of info on this stuff from a year back from "top" names such as Bloomberg, Good Morning America, and Forbes.

How is this crypto related?

It's really only a matter of time before crypto communities begin to take on a more physical form. Imagine Hive skyscrapers popping up. Not only can we do governance better, we are also our own central bank and can distribute resources in a superior fashion. Imagine some of these buildings even being funded by the development fund to cut down on initial overhead costs. Anything is possible.

All the reasons why WeWork was a failure (mostly centralized control and greed) is eliminated with crypto. By learning from documentaries on cults and communes I think we can create a lasting scaling solution that takes over.

Posted Using LeoFinance Beta

Return from WeWork Documentary to edicted's Web3 Blog