Hmmm yeah...

We can see the cracks in the economy spreading quite fast.

It won't be long now before something breaks.

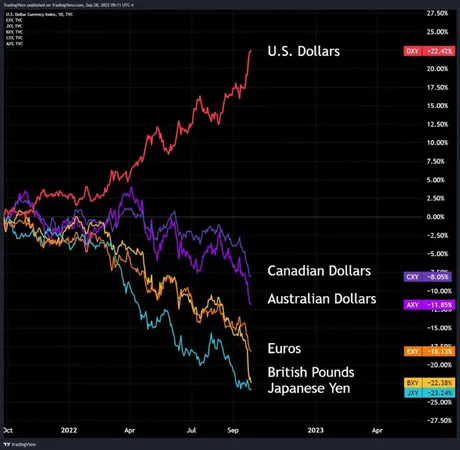

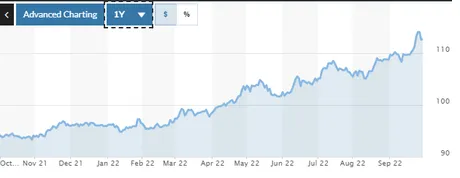

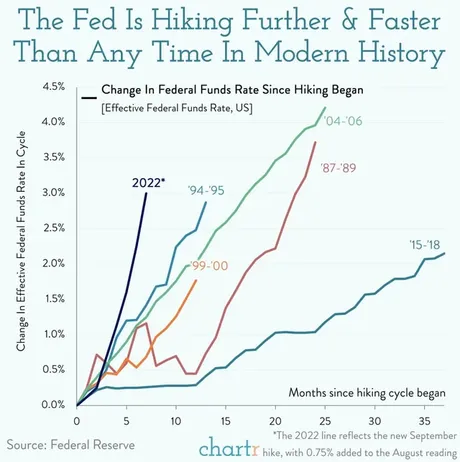

Just like Britain is being forced to turn on the money printer,

so will the FED soon enough as this economic Earthquake gears up.

When that happens, crypto is going to rip hard and fast.

It's been artificially suppressed for quite some time.

On the same side of that coin, crypto has been non-artificially suppressed as well. 3 Arrow Capital fucked us up bad. I just listened to a video on it that a buddy of mine recommended. Crazy stuff. And lets not forget the Terra Luna fiasco. All these things are connected, so when they implode they affect the markets they're connected to, which affect the markets they are connected to, in a wicked chain reaction.

My buddy thinks that all these scams and overleveraged custodians are going to continue to suppress crypto (perhaps indefinitely). The rest of us know that this is just all part of the standard bear market. This one came with a nice "not your keys not your crypto" lesson to be learned.

In fact the scams are almost a necessary part of crypto. They are totally unavoidable. The sheer exponential value of crypto absolutely guarantees there will be scams and greed and ridiculous leverage around every turn. Only those who stick with it, control their own keys, and stop needlessly increasing their risk within the most risk-on asset class in the world are going to make it through the bear market.

The thing that none of the TA is paying attention to is: volume

Ever since we broke out of the tiny 7-day wedge volume has been off the damn charts. x3-x5 normal levels. At the same time relative volatility has been very low. This means that bears have been dumping the market hard and maker orders just keep sucking up all the liquidity, creating a ton of volume around the $19k area but really not moving the price much. I must admit I can't remember the last time I saw something like this.

It appears as though this support just has infinity money backing it up and deep pockets are willing to buy everything that gets dumped at this level. In the last five days, bears have dumped enough Bitcoin to crash the price another 30% or more, but again we see that the support just keeps holding and the range of volatility is very very small compared to volume. Again, this is significant. This situation almost never happens. This is especially true considering how many times we've tested this support. It should be weakening, but it appears to just be getting stronger. We've tested it like 12 times now (wtf?) A breakout is imminent next month.

In the stock market we see that the double bottom we are testing right now could fall away at any moment. Or not, it's hard to say. I'm pretty confident though because even if support does fail it's only an 8.5% drop to March 2020 levels. It only takes one good CPI report for the FED to lose traction on the whole "inflation" narrative and realize they are wrecking everything else. Although at this point it seems obvious that they want to create a hardcore recession, so who knows what they'll do. Loose cannons over there.

Many Bitcoin bears are looking at support levels like $14k, $12k, and even $8k. Why? Because they are greedy. Because they want to think they can still make a big win at this level. Kinda ridiculous if you ask me. Not a single one of them is calling for something like $16k. Why? Because they want a big win. They want to make their decision and then have it pay off. A drop to $16k isn't enough for anyone to bet on (without leverage). But again, if we look at the numbers, that's exactly where we'll be if stocks drop 8.5% and Bitcoin drops 10%-15% in the wake of another crash. These rock-bottom levels are not going to be kind to bears, that's for sure.

The bottom.

We are at rock-bottom levels. There are no bulls that are going to get flipped bearish at this point. No bull is going to suddenly think: you know what I should dump here and try to buy lower. Nah. Was this the case at $30k? Absolutely not. Such is life when a bunch of scams and overleverage come tumbling down around the market. That can't happen again. Bitcoin moves faster than the market. We already had our recession. It ended on June 17th. Change my mind.

Dates of note:

- Mercury retrograde ends: Oct 2

- Full moon: Oct 9

- CPI report: Oct 13

- FOMC meeting Nov 1-2

Wow, what?

I guess the star charts need to unwind.

Uptober?

Given rates can't be increased on October, and a favorable CPI report (less than 8%), and DXY's parabolic run breaking down... it's almost guaranteed October is gonna be a good month for the markets, even if it's just a bull-trap dead-bounce. If the CPI is very good many will assume the FED will taper or stop increasing rates altogether. Then we can finally stop fighting the FED.

HIVE?

Unfortunately Hive charts look extremely weak. We've got some light death crosses incoming with the MA(25) on both the USDT and BTC chart. Spot price on USDT is particularly disappointing because we are trading lower than every single moving average. Very sad.

A crash to the MA(200) on the Bitcoin chart is about a 10% loss, which puts Hive at 43 cents. Unsurprisingly, there is a strong support line there on the USDT chart. 43 cents is a strong buy for Hive.

What about HF26?

The upcoming hardfork is a huge upgrade and technically very impressive, but it is also a 'sell the news' type scenario (as these things often are). Fundamental gains like this can take years to build real value, while the speculation falls flat on it's face in the moment. Be cautious.

What I will say is that I still value this network at 80 cents, so all accumulation done during this time is a massive discount. A 10% dip is largely inconsequential in the grand scheme of things.

Conclusion

Will October be a good month for the markets?

I think so.

There are a lot of ways it can all crash into the mountain, but I think October is safe from anything truly catastrophic happening. Although when I look at the economy it is perhaps... an optimistic outlook. Then again it's hard to be pessimistic when you see enough Bitcoin dumped on the market to crash it 30% and it doesn't crash at all. This support seems uncrackable. It will be nice to see it annihilate the resistance lines in play. We've seen what happens when an uncrackable support smashes the macro resistance. Bears become very sad pandas.

Posted Using LeoFinance Beta

Return from What Goes Up Must Come Down to edicted's Web3 Blog