Bitcoin is spiking and the first week of November isn't even over. I believe we can expect the uptrend to continue at least until mid December. At the latest I think the market will be tapped out by mid January.

I'll be looking to buy the dip during the 3rd week of February at the latest. At the earliest I'll start buying back in when Bitcoin flash crashes back to the doubling curve.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

This means I expect a crash down to $15k in February based on the curve. I think the lowest it could go is $13k for a short while (probably a couple days) before it spikes back up. I'm not sure if I'll FOMO all in at $15k or actually save some for the best case scenario. It depends on the timelines.

However, now that Bitcoin is "clearly" going to surpass all time highs... probably even this month or maybe even next week... we have to wonder where this peak is going to climax.

All of my best predictions rest solely on the doubling curve. We have to guess how much hype and how much money will get pumped into the market. No easy feat indeed.

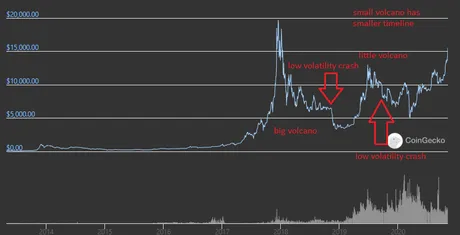

The last pump we have to look at happened back in Summer 2019.

We peaked at $13.8k on June 25th 2019. The top blew off the volcano while volatile price discovery ensued.

I'm fairly certain this volcano pattern is going to rear its head once again for Q4 2020. How high will it get this time around?

2019

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $3467 | $3733 | $4000 | $4267 | $4533 | $4800 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $5067 | $5333 | $5600 | $5867 | $6133 | $6400 |

Again, using the doubling curve as the solid foundation, we see that Bitcoin only had a value of $4800 in June but the price spiked to $13.8k.

That's a difference of x2.9

So do we have similar momentum now as we did back then during the Bakkt pump/dump institutional investment hype cycle? If so, x2.9 above the doubling curve this December would be a whopping $37k Bitcoin. At this point, I am now expecting that bitcoin is going to spike up to AT LEAST $30k this Christmas.

However, let's parse that idea that we only have similar hype to back when the Bakkt pump/dump happened, because that probably isn't true. We likely have more or less hype than that.

I would argue that we have much more hype than the Bakkt pump/dump, but we're all certainly entitled to our own opinion on that front. On one hand, the election, COVID, and the economy in the short-term are a total wildcard. On the other hand institutional investment is guaranteed rather than being speculative.

With Greyscale accumulating staggering amounts of Bitcoin and corporations putting it into their reserve funds, this situation is no longer speculative. It's happening, whether we like it or not. That's going to take the market to an entirely new level of FOMO, one that will likely take everyone by surprise, including yours truly.

Therefore, if $30k Bitcoin is my minimum prediction (x2.35 doubling curve) then my max prediction is going to be somewhere in the x5 range. That's $64k Bitcoin. Can you imagine that? I can't. Yet, according to these metrics, it is easily possible.

Remember, no matter what level Bitcoin attains during this bull run, I think it's going to crash to the doubling curve no matter what. The market is going to get greedy and then panic dump just like it always does. This is the nature of the Volcano pattern. I repeat, no matter how high Bitcoin spikes over the next 5-9 weeks, I'm expecting a crash down to $15k no matter what.

Day trade that shit

One of the nice things about the Volcano pattern is that it gives us the absolute best time to day trade for almost certain gains. For one day out of the entire year (or in this case 18 months), when this pattern comes to the apex and the top blows off the volcano, the next 24 hours are almost certainly going to be an epic flash crash followed by an equally epic spike the next day, followed by an equally epic flash crash the day after that. Timing this even 25% percent correctly will lead to a solid gain in just one or two days.

What to look for:

In a single day (four 6-hour candles) watch for the price of Bitcoin to lose all of it's gains of the most recent flag up during that 24 hour period. This signals the top has blown. When that happens, buy Bitcoin, with the expectation of selling it 24 hours later. Sorted. Compared to all other day trading opportunities, this is the only one I would recommend to anyone, as day trading is just about the most risky thing one could possibly do. Best to wait for that once-in-a-year opportunity that gives one the best chance for success.

After the day trade opportunity has come and gone, we then look for a dip even worse than the day trade bottom. Volume will be out of control and everyone will be losing their damn minds. Keep a cool head.

Eventually the volcano stops erupting and the price equalizes. That's when the last and final dip comes, right when everyone thinks the price of Bitcoin has stabilized. It usually happens when the declining resistance lines of the peaks hit the stabilized area. This has happened at least 2 or 3 times since 2017.

Again, I expect that crash to take us back to the doubling curve at $15k around late February. I'll be the first one to admit that a lot of my predictions have been wrong during the bear market, but this is bull territory, and I'm an ultra-bull, and so are my predictions. I think my gambling luck is about to shift in a big way.

LEO

I've sold off all my liquid LEO (still have 70k powered up). When it really comes down to it I need more influence on the main chain. I believe having access to bandwidth and resource credits is going to be extremely important on the main chain as we head into this bull market cycle. Potentially Hive could be hit by a million users next year and our network is going to get absolutely wrecked by scaling problems that we haven't had to deal with since 2017. We still haven't had the opportunity to test the resource credit system... ever. We've never had enough users to stress test our nodes. I'm expecting serious bandwidth issues in a year, and I want to get ahead of it.

But I thought you were a LEO bull... why sell?

Well, plain and simple, I've done the math. I FOMOed in hard and spend $4000 of my Bitcoin reserves on LEO right before the wLEO hack. Scooped up an entire buy wall at the 1.2 ratio and I'm painfully overextended.

When it really comes down to it, 70k coins is an absolutely massive amount. I own more than 1% of the network. That is a fact. If I never powered up another LEO coin ever again I'd still be a raging bull mega-whale.

Looking at the math, if I can continue to earn 3000 LEO every month from curation and posting rewards I can sell that LEO for 5000 Hive at this ratio. That's a dolphin's worth of stake on the main chain every month. If you had told me 3 years ago that one day I'd acquire so much stake on a Hive side chain that I'd be earning a dolphin's worth of stake just from inflation rewards, I'd of told you to GTFO that's impossible. Here we are. And I'm taking the deal. It's a good one.

I expect LEO and Hive to continue spiking up, but LEO won't be able to outperform the main chain forever. At some point LEO bulls will stop this aggressive buying spree and start selling off their inflation.

Many users on LEO have forgotten what it's like for the token price to crash x10. I've seen LEO 'dip' from 0.5 to 0.05 and beyond, and it's not a good feeling to watch a project bleed while not having any reserves to support it.

As a LEO whale x10, it's not my job to min/max my gains and acquire as much LEO as humanly possible; it's my job to support this network as best I can. By selling here I am supporting the network. I need outside reserves to hedge my bets so I can buy back in if the price dips. If the price doesn't dip I'll just keep selling till it does, making a dolphin's stake every month not even counting Hive rewards. Good deal for everyone.

Conclusion

Financial freedom could be just around the corner for everyone who has stuck it out the past 3 years. We're on the last leg of the 4th year. I know it's been hard, but remember it's always darkest before the dawn. Buy some more Bitcoin just to be sure :D. Get a hardware wallet if you don't already. Try to keep a cool head while everyone else is going bonker ballz. You'll know it when you see it.

Posted Using LeoFinance Beta

Return from Where do we go from here? to edicted's Web3 Blog