HIVE/ETH trading pair is now very important.

If this ratio changes, the ratio for arbitrage opportunities on wLEO changes. For example, LEO is now trading a penny higher than it was yesterday. The reasons?

- The trading value of ETH increased 2.5%.

- The wLEO/ETH ratio increased from 0.042 to 0.044.

- At a USD value of 356$ that's 14.952 cents to 15.664 cents.

- Sig figs (significant digits) are very important in arbitrage.

- At a USD value of 356$ that's 14.952 cents to 15.664 cents.

- However, Hive has also increased in 24/h 3.7%.

Meet the reality.

Yesterday I announced to everyone that I was undercutting the 0.8 sell wall to 0.83. That order sold, and I was 'instantly' able to turn that LEO into 100 more Swap.Hive after doing the arbitrage dance.

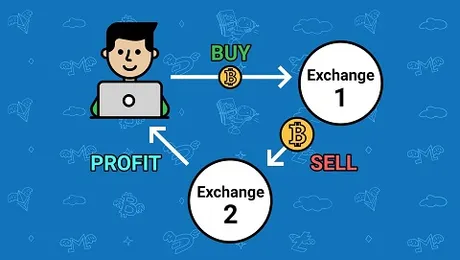

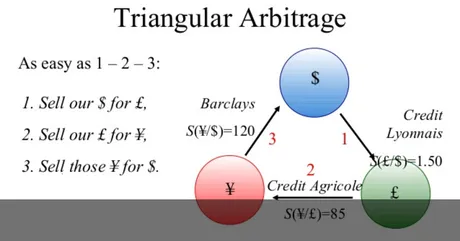

Arbitrage dance.

- Spend 1016 Hive for 1225 LEO.

- Turn 1225 LEO into 1193.5 wLEO.

- 1193.5 wLEO into 0.49 ETH.

- Sell 0.49 ETH into 1130 Hive.

- Wrap 1130 Hive into 1127 HIVE.SWAP using https://leodex.io (0.25% fee)

Looks like more people have been doing #5

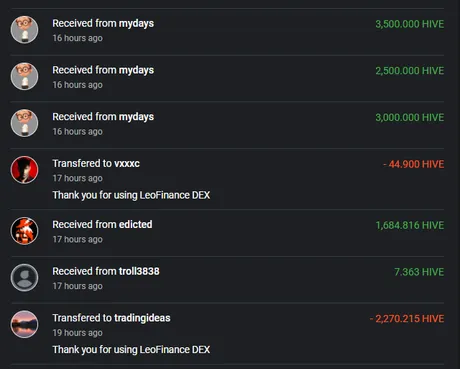

Ah see, look at that. This @mydays guy is doing what I'm doing only he had more money to do it. That'll teach me to power up my 5k HIVE.SWAP.

In any case, the @leodex account has gone from a couple thousand Hive coins in reserve to 27k. That account is much more balanced out now, with 35k Hive.Swap coins remaining.

So this is kinda cool...

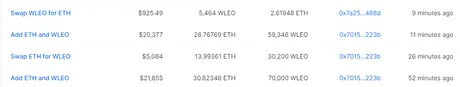

These are a list of transactions on Uniswap. Notice anything? Someone dumped 12.5k LEO for 5.4 ETH and the price didn't flinch. The price came right back up 9 hours later with 3 positive trades from the ETH side.

Notice anything?

There's a transaction that exists that never appears in the last 24 hours of activity.

Can you see what it is?

Notice how no one is actually removing liquidity from the pool. This trend will continue for quite a while while the bounty is going. The most recent transaction adds $22k to the liquidity pool... wow.

I can't even write this post fast enough... already $5000 more wLEO has been purchased in a 14 ETH clump and another $20k has been added to the pool.

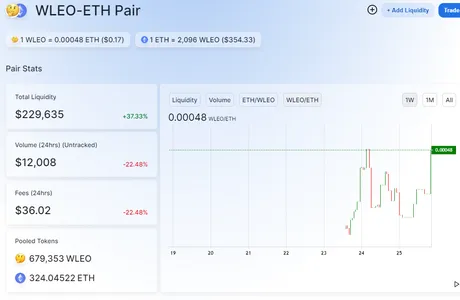

Yeah shit's getting real and moving fast so I just need to post this now and start writing an update that I'll post in a few hours or at the end of the day. $230k liquidity is out of control.

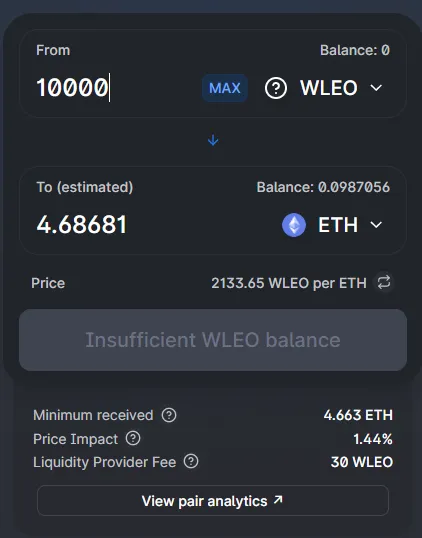

With this much liquidity we can now buy and sell 10k LEO at a time with only 1.44% slippage. That's pretty unheard of up until now. Liquidity is only going to rise, and with it the value of LEO token. We all think a ratio of 1:1 is expensive because it just went x7, but the 1:1 ratio is now a baseline with a lot of liquidity behind it.

Once again, there is simply too much incentive to stake liquidity at the moment for the price of LEO to go down from here even after going x7. Even if Hive happened to spike and those buy walls HAPPENED to get bought out for arbitrage... that doesn't matter.

As we can see even if those 50k coins somehow got dumped on the wLEO market the price would not move much. Much more likely the people posting those walls (myself included) would take down the offer instead of allow ourselves to be arbitraged like that. This puts the price of LEO fully in Uniswap's hands, as I've already explained a few times now in other ways.

To be continued!

Return from When Theory Becomes Reality to edicted's Web3 Blog