There are many things in life that make perfect sense on paper and make zero sense in reality. On the other side of that coin, there are many things that don't make any sense in reality but are completely true. Many of the best inventions, much like evolution itself, were created by completely random-chance accidents. Examples of such products are the ever important Slinky, chocolate chip cookies, Velcro, super glue, and even Penicillin. And lets not forget the most important one: beer.

When I was a kid I remember this one time my teacher told the class that there's more bacteria in a kitchen sink than there is in a toilet. I parroted this information to my father and he immediately rejected it.

No, that's wrong.

Zero consideration about whether the statement could be true or not. It sounded wrong so he said it was wrong without a second thought. I found this alarming, and it became a core childhood memory and part of my current personality. I didn't even try to argue with him. What was the point? Such a stupid hill to fight on.

2022 Google seems to think I was correct and Dad was wrong.

People get trapped in this know-it-all way of thinking where they just assume things are true without maintaining healthy levels of skepticism about the perceived world around them. This is not only a bad idea on a scientific basis, it's also just flat out dangerous.

Look at the world around us. Every day more and more lies coming from the powers that shouldn't be. We live in a Clown World now where some conspiracy theorists are batting 1000 and end up being right about everything they say these days. And do they get any credit? Do the nay-sayers apologize or admit they were wrong in retrospect? Of course not. They just sweep it under the rug like it never happened and continue living out their life in Clown World. This is why we can't have nice things.

Applications to crypto

Pegging a crypto to gold sounds like a good idea. Right? Common sense dictates that crypto has no intrinsic value, and by pegging it to another asset that has had value for thousands of years we can give crypto more legitimacy.

That is just common sense.

And once again common sense fails us. Pegging a crypto to gold is terrible because pegging a crypto to a physical asset means a physical asset must be redeemable by the users. So tell me, how easy is it to secure a physical asset in the physical world compared to securing a digital asset with private key encryption? The difference is night and day. Crypto pegged to gold is inherently centralized on every level, and even if the security of the physical gold was somehow a decentralized solution it would still be a thousand times more complex and haphazard than just scrapping the entire project and allowing digital assets to do their thing.

This is precisely why NFTs are 'never' going to represent physical property. Imagine demanding the police to use the threat of lethal force to remove someone from a property because you owned an NFT. Eviction is a legal process that takes months. In California it takes like six months. Physical property can only be truly secured by the threat of lethal force. The NFT doesn't matter. The threat of law enforcement telling you to do something is what matters. To claim that these two things will become one and the same is a complete fantasy. Only within the borders of a crypto city-state could this ever become a reality, and even then it might be a completely failed experiment.

Market feed is better

It is also possible to create a derivative that is pegged to gold but can't be directly redeemed for actual gold. This is a better solution, but still not ideal. Imagine if HBD was pegged to gold instead of USD. We have all the tools to make this a reality today this instant. All that would be required is that the witnesses change the price feed from a USD metric to a new unit-of-account (in this case gold). Then HBD would be pegged to gold instead of USD.

What is the risk of that?

The benefit of pegging HBD to USD is that USD is the most stable asset in the world and the value of it is guaranteed to slowly go down over time. With gold we would be gambling with network debt and hoping that the value of gold stays low. If it didn't the network would lose money and have to pay back more debt than it issued.

Also it's important to note that in the worst case scenario, the debt we owe back becomes too high of a percentage and the haircut kicks in, which completely ruins the peg and creates an extreme loss of confidence of anyone who was holding the token for the sole purpose that it was artificially pegged to gold. This has a much higher chance of happening with a volatile asset than it does with FIAT, which is exactly why it is the way it is.

The economy is fishtailing

The entire world is fishtailing honestly. The incumbent president can no long win reelection even though that is the standard. The democrats have lost their fucking minds and have swung so far into authoritarian extremist territory that we live in a constant clown world. The Green clean-energy initiative is hypocritical and completely lacks any self-awareness. Ironically, it also lacks sustainability, which is exactly what the movement requires. Demanding everyone get an electric car and then tell people to stop using electricity a week later. Clown World.

Looking at the economy.

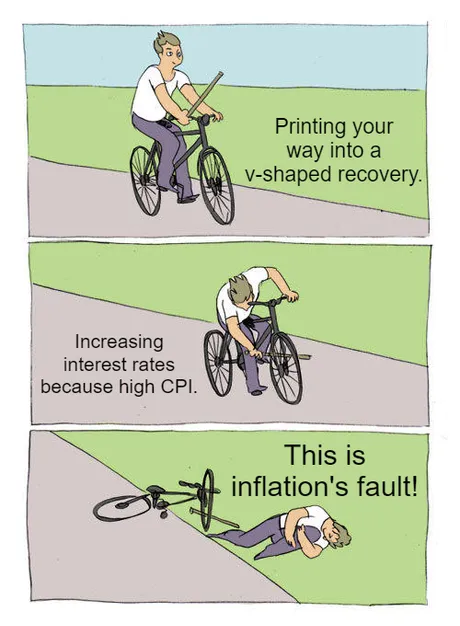

The world economy is a slow lumbering beast. Many are trying to say that "inflation" is making stocks and crypto go lower. That's just common sense, right? We can see it happening. CPI is high and stocks and crypto are going down. Obviously!

Yeah... not so obvious...

What people fail to consider is that all the actual inflation occurred in 2020 and 2021 when all that free money was being printed out. No one complained about everything pumping to the moon. That was inflation. Inflation pumps the market.

Now the chickens have come home to roost, and because the CPI is high due to supply shock, the FED is increasing rates and choking the debt market. The FED can do nothing about supply shocks of goods and services, and can only choke demand, which is exactly what they are doing. And then people wrongfully say inflation is to blame.

Correlation not causation.

It is the response to a high CPI that stomps the market.

Not the high CPI itself.

What is happening here is that the FED is peacocking for the world and pretending like they have power over this situation. They increase rates... and honestly I don't even think it's helping at all. Rather, the economy is just going about its business and the CPI is rising and falling based on completely different factors.

Once the CPI goes down by itself, the FED will come forward and announce that they are the ones who defeated inflation. It's comical. They aren't helping anything. The CPI will go down on its own because of factors that are completely out of the control of the FED (like people running out of money). All the FED can do is insider trade the recession they are creating... seemingly on purpose.

What many do not seem to realize is that if inflation hadn't of happened in 2020 and 2021, Bitcoin would have never gotten as high as it did. Nobody cares. The greed is infinite. Everyone just runs around thinking they deserve $69k BTC. You don't. It was overpriced because of the free money floating around. Now on the swing backwards we blame inflation, when it is really deflation and choking the debt market that is fucking everything up. This is what we get for not paying attention. In retrospect a lot of this was pretty obviously guaranteed to happen. We all knew the economy was in bad shape ever since the COVID crash in March 2020. Greed didn't care. Now here we stand.

Conclusion

Common sense isn't very common, but those who employ it too often without real-world experience are going to get it wrong a lot of the time. Even worse is when people get it wrong and then don't even check their own work and just keep running around thinking they were correct the whole time.

Just because something doesn't make sense on paper doesn't make it false. On an intrinsic level, common-sense involves a lot of speculation, guessing, and projection of knowledge from adjacent territory that may or may not apply. Anyone who knows about the Butterfly Effect knows just how wrong extrapolating a small subset of data can be.

We often criticize those who have no common sense. We even resort to insulting their intelligence and blaming them for the faults of this world (this is why we can't have nice things). However, there's a reason why people have such a diverse set of skills and reasoning ability. It's a feature, not a bug. Everything is working as intended. Intuition is a double-edged sword. It is a blessing if we guess right and a curse if we guess wrong. Some people are more risk-averse than others. Working as intended.

Posted Using LeoFinance Beta

Return from When Common Sense Fails to edicted's Web3 Blog