Don't care, don't care.

LINK is one of those tokens I've been ignoring for a long time. I didn't really understand it and I didn't really care to. For me, the fundamentals don't make sense and it just seemed like another one of those scam ICOs.

LaLaLaLaLa; I'm not listening!

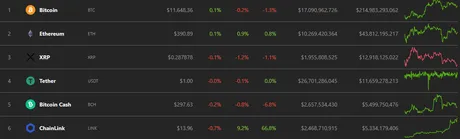

From $2 to $14 in the last 4 months, it's kind of hard to ignore now.

You know what's sexy as hell?

Seeing an ERC token in the top 6!

It's been a very long time since I've done research on a project. In fact, I've been cutting back on the networks I'm invested in. Right now it's all about Bitcoin, Ethereum, and Hive for me at the moment.

- Bitcoin being my bet on security and dependability (The Anchor)

- Ethereum being my bet on development and DeFi.

- Hive being my personal favorite and most used; a bet on myself.

Extension of ETH

The interesting thing about Ethereum tokens is that any success they achieve trickles up to the main chain. Remember during the ICO craze when everyone was saying Ethereum was going to be killed by its own tokens and would no longer have any use case? I didn't buy it then, even though it sounded legit, and now that thought-experiment has played out and is just downright laughable.

This is especially true with projects like MakerDAO, whose protocols can be used without actually owning the governance token (ETH is the collateral, not Maker). The false projection of competition onto this space is never-ending and taxing at times. A win for LINK or any other ERC is a win for ETH and even the rest of the cryptosphere.

But I'm not here to talk about other projects.

Let's get to it, shall we?

Not an ERC-20 Token

Apparently LINK is an ERC-677 token, which adds some functionality that allows multiple contracts on ERC-20 to be combined into a single transaction. These technicalities are worth noting because it's always possible that there's a bug floating around somewhere in token protocols that aren't used as much or have less testing in the field. For the most part though, the distinction is very much a moot point for most end-users and investors.

So what is LINK?

I thought it had something to do with supply chains and perhaps Oracles. Here's what Google had to say:

ChainLink is a decentralized network of nodes that provide data and information from off-blockchain sources to on-blockchain smart contracts via oracles. ... The Chainlink Aggregating Contract takes all the data from the chosen oracles and validates and/or reconciles it for an accurate result.

A lot of the information I found was pretty useless and generic like this. Probably one of the reasons why I've been ignoring it so long, as the empty promises in this space are without limit.

I decided to consult the YouTube Gods:

This video pretty much had all the information I needed, and the bulk synopsis of what ChainLink is all about was contained within the first 5 minutes, which was nice.

So, for the most part, LINK is self-explanatory. It links real world data to blockchains using oracles and a reputation system. For some reason I was originally thinking it was custom-tailored towards supply-chain solutions, but the true use-case is much more generic than that. It can be used for a lot of things, including interoperability between blockchains and perhaps even Atomic-Swaps (although that is not expressly stated).

Only a third of the supply in circulation.

There are a total of a billion tokens but only 350M in circulation. This implies (did not confirm) that the dev team and/or private investors still control the majority of the circulating supply. In fact, this is a huge red flag and the numbers involved are even worse than Ripple's XRP, which in my opinion is downright embarrassing.

That being said, this may not be that big of a deal. As with all crypto (even XRP) coins can only be spent once. It's not like a fiat currency where the central authority can just print more. In addition, LINK (along with most other ERC tokens) don't have any inflation whatsoever, so you know the total supply will never surpass 1B tokens unless the entire network agrees (which is basically impossible and would probably force a split community and impending fork).

Accused of market manipulation.

There were some random posts on Google alluding to market manipulation accusations regarding LINK. I won't look into it much farther than that because I have no personal interest risking money on it. All these markets get manipulated, and obviously if only 1/3rd of the tokens are in circulation the entire network is controlled by a single centralized authority, so far. Doesn't mean the project isn't worth the risk, just that the risk is likely higher than many of the investors realize.

Tokenomics

-

Oracles on LINK are paid for their services by smart-contract users. This process utilizes the emergent free-market. Oracles essentially set the price and compete against other oracles to provide trusted data to the network.

-

Oracles provide a "bond" contract for uptime using staked coins. If an Oracle takes too long to provide their data they can lose their staked tokens. This price is set by creators of the smart-contract. Oracles can refuse to risk their stake in this way and provide their information to those willing to accept otherwise, but again the free-market mechanics will likely deter this kind of behavior unless justified by some peculiar use-case. For the most part, this collateral will be an important part of most systems.

-

Demand for tokens increases as more use-cases are developed.

-

Supply of tokens decreases as more coins are locked in contracts.

Most important use-case?

As I teased before, I believe the most valuable use-case of LINK will end up being atomic swaps and interoperability between chains. If hundreds of networks can all communicate with the LINK network via trusted oracles, atomic-swaps or pseudo-atomic-swaps (depending on your definition) may be implemented relatively quickly between the entire cryptosphere. This certainly isn't an ideal solution and could be easily be made obsolete in the future, but it will be a good-enough solution that could last a decade or more. For example, if Litecoin knows that Hive entered a particular account, a contract can be written around that to swap Litecoin for Hive relatively easily and permissionlessly.

Other use-cases.

When we're talking about oracles, the sky is the limit. This is an issue that can theoretically target every network, including Hive (even though our witnesses can and are being used as Oracles already). It really comes down to how trustworthy the reputation is for ranking the trustworthiness of oracles themselves. The game theory looks great but who knows how it will actually work out in reality over time as more and more developments and innovations progress.

Conclusion

- I have not invested in LINK.

- I don't want to invest in LINK.

- Pick a lane and stay in it.

- Especially in 2021.

I don't play the speculation game anymore.

I only invest in networks that I use personally. Still, it's good to know what drives these speculative markets.

Speculation

When it really comes down to the speculation game, we have to ask ourselves one simple question: Will LINK continue to outperform other networks even after going x7 in four months and getting into the top 10? From my perspective, it's simply not worth the risk when Bitcoin and Ethereum are already extremely risk-on assets. In a way, an investment in Ethereum is already somewhat of an investment of the tokens of that network, so that's were I'll put my money for the time being on that front. I would require more information or there would have to be a personal use-case for yours-truly to justify switching gears.

That being said, I certainly don't view this bit of research to be wasted time. Top 6 market cap is no joke, even if it is based entirely on fluff (which I am not implying either way). All data is valuable even if we don't make an investment decision based off of it. Interestingly enough, LINK is all about providing off-chain data to the cryptosphere in the most trustworthy way it can muster. The theory is solid, but will the reality mash up? Time will tell.

Return from What's up with ChainLink? to edicted's Web3 Blog